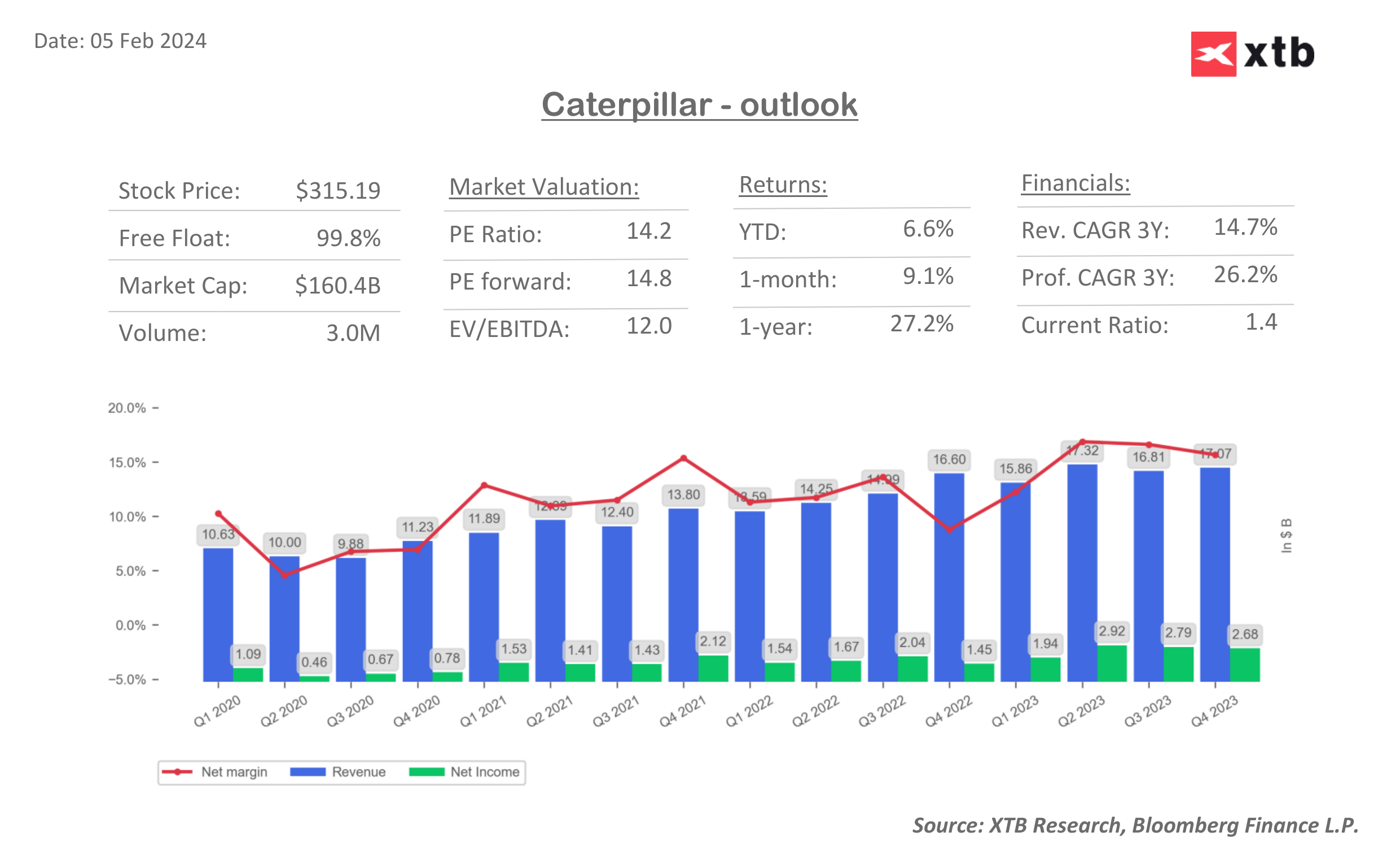

Shares of one of the largest U.S. industrial companies, Caterpillar (CAT.US), are gaining more than 4% today before the open, as the company managed to significantly beat earnings per share expectations in an environment of slowing revenue growth. The company remains one of the main beneficiaries, high infrastructure spending in the United States.

Caterpillar (CAT.US) financial results, for Q4 2023

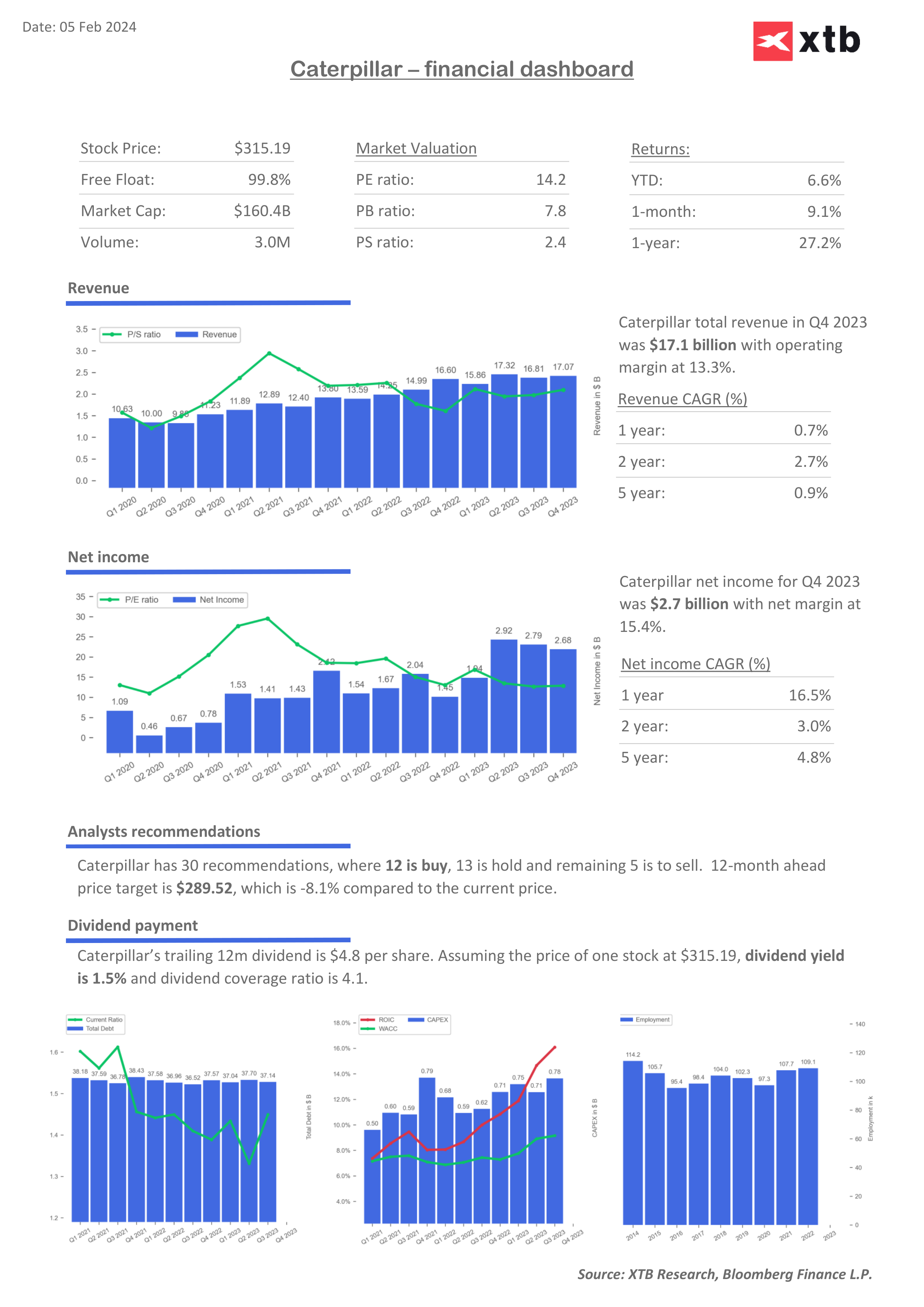

Revenues: $17.07 billion vs. $17.2 billion forecast (2.8% y/y)

Adjusted earnings per share (EPS): $5.23 vs. $4.73 forecast and $3.86 previously

- Revenue from machinery/energy/transportation division: $16.24 billion vs. $16.53 billion forecast (2.3% increase y/y)

- Revenue from the finance division: $833 million (15% y/y)

- Operating profit margin improved to 18.4% from 10.1%.

- Research and development (R&D) expenses: $554 million vs. $532.7 million forecast (38% y/y)

Comments on results

Sales rose thanks to higher prices and very strong positions in the energy and transportation businesses. Business at the leading U.S. manufacturer of construction and mining equipment continues to do well. Net income rose to $2.68 billion, compared to $1.45 billion in Q4 2022. The favorable f/x effect was also offset by lower sales volume.

Sales in the construction industry fell 5% to $6.85 billion, slightly below forecasts of $6.88 billion, sales in the raw materials industry fell 6% to $3.44 billion (above expectations of $3.29 billion). Sales in the energy and transportation sector, on the other hand, rose by double digits, up 12% to $6.82 billion against $6.7 billion estimates.

Overall, the report indicated that the construction and industrial sectors are doing quite well, despite weaker readings from regional indices in the US. U.S. budget funding for infrastructure is expected to last for many more years, but revenue growth has slowed noticeably as dealers have reduced inventories. Backlog of future orders fell by another $600 million, after falling by $2.6 billion in Q3 2023. Normally, CAT's valuation falls when the backlog of future orders falls, but this time the stock remains resilient to that.

Caterpillar shares (D1)

Caterpillar shares are trading near $325, ahead of the start of US trading. Looking at geometric layouts, the current cycle is starting to turn increasingly vertical, signaling growing optimism and the risk of an equally dynamic correction, where potential support will be around $315 (closing of the price gap) and levels between $280 and $290 per share (price reactions from the fall of 2022 and spring of 2023).

Source: xStation5

Caterpillar valuation indicators

Source: XTB Research, Bloomberg

Source: XTB Research, Bloomberg

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

Economic calendar: NFP data and US oil inventory report 💡