-

Pfizer and Moderna announced Covid-19 vaccine breakthroughs

-

Vaccine proceeds likely to boost sales significantly

-

Profits made on vaccine may not be that big

-

Very high valuation of Moderna compared to Pfizer

-

Gains made on vaccine announcements have been already erased

Vaccine announcements from Pfizer (PFE.DE) and Moderna (MRNA.US) triggered big moves on the financial markets at the beginning of this and previous week. Both stocks jumped on their announcements but gains were completely erased already. In this short analysis we take a closer look at these two biotech companies that have recently given hope to the World.

Vaccine

While there are many coronavirus vaccine candidates being developed at the moment, vaccines from Pfizer/BioNTech and Moderna stand out as there is already solid data to back its efficacy. Both vaccines are said to have 95% efficacy and produce strong immune responses across different groups of patients. Companies applied for an emergency use approval and are in talks with numerous countries over supply of the product. However, given current circumstances it looks likely they will not seek to maximize profits (in many cases vaccine R&D funding was provided by governments) and will charge below-market rates (Pfizer already announced it). Given the huge demand for vaccines, proceeds from sales will be massive but the profit margin may be low.

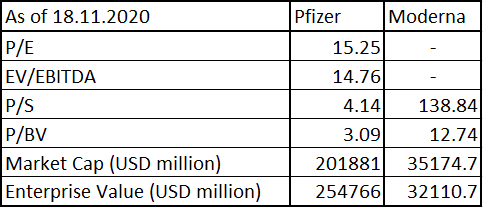

Selected financial data for Pfizer and Moderna. Source: Bloomberg, XTB

Selected financial data for Pfizer and Moderna. Source: Bloomberg, XTB

Fundamentals

However, let's look past vaccines and see how each company looks on the fundamental side. We have provided some basic financial data in the table above. The first and biggest difference between the two companies is size - Pfizer had over $48 billion in sales in the last 4 quarters combined while Moderna had less than $250 million. Secondly, Pfizer is a well-established company that is turning in profits on a regular basis while Moderna didn't have a single profitable quarter since its stock market debut in 2018. Unlike Pfizer, Moderna is not paying dividends therefore it may not be the best pick for income investors. On the other hand, Moderna has much smaller leverage than Pfizer with debt-to-equity ratio less than 8%, compared to Pfizer's 96%.

Valuation metrics for Pfizer and Moderna. Source: Bloomberg, XTB

Valuation metrics for Pfizer and Moderna. Source: Bloomberg, XTB

Valuation

When it comes to valuations, Pfizer is a much bigger company than Moderna. Pfizer has a market cap of just over $200 billion while Moderna is valued slightly above $35 billion. As Moderna is an unprofitable company we cannot calculate P/E or EV/EBITDA ratios for it. However, a look at sales or book value multiples shows us that Moderna is much more expensive in market terms than Pfizer. Of course, we can look past book value multiples as they are not the best way to value biotech companies. However, enormous difference between sales multiples (Moderna - 138.8, Pfizer - 4.1) should be seen as a warning sign when trying to gauge the upside potential for Moderna's stock.

Summary

Summing up, proceeds from coronavirus vaccine sales are likely to be big but at the same time profits may not be too big. First of all, vaccines seldom have high profit margins. Secondly, a significant share of R&D financing was provided by governments and putting high margins on doses may trigger public backlash. Having said that, coronavirus vaccines may not be a gold mine for biotechs. Pfizer has been a profitable company for a long time and has been paying regular dividends. Meanwhile, Moderna still has not seen a single profitable quarter and its valuation is sky-high with P/S at almost 140.

Pfizer (PFE.US) has erased all the gains triggered by coronavirus vaccine news. Stock has returned to its previous trading range $35.50-39.00. Recent price actions have been quite lacklustre so lower limit of the range at $35.50 may be on watch in the final trading days of the week. Source: xStation5

Pfizer (PFE.US) has erased all the gains triggered by coronavirus vaccine news. Stock has returned to its previous trading range $35.50-39.00. Recent price actions have been quite lacklustre so lower limit of the range at $35.50 may be on watch in the final trading days of the week. Source: xStation5

Moderna (MRNA.US) has also erased all of the vaccine news gains already. Stock still sits not far from the all-time high reached during the opening of Monday's trading but has been in freefall since. Near-term support to watch can be found at the lower limit of the Overbalance structure that more or less coincides with a peak from May 2020 ($84.70). Source: xStation5

Moderna (MRNA.US) has also erased all of the vaccine news gains already. Stock still sits not far from the all-time high reached during the opening of Monday's trading but has been in freefall since. Near-term support to watch can be found at the lower limit of the Overbalance structure that more or less coincides with a peak from May 2020 ($84.70). Source: xStation5

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

Economic calendar: NFP data and US oil inventory report 💡

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026