C3.ai (AI.US) experienced a significant surge in its stock value, rising over 24%, following its announcement of better-than-expected financial results for the third quarter and an optimistic revenue forecast.

The enterprise software company, led by Thomas Siebel, is making strides in the generative artificial intelligence market and is actively investing in expanding its global presence. The company has revised its full-year fiscal 2024 revenue projection to between $306M and $310M, up from the earlier estimate of $295M to $320M and exceeding the consensus of $305.53M. Additionally, C3.ai anticipates its fiscal fourth-quarter sales to be in the range of $82M to $86M, compared to a consensus estimate of $83.91M.

Analysts Commentary:

- This positive trend led Wedbush Securities analyst Dan Ives to increase his price target for C3.ai to $40 from $35.

- Despite this positive performance, Morgan Stanley analysts maintain an Underweight rating on C3.ai with an increased price target of $21, up from $20.

For the fiscal third quarter, C3.ai reported an adjusted loss per share of 13 cents on revenue of $78.4M, which was better than analysts' expectations. The company successfully closed 50 agreements during the quarter, including new deals with major firms like Boston Scientific, AbbVie, and T-Mobile US. Furthermore, C3.ai's federal contracts showed substantial growth, with a 100% increase in revenue and bookings from federal services. The company's subscription revenue also rose by 23% year-over-year, accounting for 90% of its total revenue.

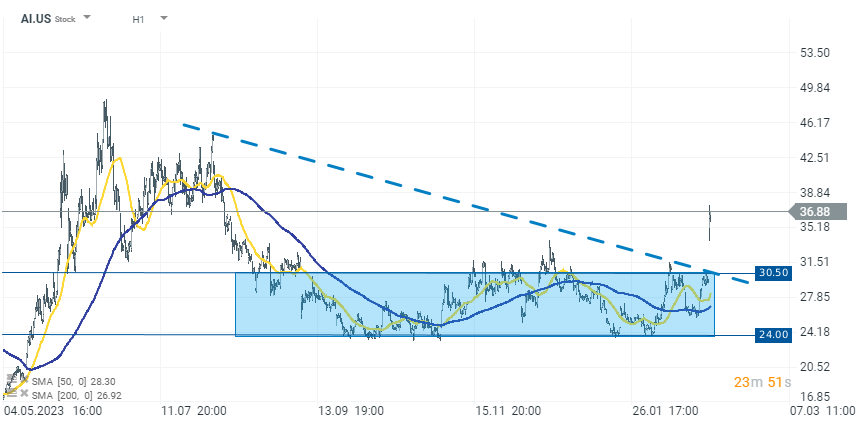

C3.ai shares are rising today by over 24% to $36.90 per share, breaking above the recent consolidation zone below the $30.50 level. Source: xStation 5

Broader AI Trend

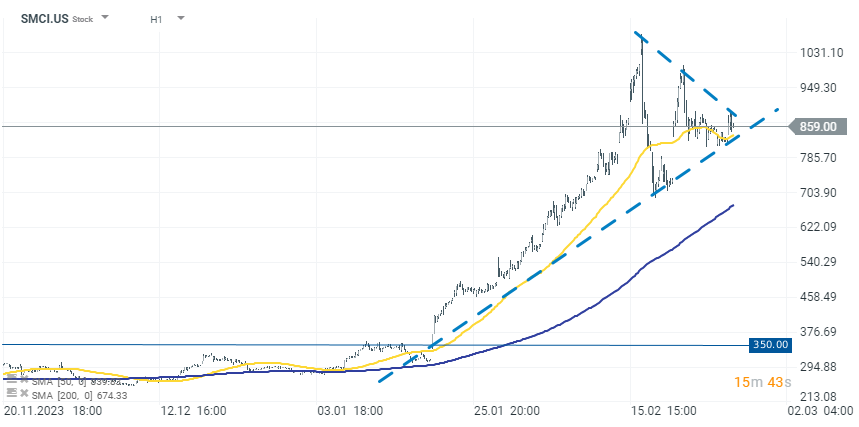

Investor euphoria in the AI sector continues, fueled by Nvidia's recent results. Today, the Nasdaq is testing the 18,000-point level, gaining over 0.70%. Super Micro Computer (SMCI.US) is also gaining on this upward trend and is currently consolidating around its peaks after a recent dynamic rise.

Source: xStation 5

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

Economic calendar: NFP data and US oil inventory report 💡