- The Monetary Policy Committee reduced the OCR by 50 basis points, from 5.25% to 4.75%

- The Committee is confident that inflation is converging towards the 2% target, with business surveys showing fewer firms planning to raise prices

- The Committee believes the economic environment supports further easing of monetary policy and agreed that the 50-basis point cut is appropriate to maintain stability and address weak economic growth

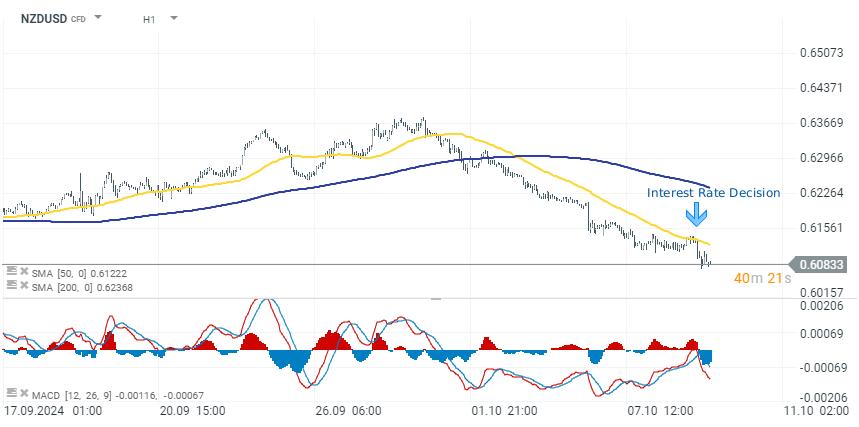

Before the decision was announced, the market was pricing in nearly an 80% chance of a double rate cut. A 25 basis point rate cut was fully priced in by the market. The market's reaction, along with the sharp sell-off of the New Zealand dollar (NZD), was more influenced by the communication from the Reserve Bank of New Zealand. The central bank emphasized that monetary policy remains restrictive, signaling that there is room for further interest rate cuts.

Currently, the market expects another 50 basis point cut at the November 27 meeting and the continuation of aggressive cuts between 25-50 basis points at the meetings in February and April. The key takeaways from the bank's publication following the decision:

Start investing today or test a free demo

Open real account TRY DEMO Download mobile app Download mobile app-

New Zealand's annual consumer price inflation is within the 1-3% target range and is expected to converge toward the 2% midpoint

-

Lower import prices have contributed to disinflation, and price-setting behavior aligns with a low-inflation environment

-

Economic growth in New Zealand is weak, due to restrictive monetary policy, low consumer spending, weak business investment, and low productivity growth

-

Global economic growth is below trend, with the outlook for the U.S. and China expected to slow further

-

Employment conditions are softening, with a decline in filled jobs and advertised vacancies

-

While wholesale and bank interest rates have declined, financial conditions remain restrictive, and credit demand is low

-

Geopolitical tensions, such as the conflict in the Middle East, pose risks to global economic activity, particularly through potential increases in oil prices and tighter financial conditions

-

Uncertainty around the U.S. elections and China’s economic policies also extend downside risks

NZDUSD (D1 interval)

The NZDUSD currency pair has dropped significantly following the decision, with declines of around 0.90% to a level of 0.60800. The New Zealand dollar is down today by 0.7% to 1.0% against other G10 currencies.