EURUSD is one of the FX pairs to watch today. The first potential source of volatility will come with the release of German ZEW index for May at 10:00 am BST. Report is expected to sow improvement in Economic Sentiment and Current Conditions indices. The more important release is scheduled for 1:30 pm BST - US PPI inflation report for April. PPI data is usually of second-importance as it tends to be release after CPI data. However, PPI print this month will be released before CPI data (Wednesday, 1:30 pm BST) and may help shape expectations for that release. This, however, will not be the end of potential EURUSD-volatility triggers. Fed Chair Powell along with ECB member Knot will take part in a moderated discussion at 3:00 pm BST, and comments on monetary policy look likely.

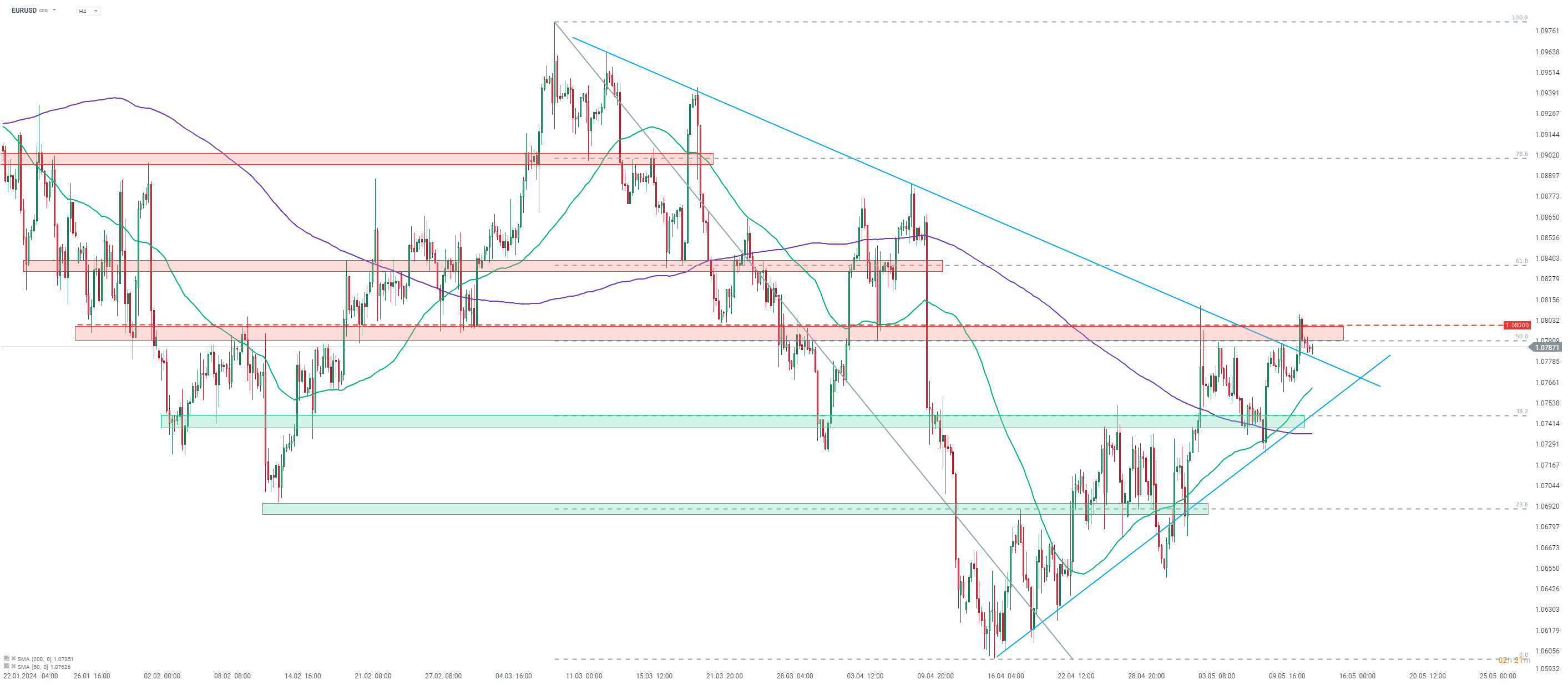

Taking a look at EURUSD chart at H4 interval, we can see that the main currency pair has been trading higher recently. Short-term recovery move pushed the pair above 1.0790 resistance zone, where one can find previous price reactions, downward trendline and 50% retracement of the downward impulse launched in the first half of March 2024. While at first it looked like bulls may be able to push the pair above, the advance was halted and the pair began to pull back. A dovish surprise in PPI data (lower than expected reading) today may provide fuel for a move above 1.0800.

Source: xStation5

Source: xStation5

BREAKING: US jobless claims slightly higher than expected

Market Wrap: UK Stagnation, Tariffs Weigh on Giants, and Crypto Stabilizes

Morning wrap (12.02.2026)

Daily Summary - Powerful NFP report could delay Fed rate cuts