Zscaler (-8.0%), Palo Alto Networks (-7.0%), and Cloudflare (5.9%) shares dips following Microsoft's (+1.8%) announcement of their new security services, a move that analysts believe could pose a competitive threat to these established players. While Microsoft's new services are still in their early stages, the company's broad portfolio and substantial distribution capabilities make the announcement a considerable concern for cybersecurity firms. However, despite today's dramatic decrease in shares value, the largest investment banks have a different opinion:

-

Goldman Sachs suggests that Microsoft's expansion in the security sector will have minimal impact over the next year and network security vendors are likely to maintain their technology lead over Microsoft.

-

Morgan Stanley warns that while Microsoft's massive network and capacity to invest are advantages, gaining meaningful market share in this part of the security market may be more difficult due to the lack of synergy with Microsoft's existing estate.

Microsoft's latest security service expansion involves the development of their Entra suite, starting with the introduction of Microsoft Entra in May 2022, featuring Azure Active Directory (Azure AD), Microsoft Entra Permissions Management, and Microsoft Entra Verified ID.

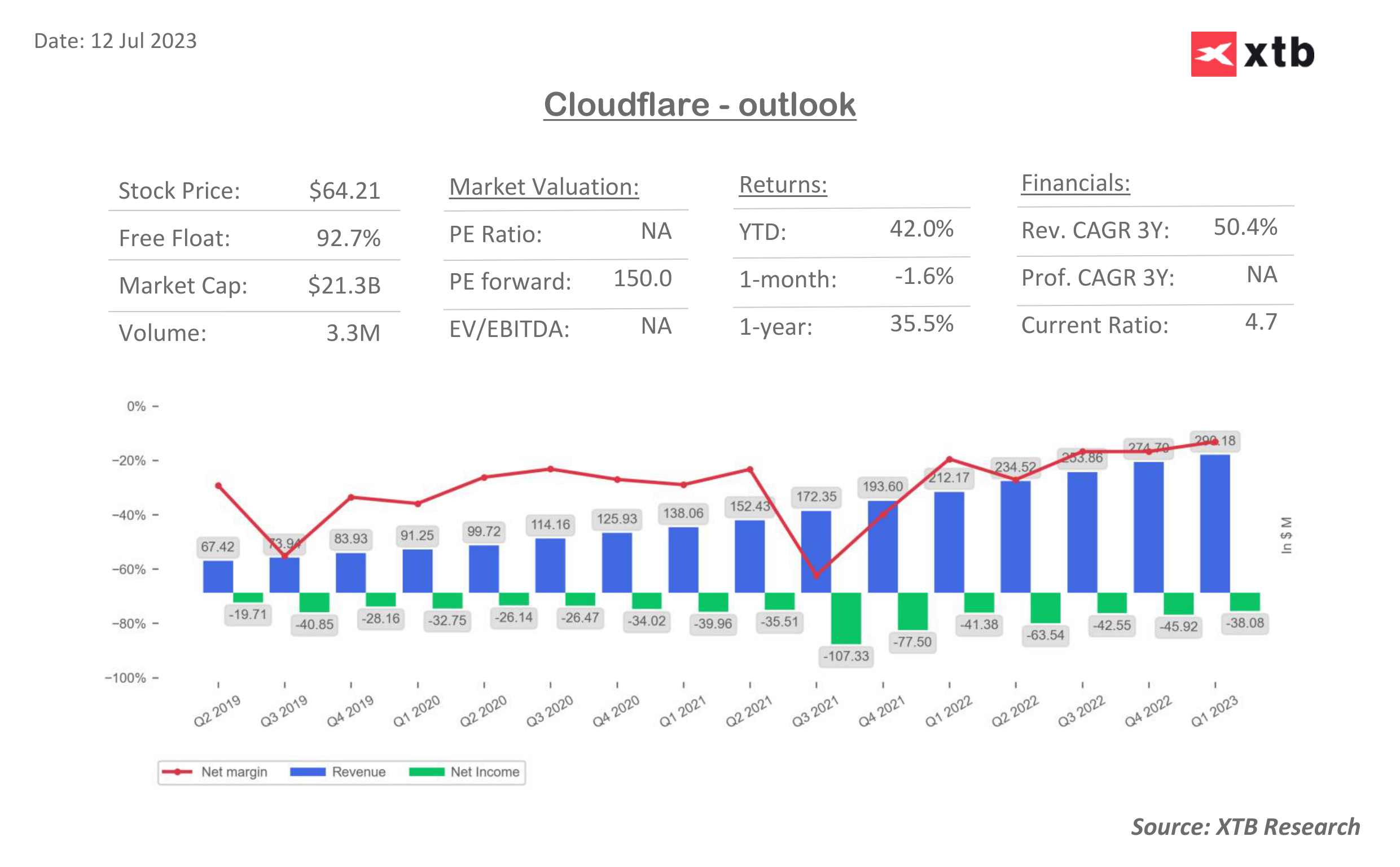

Cloudflare (NET.US) financial outlook

Cloudflare (NET.US) financial outlook

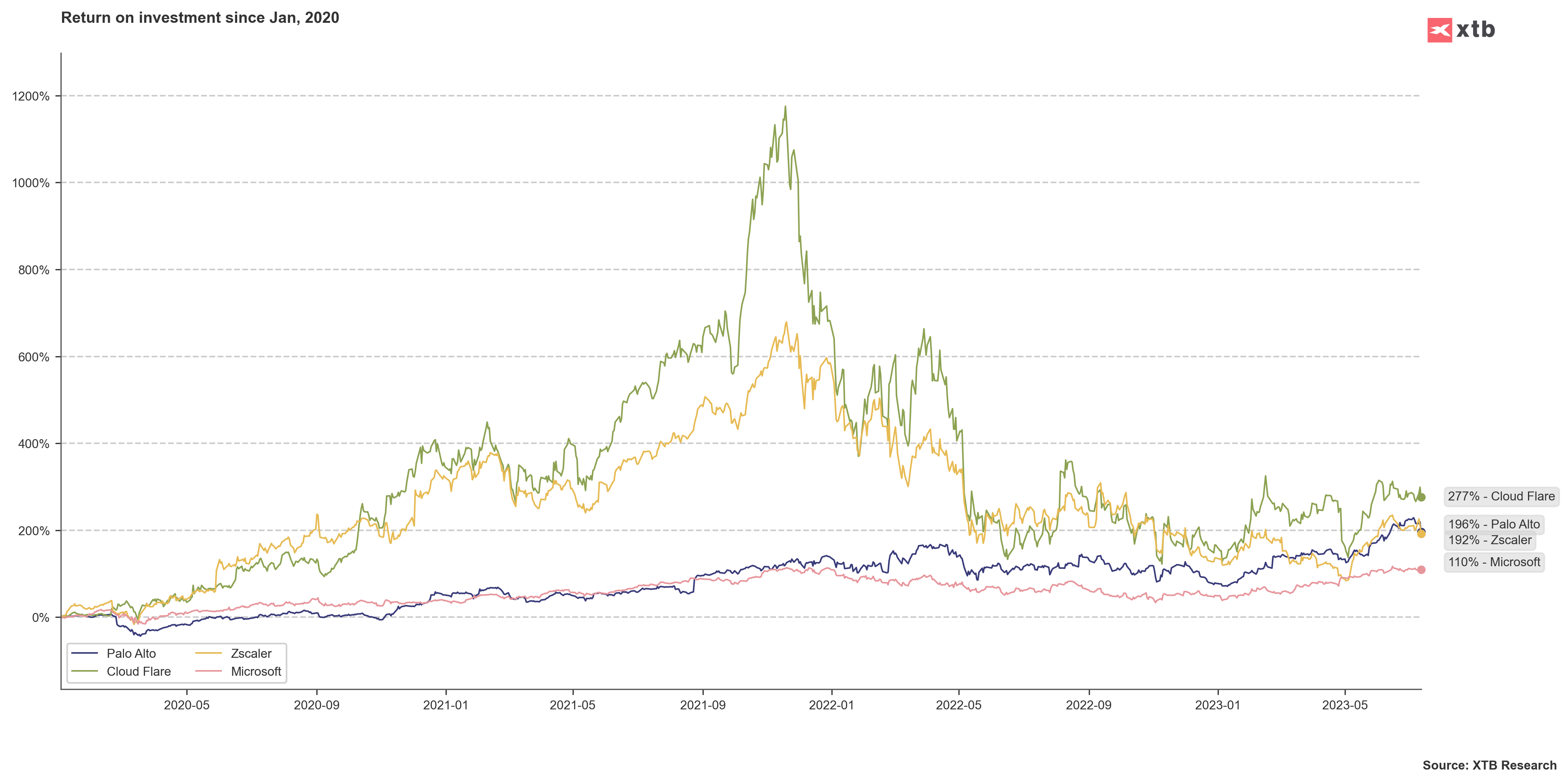

Return on investment in stocks at the beginning of 2020, Microsoft achieved the lowest return, but being the largest company a 110% return is still impressive. The opposite could be noticed recently, when stocks of the remaining companies decrease while Microsoft's are gaining. What's more, Palo Alto, Zscaler, and Cloudflare are far from their ATH reached during the post-Covid bullish market, source XTB Research, bloomberg.

Return on investment in stocks at the beginning of 2020, Microsoft achieved the lowest return, but being the largest company a 110% return is still impressive. The opposite could be noticed recently, when stocks of the remaining companies decrease while Microsoft's are gaining. What's more, Palo Alto, Zscaler, and Cloudflare are far from their ATH reached during the post-Covid bullish market, source XTB Research, bloomberg.

Arista Networks closes 2025 with record results!

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

Does the current sell-off signal the end of quantum companies?

Howmet Aerospace surges 10% after earnings reaching $100 bilion market cap 📈