Chinese equities face mounting pressure as Beijing's latest economic pledges fall short of market expectations, while the threat of renewed US trade tensions casts a shadow over the 2025 outlook. The policy shift toward consumption-led growth and looser monetary stance has yet to convince investors, with bond yields reaching historic lows amid persistent deflation concerns.

Key Market Statistics:

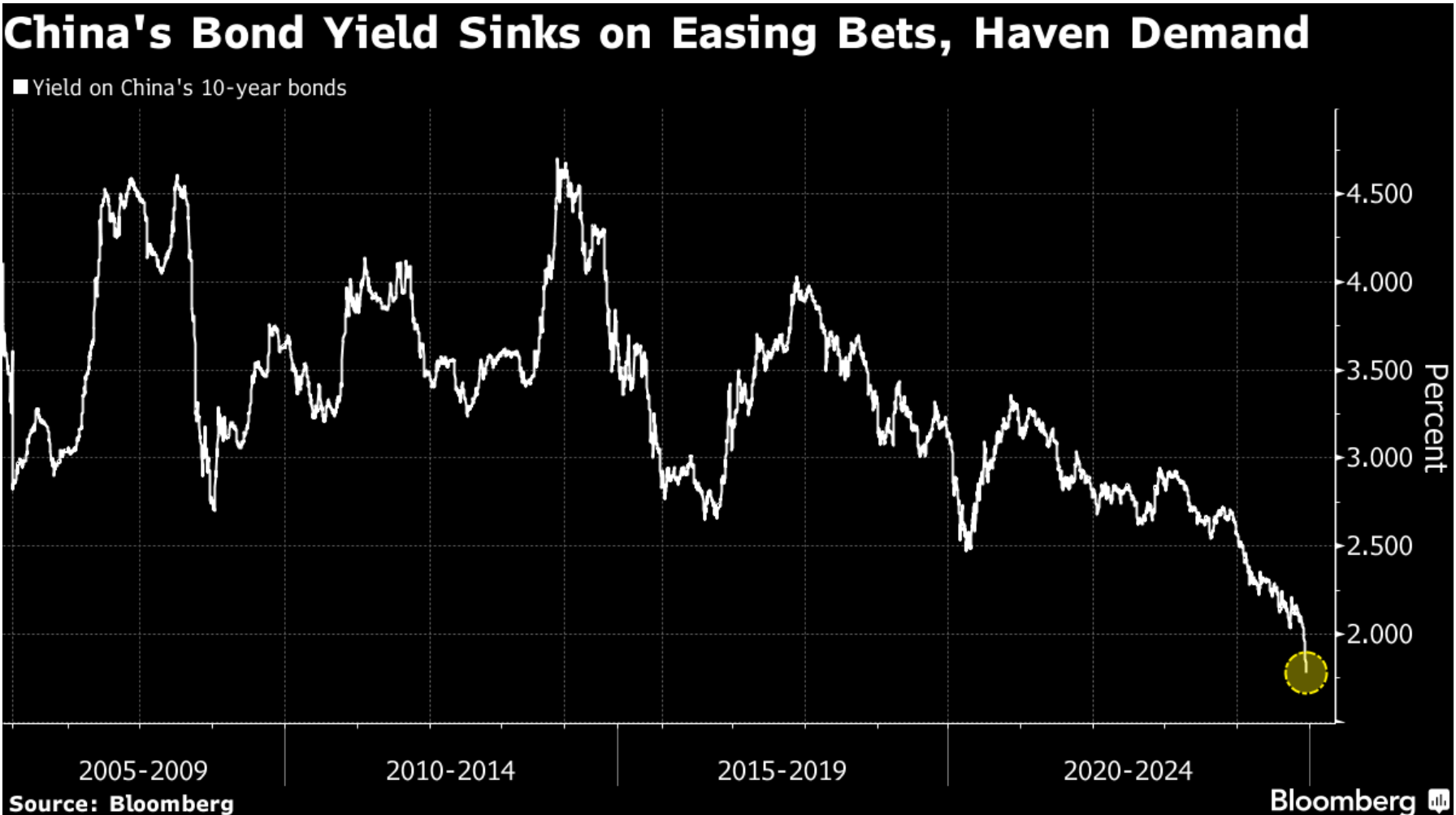

- Chinese 10-year bond yields hit record low of 1.77%, down 5bps

- Yuan expected to weaken to 7.37-7.50 per dollar in 2025

- Fiscal deficit target projected to expand to 4-4.5% of GDP

The CHN.cash declined as markets digested the outcome of China's Central Economic Work Conference (CEWC), which prioritized consumption growth but stopped short of delivering the aggressive stimulus package many investors anticipated. While officials pledged to boost domestic demand and signaled higher public spending, the lack of concrete measures has left markets questioning Beijing's commitment to meaningful reform.

10-year bonds yield. Source: Bloomberg

Policy Shift vs Market Reality

Bond markets are painting a particularly concerning picture, with the benchmark 10-year yield sliding below 1.8% for the first time in history. This persistent decline in yields, despite promises of increased fiscal spending, suggests deep-seated concerns about China's growth trajectory and deflation risks.

The conference's emphasis on "lifting consumption vigorously" marks only the second time in a decade that domestic demand has taken top priority, reflecting growing awareness of the economy's structural imbalances. However, analysts remain skeptical about implementation, with Macquarie Group noting that direct consumer stimulus appears unlikely.

Trade Tensions and Currency Strategy

Looking ahead, the specter of renewed US trade tensions looms large over Chinese assets. Reports indicate Beijing may allow the yuan to weaken in 2025 as a buffer against potential Trump-era tariffs, including a threatened universal 10% duty and 60% tax on Chinese imports. Currency strategists project the yuan could depreciate to 7.37-7.50 per dollar, representing a significant shift in China's traditionally strict exchange rate management.

CHN.cash (D1 interval)

The HSCEI Index, represented by CHN.cash, is trading between the 23.6% and 38.2% Fibonacci retracement levels. The 50-day SMA is positioned to act as either support or resistance depending on the direction of future price action.

For bears, the key target is a move toward late-November lows, followed by a potential retest of the 200-day SMA at 6,485. Bulls, on the other hand, will aim to break above the 38.2% Fibonacci retracement level and target early-December highs.

The RSI is consolidating in the neutral zone, indicating a lack of strong momentum, while the MACD is tightening, signaling potential for a breakout in either direction. These technical indicators suggest a pivotal moment for the index.

Three markets to watch next week (09.02.2026)

US100 gains after the UoM report🗽Nvidia surges 5%

Market wrap: European indices attempt a rebound after Wall Street’s record selloff 🔨

📈Wall Street rebounds, VIX slips 5% 🗽What does US earnings season show us?