Chewy (CHWY.US) stock plunged over 10.0% during today's session, after the online pet supplies retailer reported disappointing quarterly figures. Company lost 4 cents per share while analysts expected a much smaller loss of 2 cents per share. Revenue jumped almost 27% on a year-over-year basis to $2.16 billion in Q2, however came in below market projections of $2.20 billion. Chewy pointed to a higher-than-usual level of out-of-stock products and also warned that sales growth for the third quarter would not be as high as analysts expected. Chewy’s third-quarter sales guidance of $2.20 billion to $2.22 billion came in slightly below Wall Street expectations of $2.23 billion. Despite weak quarterly performance, Chewy CEO Sumit Singh is pleased with the company's performance and is not worried about the future as customer spending is at an all-time high. In the latest quarter, net sales per active customer increased 13.5% to $404, compared with the same period last year. Also active customers base increased to 20.1 million which is a 21% increase, compared to the second quarter in 2020.

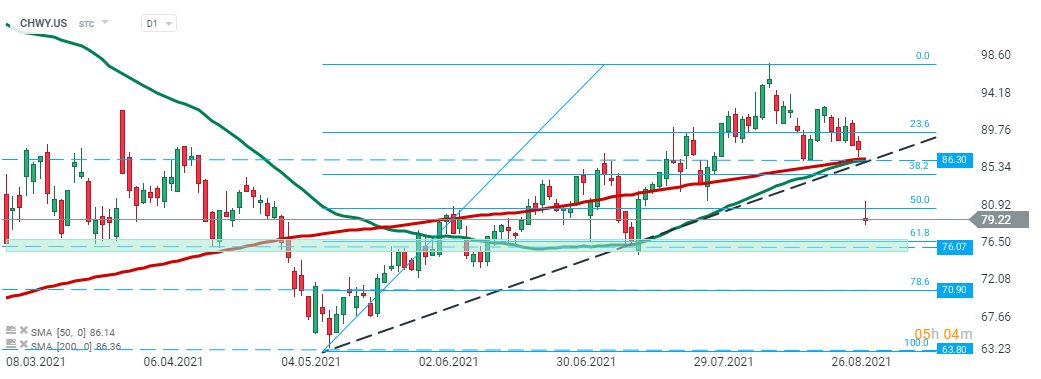

Chewy (CHWY.US) stock launched today's session with a bearish price gap and is approaching major support at $76.07 which coincides with 61.8 Fibonacci retracement of the last upward wave. Source: xStation5

Chewy (CHWY.US) stock launched today's session with a bearish price gap and is approaching major support at $76.07 which coincides with 61.8 Fibonacci retracement of the last upward wave. Source: xStation5

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

Economic calendar: NFP data and US oil inventory report 💡