Today's cash session in the USA is moderately bullish, extending dynamic gains in European markets in the first part of the day. However, there is one sector that stands out in the market, semiconductors. Companies from this sector are recording several percentage points of declines, along with Nvidia, which is down 4.9% to $120 per share.

The situation is exceptional given that so far, only about 36 out of 120 trading sessions have seen Nvidia's shares diverge from the US500 index. Most of these instances were bullish sessions for Nvidia. Nvidia's shares also accounted for about 30% of total returns this year, exerting a significant impact on the benchmark. Therefore, a lasting reversal of the bullish trend in the semiconductor sector could potentially negatively impact the mood in the broader stock market.

Nvidia (NVDA.US) is the worst-performing stock within the US100. Right behind Nvidia are other companies from the AI and semiconductor sectors like Broadcom (AVGO.US) and Qualcomm (QCOM.US).

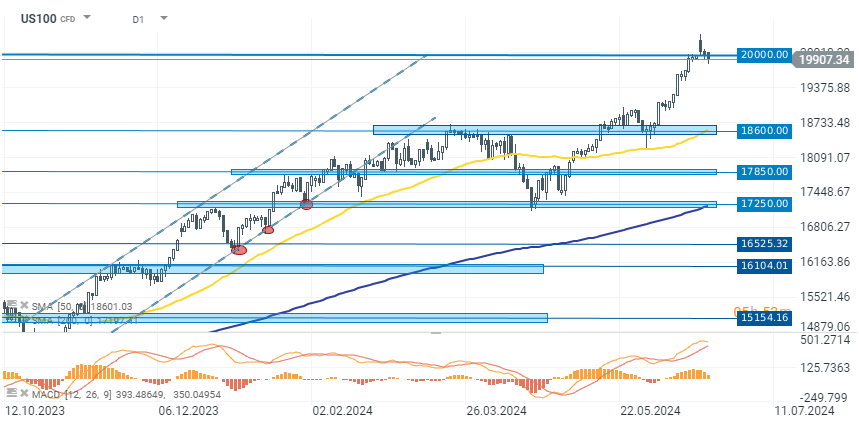

US100 (D1)

The technology companies index (US100) is down today by 0.35%, with declines largely caused by the semiconductor sector. Recent dynamic gains stopped after encountering a key resistance zone at the 20,000-point level and since then, the index has been consolidating below.

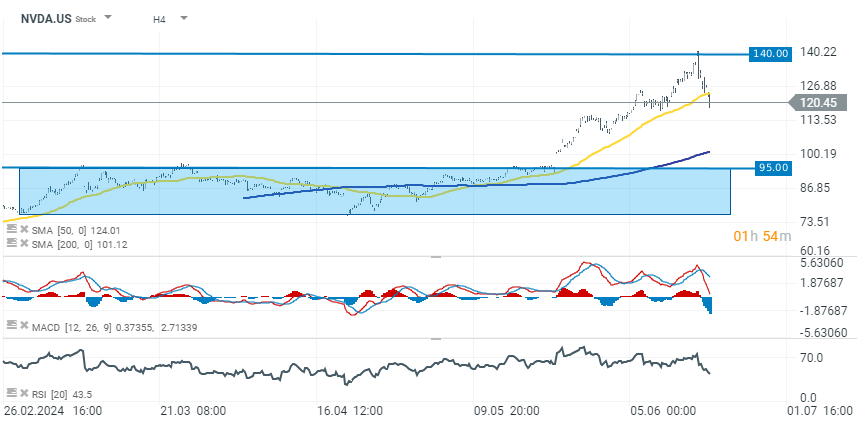

Nvidia (H4)

Until recently, Nvidia was a catalyst for growth in technology companies. However, for the past few sessions, we have observed a deeper correction, which at the time of publication reaches over 15% from the peaks at the level of $140 per share. The company is experiencing the largest correction since the consolidation period before the publication of quarterly results, which were directly a catalyst for the next wave of growth above $1,000 per share (before the 1:10 split). If the declines are not halted at the current support levels, the next nearest support for the current downward movement may turn out to be the $108-112 per share zone, and then the $95 per share level. It is also important to remember that the current correction seems to be caused solely by investors' profit taking strategy. From a fundamental standpoint, the company still offers a promising growth prospects in the coming quarters.

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

US Open: Wall Street rises despite weak retail sales

Coca-Cola Earnings: Will the New CEO Withstand the Pressure?