-

The dollar is currently undergoing a correction, with the U.S. currency significantly strengthening during today's session. The GBPUSD pair has tested support at 1.2850, while EURUSD is trading around 1.1120.

-

The Swiss franc struggled the most today, depreciating over 1% against the dollar, and the USDCHF pair has already rebounded more than 100 pips from the low set on Tuesday.

-

Positive sentiments dominated the European stock market, with the main indices of the Old Continent closing the session higher. The DAX gained 0.6%, while the CAC added 0.8%, and London's FTSE100 closed 0.75% higher.

-

On Wall Street, there is a pullback with the tech-heavy Nasdaq suffering the most, with losses exceeding 1%.

-

The Central Bank of Turkey (CBRT) has only raised interest rates to 17.5%, though it was expected that it could even reach 20%. Previously, the rate was 15%, though it was 8.5% not long ago.

-

Jobless Claims came in below expectations at 228,000, with expectations of 242,000 and previously 237,000, which the market took as hawkish due to the strong job market.

-

The Philadelphia Fed Index was slightly below expectations at -13.5 points, compared to expected -10 and previously -13.7. After the data publication, EURUSD started a correction breaking the 1.12 level.

-

Quarterly results were announced yesterday by Netflix and Tesla after the session close, while companies like TSMC, IBM, and United Air published their results today.

-

Blackstone became the first private equity firm to manage $1 trillion following the publication of its quarterly results.

-

The People's Bank of China decided to keep interest rates unchanged, with the one-year loan rate remaining at 3.55%.

-

WTI Crude Oil is trading around $75 per barrel. Precious metals depreciated due to the stronger dollar. Gold fell below $1970, and silver fell below $24.80.

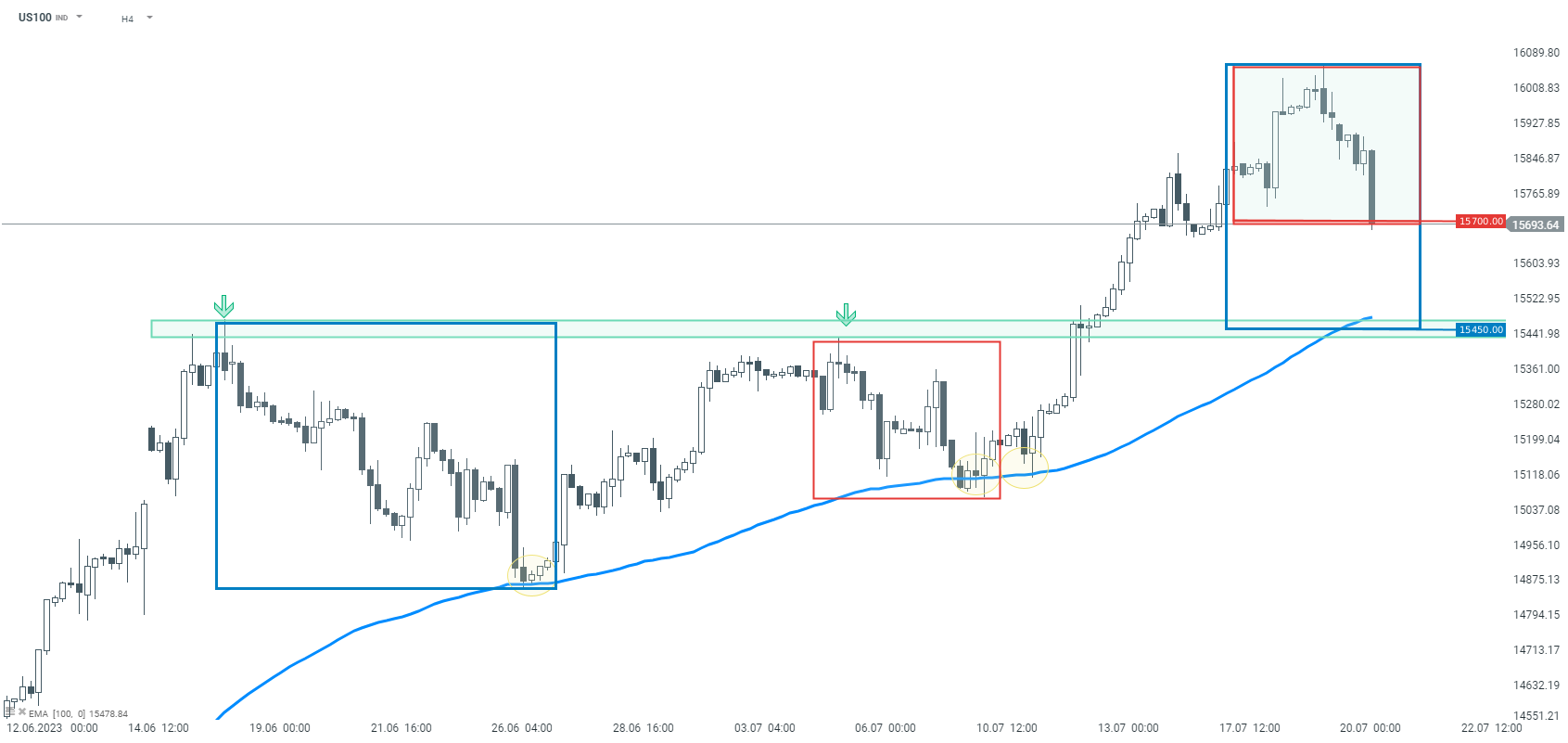

US100 experienced a dynamic downward correction. If the support at 15700 points were to be negated, the declines could head towards the next support level at 15450 points, which arises from broad geometry and previous price reactions. Source: xStation5.

US100 experienced a dynamic downward correction. If the support at 15700 points were to be negated, the declines could head towards the next support level at 15450 points, which arises from broad geometry and previous price reactions. Source: xStation5.

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: US100 jumps amid stronger than expected US NFP report

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)