US Consumer Confidence Index rose to 104.2 from 102.9 in March (revised to 103.4). Today’s reading came in above analysts’ estimates of 101.0.

-

Present situation index 151.1 vs 153.0 prior

-

Expectations index 73.0 vs 69.7 prior

-

1 year inflation 6.3% vs 6.3% prior

-

Jobs hard-to-get 10.3 vs 10.5 prior

-

14.9% expect their incomes to increase, up from 14.4% last month

Conference Board Confidence index moved higher in March, however inflation expectations still remain high, which is not what FED would like to see. Source: Bloomberg via ZeroHedge

Simultaneously, Richmond manufacturing index for March was released. The index unexpectedly fell less than expected to -5 from-16 in February, while analysts’ expected -10.0 pointing to a modest improvement in business conditions. Of its three component indexes, shipments saw the largest change (up to 2 in March from -15 in February) and both the employment (-5 vs -7) and new orders (-11 vs -24) indexes improved but remained in negative territory. Firms continued to report easing of supply chain constraints as the indexes for backlogs and lead times remained negative. The average growth rate of prices paid decreased moderately, while the average growth rate of prices received changed little in March. Firms remained pessimistic about local business conditions and the index for future local business conditions edged down slightly.

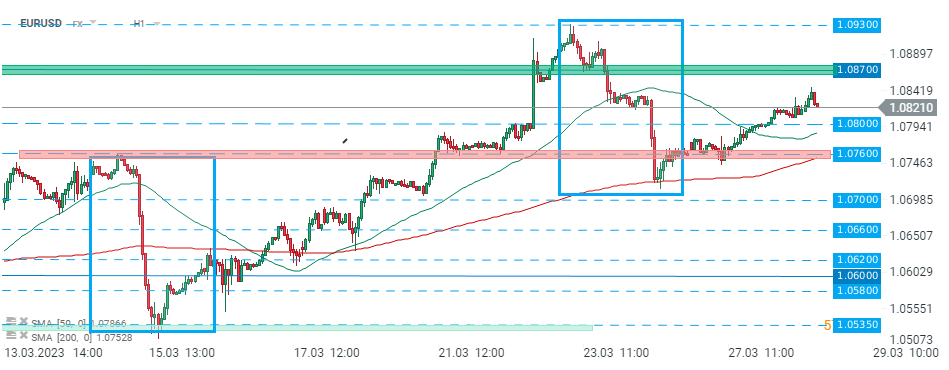

EURUSD saw relatively small reaction to today’s data releases. The most popular currency pair continued to trade around 1.0820 level. Source: xStation5

EURUSD saw relatively small reaction to today’s data releases. The most popular currency pair continued to trade around 1.0820 level. Source: xStation5

Economic calendar: Indices and EURUSD await US retail sales report

Morning wrap (10.02.2026)

Market wrap: Novo Nordisk jumps more than 7% 🚀

Economic calendar: Delayed labour market data the key report of the week 🔎