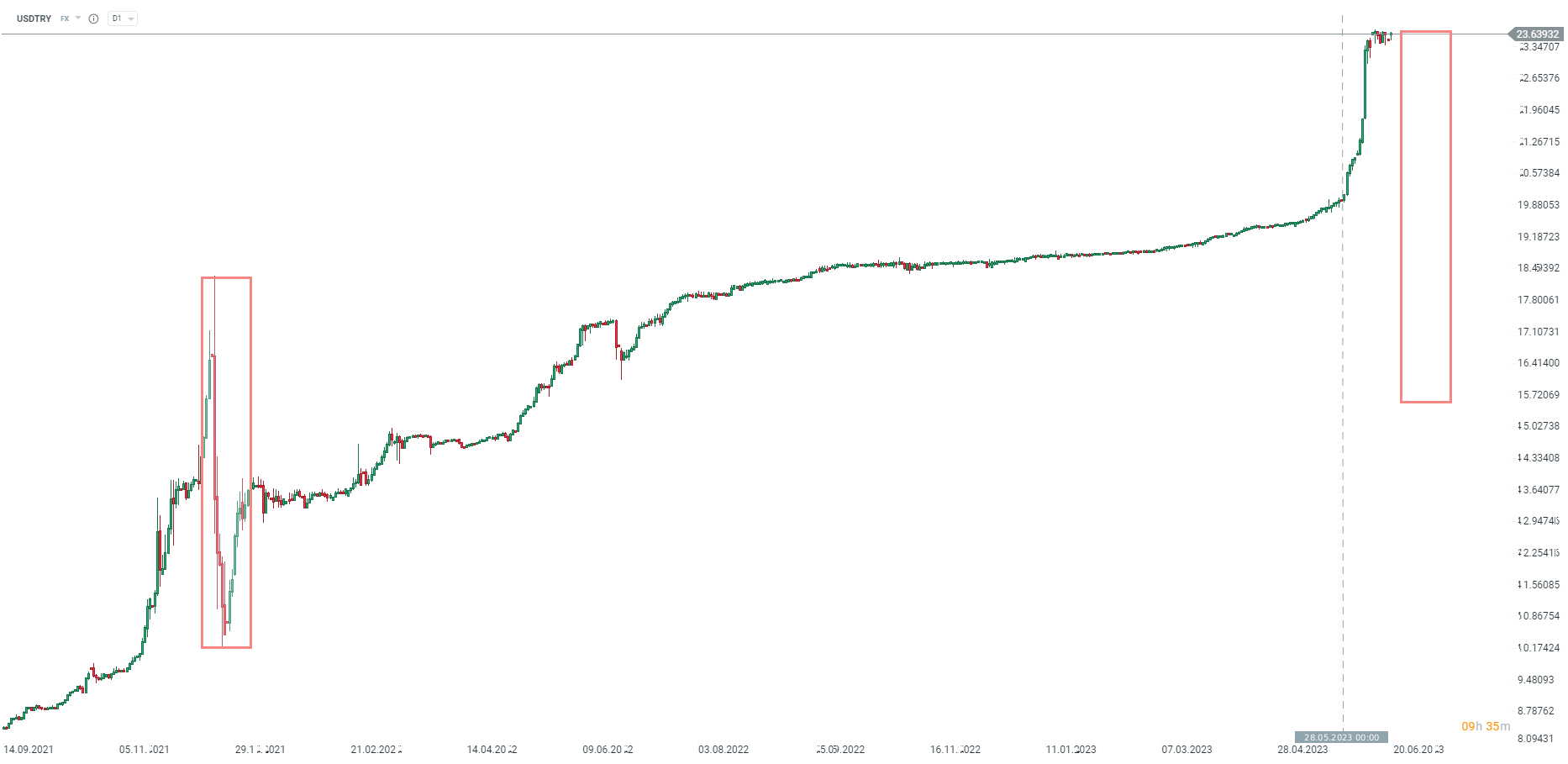

USDTRY trades at extremely high levels, although it is expected that CBRT may decide on an extreme rate hike when it decides on rates this Thursday (12:00 pm BST). Median consensus among economists is that CBRT will hike the 1-week repo rate from 8.50% to 20%! This would be the highest level of rates since 2019. Turkish inflation has slowed to below-40% but the country is still facing significant capital outflows, which drag down the currency. This is why president Erdogan said that he will accept steps that the central bank and finance ministry will take to stabilize the situation.

Goldman Sachs has one of the highest forecasts for the upcoming CBRT meeting - Bank expects Turkish central bankers to hike 1-week repo rate to 40.00%! Bank of America sees 1-week repo rate being hiked to 25% on Thursday. Hiking rates above 20% may triggered a massive jump in TRY volatility. On the other hand, implied volatility for USDTRY dropped significantly since May, when elections were held in Turkey. USDTRY gained over 17% since the second round of Turkish presidential elections.

Of course it should be noted that even if Goldman Sachs is right with its forecasts, a 40% interest rate would not be the highest in the world. Main interest rate in Argentina currently sits at 97% while inflation in the country runs above 100%.

Interest rates and Turkish CPI. Source: Bloomberg

Lira remains weak, even in spite of an expected massive move in the interest rates. It should be noted that we have observed a similar weakness in TRY in December 2021. Back then, CBRT began to cut rates in spite of sky-high inflation. President Erdogan decided to employ capital controls back then, which triggered massive volatility on TRY market. While an interest rate hike on Thursday is expected, a hike to 40.00% could help lira start to recover some of recent losses, given huge interest rate differentials that may encourage financial institutions to engage in carry trades as was the case in 2018 and 2019.

USDTRY continues to trade at elevated levels even in spite of an expected massive CBRT rate hike. Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️