EURCHF is one of the pairs that saw some moves today. The pair gains 0.6% at press time and trades at the highest level since early-May 2023. The move higher was triggered by release of Swiss CPI inflation data for March at 7:30 am BST today.

Report showed an unexpected slowdown in headline CPI from 1.2% to 1.0% YoY. This was the lowest CPI reading in 2 and half years. Meanwhile, the market was expecting an acceleration to 1.3% YoY. Swiss National Bank unexpectedly cut interest rates at March meeting and today's CPI release makes another rate cut almost certain. Markets were pricing in an around-75% chance of 25 basis point rate cut at June meeting yesterday, and those odds increased to 93% after today's data release.

EURCHF was also supported by upward revisions to European services PMI indices for March this morning. Pair may also see elevated volatility in the early afternoon when ECB minutes are released (12:30 pm BST). However, it will be hard for the document to surprise markets after ECB President Lagarde strongly hinted 2 weeks ago that the first rate cut is likely in June.

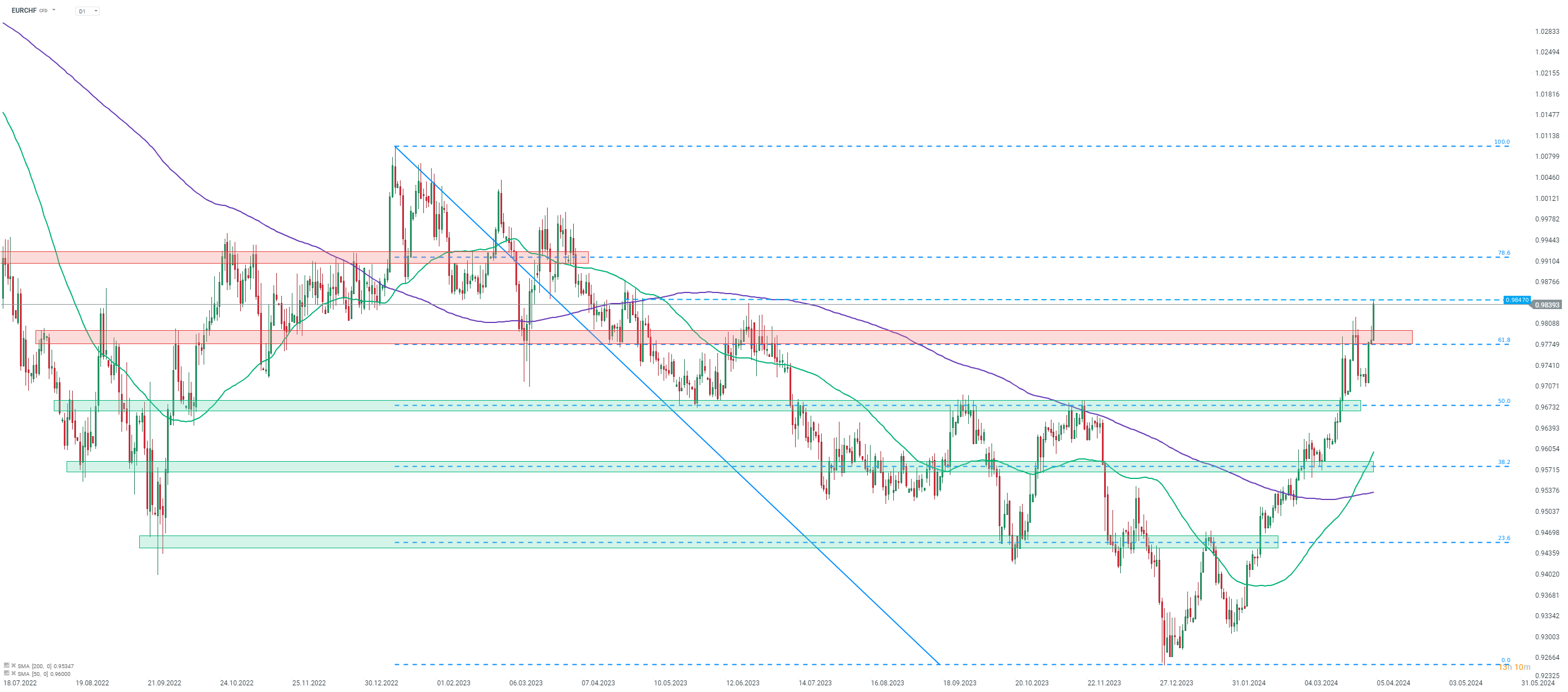

Taking a look at EURCHF chart at D1 interval, we can see that the pair is rallying today and has broken above the resistance zone ranging above 61.8% retracement of the downward move launched in January 2023. Pair reached a daily high at 0.9847 - the highest level since early-May 2023. Should the upward move continue, the next resistance to watch can be found in the 0.9915 area, where the 78.6% retracement can be found.

Source: xStation5

Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️

Three markets to watch next week (09.02.2026)