- Wall Street indices gained following flat opening and now trade higher on the day. S&P 500 gains 1.1%, Dow Jones trades 0.6% higher, Nasdaq rallies 1.5% and Russell 2000 adds 1.3%

- Risk sentiment improved following release of weak US data - CB consumer confidence and JOLTS job openings

- Conference Board consumer confidence index dropped to 106.1 in August from 117.0 in July (exp. 116.1)

- JOLTS job openings for July came in at 8.827 million (exp. 9.500 million)

- Fed swaps now price rate cuts in June 2024 rather than July 2024 as before the release

- Precious metals also gained amid drop in yields. Gold and platinum trade 1% higher while silver rallies over 2%

- European stock market indices finished today's cash session higher. German DAX gained 0.9%, UK FTSE 100 rallied 1.7%, French CAC40 jumped 0.7%% and Dutch AEX traded 0.6% higher

- Cryptocurrencies gained after US Federal Court of Appeals said that SEC was wrong in rejection spot Bitcoin ETF application from Grayscale and order another review

- Spanish retail sales increased 7.3% YoY in July (exp. 6.7% YoY)

- Energy commodities traded mixed today - oil gained 1.3-1.4% while US natural gas prices dropped 1.5%

- Industrial metals traded higher today - copper gained 1.1%, aluminum moved 0.6% higher and zinc rallied 1.8%

- AUD and NZD are the best performing G10 currencies while USD, GBP and CAD lag the most

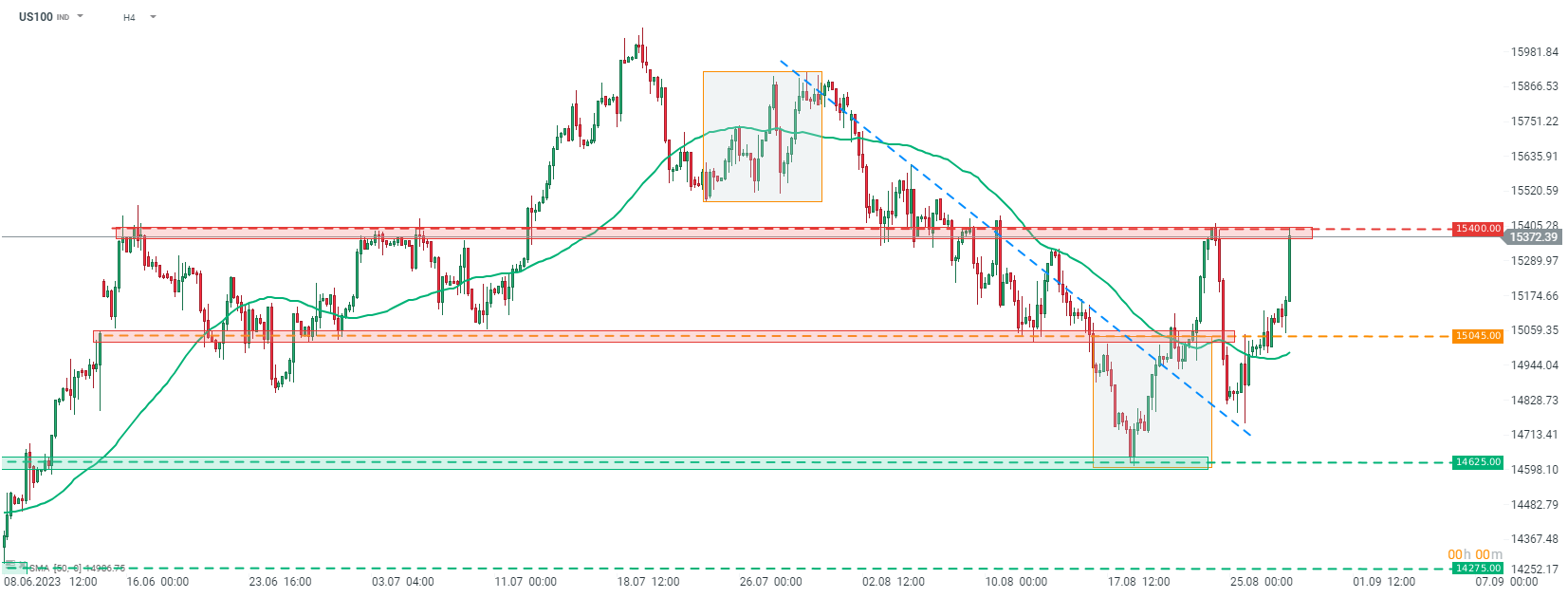

Indices caught a bid after release of weak US data. US100 rallies over 1.5% and tests 15,400 pts area. Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report