Rate decision from Federal Reserve on Wednesday, 7:00 pm GMT as well as US NFP report for January on Friday, 1:30 pm GMT are key events of the week. However, it does not mean that there are no other noteworthy macro events scheduled. In fact, there are plenty of those and they may have some big impact on European assets. The European Central Bank is set to announce a rate decision on Thursday, 1:15 pm GMT. Moreover, German GDP data for January is set to be released tomorrow at 1:00 pm GMT. Note that Spanish CPI reading surprised significantly to the upside today and this is creating risk of a similar outcome from German data. This, in turn, could make ECB members reconsider their recent somewhat dovish comments. Current market expectations are for a 50 basis point rate move.

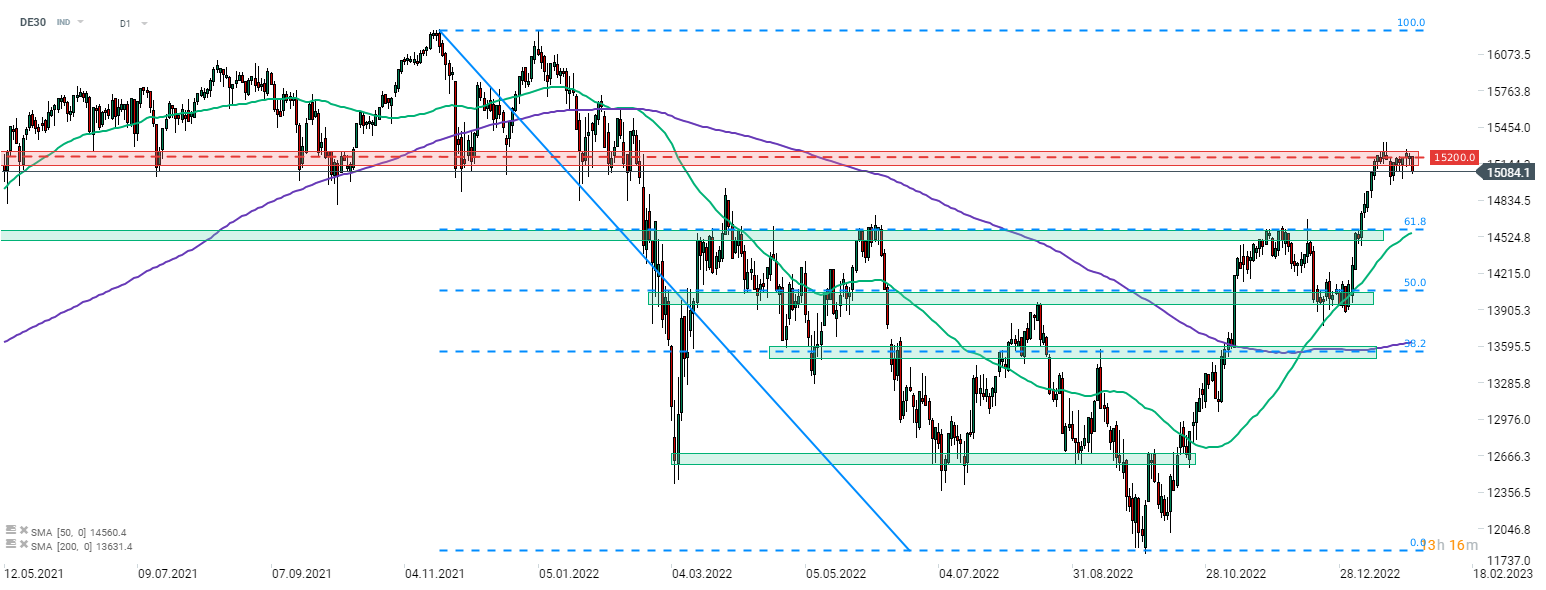

ECB decision could be very important for the German DAX index (DE30). Taking a look at DE30 at D1 interval, we can see that the index has reached the resistance zone ranging around 15,200 pts mark. The move has stalled there and the index has been trading sideways for almost 3 weeks now. Should ECB double down on its hawkish approach and signal that recent inflation developments do not change the near-term outlook for monetary policy, indices may feel some pain.

Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report