- The main European indices managed to erase some of the recent loses and ended today's session in positive territory. The Austrian and Swiss indices performed particularly well, gaining more than 1%. The German DAX finished 0.27% higher.

- Moods on Wall Street improved despite the surging US dollar. Three major US benchmarks are currently gaining over 1%. Meta Platforms (formerly Facebook) will publish its quarterly results after the closing bell.

- Stock market rebound provided support for cryptocurrencies. Bitcoin returned above the $ 39,100 level and Ethereum is trading around $ 2,870.

- The US dollar index approached its multi-year highs amid growing uncertainty over next week's FOMC's decision and scale of rate hikes, the epidemic in China and the lingering conflict in Ukraine. The appreciation of the world reserve currency also negatively affected the valuation of gold, which fell below $ 1,900.

- Crude oil gains slightly after today's EIA report showed US oil inventories rose less than expected. The data on distillate inventories was a surprise, as they showed a greater than expected decline.

- NATGAS is gaining over 6% supported by reports of freeze-offs in pipelines in the Rocky Mountains. Meanwhile demand from LNG liquefaction terminals strengthened, as maintenance works were seen ending, while in Europe, Gazprom has halted supplies to Poland and Bulgaria, after both countries refused to pay for gas in rubles.

- Bloomberg reported that four European countries have already paid Russia for gas in rubles despite the fact that the European Union informed the member states that such actions would violate the sanctions.

During today's volatile session major stock indices managed to halt the downward movement at least for now. The European indices finished sessions higher, while the buyers on Wall Street after a poor start also managed to take control despite mixed results from two FAANG members- Alphabet and Microsoft. Today Meta (formerly Facebook) will publish its results, which may also cause some moves on the markets. Nevertheless, today's gains may turn out to be short-lived, given that the negative sentiment related to the deteriorating pandemic situation in China, expected interest rate hikes and worsening geopolitical tensions. This led to a sharp strengthening of the dollar which in turn put pressure on gold.

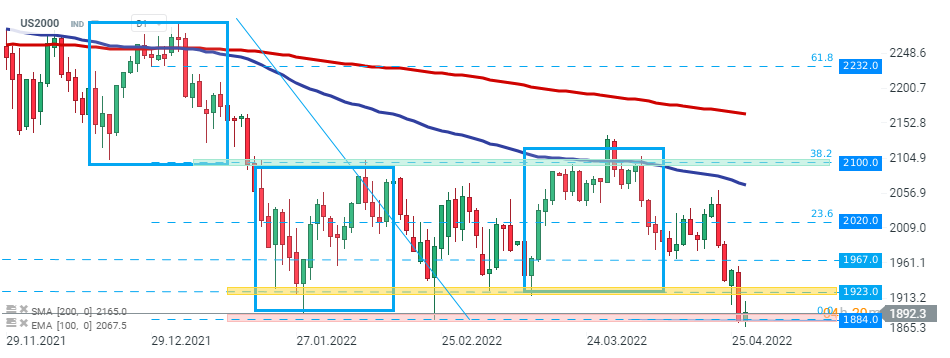

US2000 plunged 3.5% on Tuesday and today the index swings between gains and losses around key support at 1884 pts which is marked with previous price reactions and lower limit of the 1:1 structure. A decisive close below this level would be a confirmation that bears remain in control and could herald further downward pressure. However at the moment, buyers are showing more initiative, therefore another upward impulse towards local resistance at 1923 pts may be launched. Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: Massive increase in US oil reserves!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report