Japanese yen has been one of the best performing G10 currencies during Asia-Pacific session, following release of Japanese government economic forecasts. Real GDP growth forecast for the current 2023/24 fiscal year was revised from 1.3% to 1.6%, while forecast for the next year was revised from 1.2 to 1.3%. Moreover, CPI inflation in this and the next fiscal year is expected to remain above Bank of Japan's inflation target, what is hawkish development given that Japanese economy struggled to push price growth above BoJ target for years.

Fiscal year 2023/24

- Nominal GDP growth: 5.5%

- Real GDP growth: 1.6%, up from previous forecast of 1.3%

- CPI inflation: 3.0%

Fiscal year 2024/25

- Nominal GDP growth: 3.0%

- Real GDP growth: 1.3%, up from previous forecast of 1.2%

- CPI inflation: 2.5%

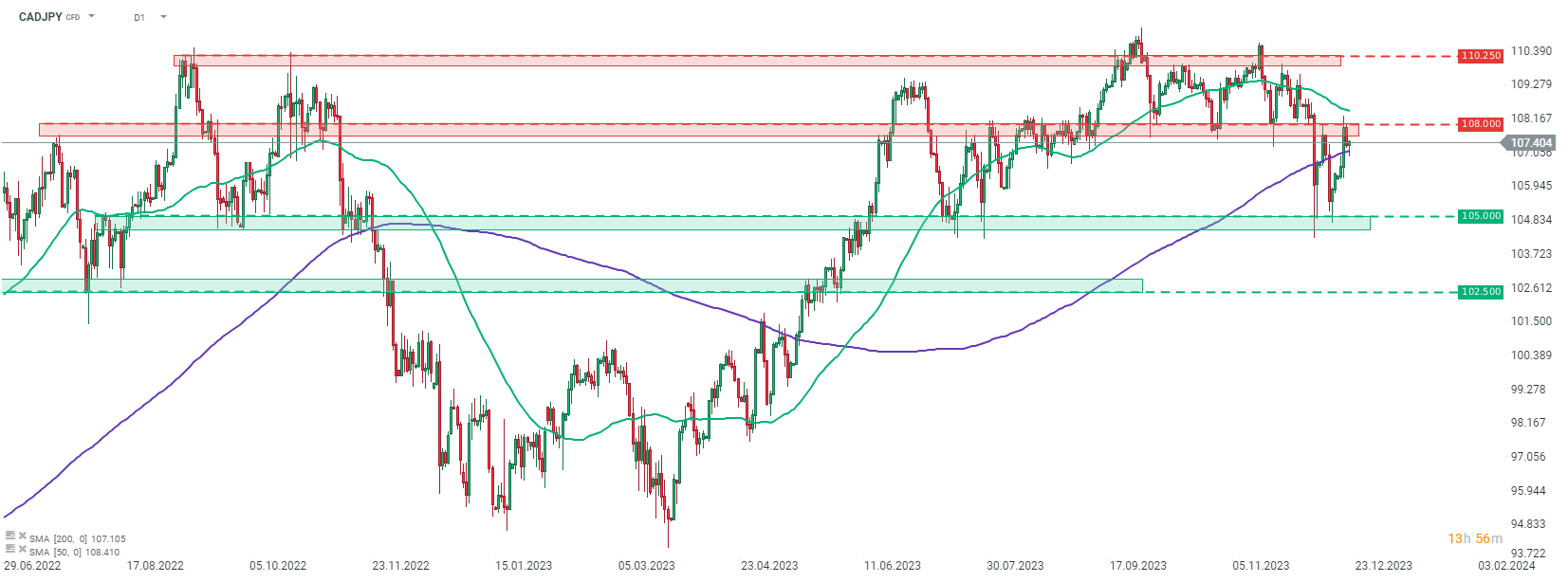

CADJPY is a pair to watch today. Apart from that already mentioned Japanese economic forecasts, traders will be offered Canadian retail sales reading for October at 1:30 pm GMT today. Report is expected to show month-over-month increases in both headline and core retail sales measures. Volatility on the pair may last beyond Canadian release as Japanese CPI inflation reading for November is expected to be released at 11:30 pm GMT today.

Taking a look at CADJPY at D1 interval, we can see that the pair bounced off the 105.00 support zone recently and rallied to 108.00 resistance zone this week. Bulls failed to break above this hurdle and a pullback was launched. However, this pullback was halted today at the 200-session moving average (purple line), raising hopes for another test of the 108.00 resistance. Should Canadian retail sales data beat expectations, such a test may come as soon as this afternoon.

Source: xStation5

Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️