Uranium Crisis

The global uranium market has captured investor attention after Kazatomprom, the world's largest nuclear fuel producer, announced a reduction in its production targets for 2025. This decision has raised concerns about potential uranium shortages and led to a significant increase in the price of this commodity.

Kazatomprom, which accounted for about 20% of global uranium production in 2023, has reduced its production forecast for the coming year by approximately 17%. The company attributes this decision to uncertainty about sulfuric acid supplies and delays in mining from new deposits.

Nuclear Energy Revival Boosts Demand

The growing demand for cleaner energy sources is driving a global shift in energy policy. Governments around the world, including Japan and Germany, are revising their plans for the gradual phase-out of nuclear energy. The International Atomic Energy Agency predicts that demand for uranium from nuclear reactors will increase by 28% by 2030 and nearly double by 2040.

Cameco Leading the Gains

The promise of higher uranium prices has attracted investors, who have begun buying shares of North American uranium-related companies. Companies such as Cameco, Denison Mines, and NexGen Energy have seen a significant increase in their share prices.

Analysts believe that Kazatomprom's reduced production targets, although higher than in 2024, are lower than previously established levels. This creates excellent conditions for companies like Cameco and other North American uranium producers.

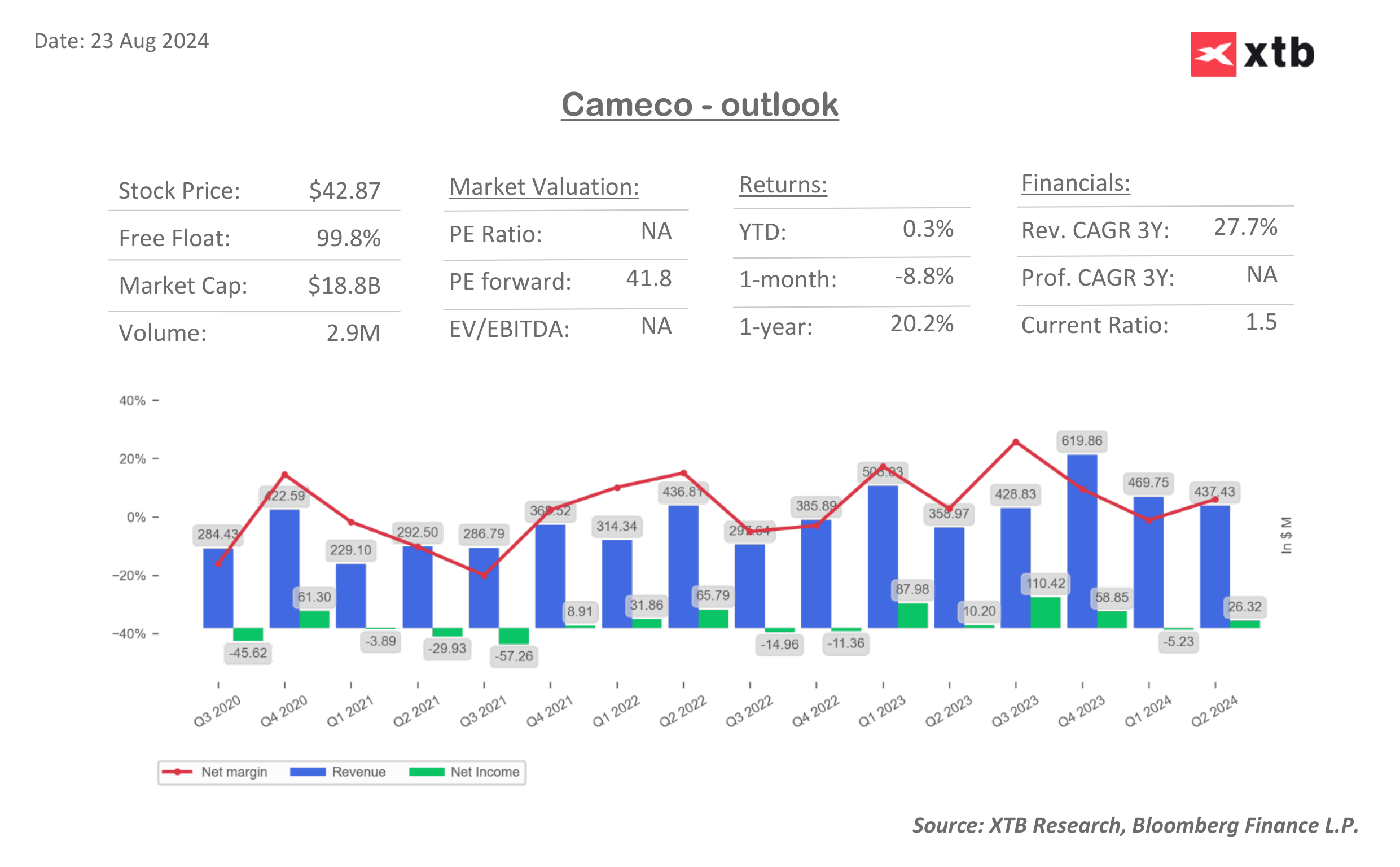

A Brief Fundamental Look

From a fundamental perspective, it is worth noting that revenues have been declining for two consecutive quarters, but due to the problems of the Kazakh producer, this situation may change. The company is valued relatively high, considering the forward P/E, but improving margins to last year's levels may change this situation.

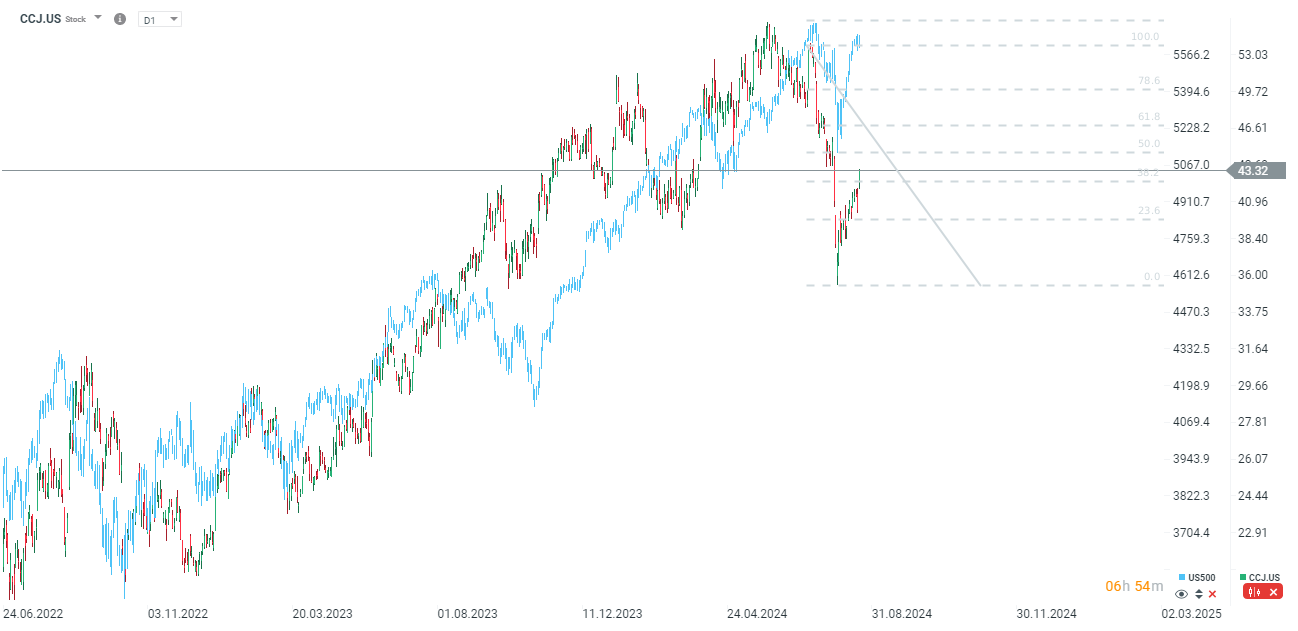

Looking at the Chart

Cameco shares have been under pressure from mid-July to early August and lost as much as 35% in value. The shares have already rebounded quite a bit from the local low around $36 per share, but are still about 28% away from historical highs. Moreover, it can be seen that Cameco seemed to rebound somewhat slower than the broader market in the form of the S&P 500 index. The outlook for the company seems to be solid, although it is important to remember the significant impact of the upcoming US elections. On the one hand, Donald Trump is betting on conventional energy sources, which do not include nuclear power. On the other hand, Kamala Harris is betting on green energy, so the impact of the election results on shares may be ambiguous. The nearest key resistances are $44.6 and $46.7.

Arista Networks closes 2025 with record results!

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉