Summary:

-

Google bans cryptocurrency mining apps from its Play Store

-

First football club to pay players in digital currency

-

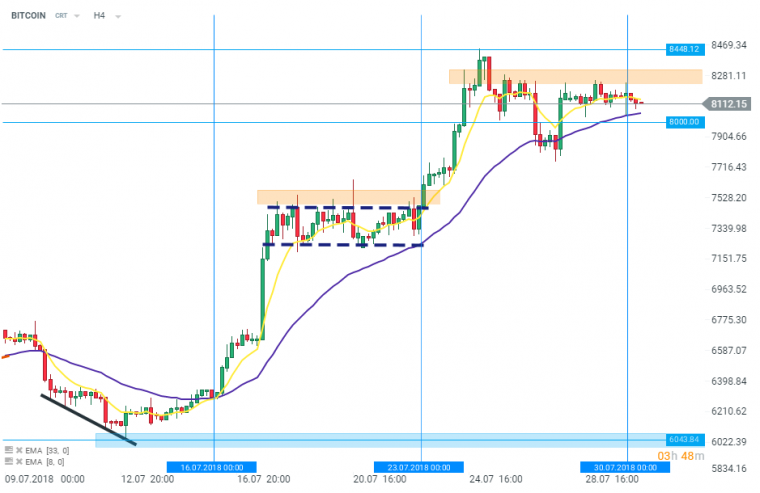

Bitcoin (BITCOIN on xStation5) is trading around the $8100 handle

The end of the previous week did not bring any fireworks when it comes to the cryptocurrency market. Over the weekend major cryptocurrencies were trading rather flat. At the beginning of Monday’s trading we are observing a continuation of this trend. The capitalization of the whole cryptocurrency market stands slightly below the $295 billion mark while the Bitcoin market cap sits subtly above $140 billion handle. Today’s major topics concern the Google’s crypto-related ban and one, particular football club from Gibraltar.

BITCOIN has been moving tonelessly throughout the weekend. The coin is trading a notch above the $8100 handle at press time. The short term resistance zone ranging $8250-$8300 could be a level to watch for BITCOIN traders. A clear break above this area could herald an extended upward movement. Source: xStation5

Firstly, let’s mention Google as it has banned cryptocurrency mining apps from its mobile app store called Play Store. The new ban is another step against digital currencies undertaken by Google. The company has also banned cryptocurrency mining expansions and addons from the Chrome Store some time ago. However, Google permits apps used to manage mining of virtual currency remotely. Google is not the only company that has banned the mining apps as Apple has implemented similar restrictions last month. Given how popular are phones using either Android or iOS operating systems such a development may limit the supply of virtual currencies. However, as a bulk of cryptocurrency mining is conducted via specialised companies an impact of the ban should not be significant.

ETHEREUM has been fluctuating around the $460 handle since about mid-July. The cryptocurrency with the second largest market cap is trading a notch below the $455 handle at press time. The coin may be set to test the short term resistance area ($460-$465) in the nearby future. Source: xStation5

According to the Guardian, one of the football clubs from Gibraltar will be the first football team to pay players’ salary in cryptocurrency. The club we are speaking of is called Gibraltar United. The club owner says each player’s contract will include payment agreements in digital currency starting from the next season effectively. It looks like digital currencies are becoming more and more popular among sportspersons and teams. When it comes to football, let us recall that individuals like Lionel Messi or Michael Owen has already founded partnerships with blockchain-related companies.

RIPPLE, just like Ether, is moving quite flat within the consolidation ranging from $0,44 to $0,46. Furthermore, the potential upward movement of the cryptocurrency has been halted by the $0,45 handle in the previous week and the coin has been unable to provide a clear break above since. Could the coin end a boring calmness this week? Source: xStation5

Disclaimer

This article is provided for general information purposes only. Any opinions, analyses, prices or other content is provided for educational purposes and does not constitute investment advice or a recommendation. Any research has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Any information provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

Past performance is not necessarily indicative of future results, and any person acting on this information does so entirely at their own risk, we do not accept liability for any loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from the use of or reliance on such information.