Bitcoin's price has retreated to levels at $19,100, and a gentle pullback is also observed among altcoins. The cryptocurrency market is likely preparing for the spike in volatility it may have after tomorrow's FOMC (8:00 pm) and Thursday's CPI inflation reading (2:30 pm), in the United States:

- Although the capitalization of the cryptocurrency market has once again fallen to levels around $900 million, in the last 24 hours the transaction volume increased by nearly 64% (about $54 billion) which supports the hypothesis of an upcoming period of increased volatility, at the same time stablecoins were responsible for nearly $50 billion of the volume;

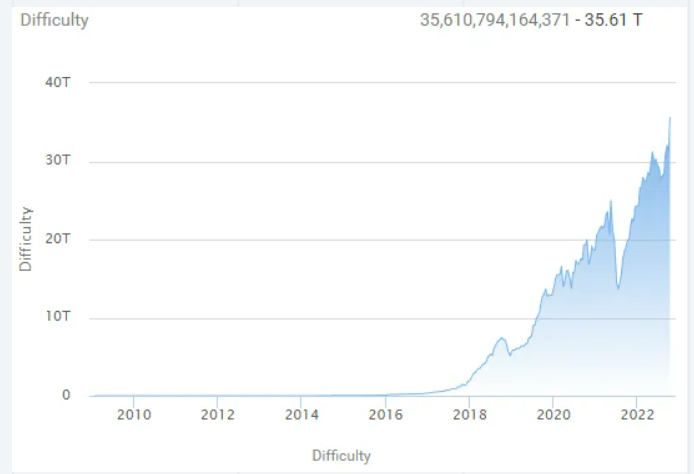

- Bitcoin miners are still under pressure, according to Blockchain.com data, their profits have fallen by 53% since the beginning of the year due to rising energy prices, the difficulty of mining and the falling price of BTC itself. At the same time, the average 30-day income of Bitcoin miners has fallen to levels around $19 million. This gives lower levels than in May 2021, when China finally banned mining causing the closure of 90% of 'mining' businesses in the country, which was the world's mining center. Over the past two weeks, the difficulty of mining BTC, the so-called hashrate, has risen by 13.55% and is at historic highs, putting additional strain on the mining sector;

- Billionaire and hedge fund creator Paul Tudor Jones again spoke positively about Bitcoin's future, assuming that cryptocurrencies will face another upward cycle. At the same time, Jones stressed that cash is, in his opinion, a safe place as long as the market does not gain reasonable expectations of easing the existing Fed policy. There was a lot of buzz about Jones in the recent bull market, when he declared that up to 5% of the entire fund he manages could be placed in Bitcoin if the Fed continues its dovish monetary policy. This did not happen, however, the Fed eventually went on the hawkish track.

The Fear and Greed Index still indicates extreme fear. Source: alternative.me

The Fear and Greed Index still indicates extreme fear. Source: alternative.me

Bitcoin's mining difficulty has risen above 35 trillion hashes. While the difficulty lowers the margins of already affected mining businesses, it may also indicate an increase in mining market activity, as the difficulty is correlated with the computing power of the Bitcoin network and the activities of miners. The surge could mean that miners are willing to invest in the equipment needed for mining or are upgrading their existing equipment, which could support the contrarian activities of cryptocurrency bulls. Source: BTC.com

Bitcoin's mining difficulty has risen above 35 trillion hashes. While the difficulty lowers the margins of already affected mining businesses, it may also indicate an increase in mining market activity, as the difficulty is correlated with the computing power of the Bitcoin network and the activities of miners. The surge could mean that miners are willing to invest in the equipment needed for mining or are upgrading their existing equipment, which could support the contrarian activities of cryptocurrency bulls. Source: BTC.com

Bitcoin, D1 interval. The price is still below the SMA200 and SMA50, the risk of a big move downside is growing as long as Bitcoin is below SMA50 (19 800 USD). RSI is still at neutral levels. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

🚨 Bitcoin drops to $69,000 📉 A 1:1 correction scenario?

Market wrap: Novo Nordisk jumps more than 7% 🚀

Crypto news: Bitcoin falls below $70k 📉Will crypto slide again?