Highly anticipated NFP report was released at 1:30 pm BST and showed the US economy unexpectedly added 263k jobs in September, compared to a 315k increase in August and above market expectations of 250k. It is the smallest job gain since April of 2021. Notable job gains occurred in leisure and hospitality (83K) and in health care (60K) while big job gains were also reported for professional and business services (46K) and manufacturing (22K). The September reading marks a drop from an average of 420K in the first eight months of the year, as higher interest rates and prices started to weigh on the economy.

The jobless rate declined to 3.5% from 3.7% last month and below market estimates of 3.7%. The number of unemployed persons declined by 261 thousand to 5.75 million in September, while the number of employed increased by 204 thousand to 158.9 million. The labor force participation rate edged down to 62.3% from 62.4%.

Closely watched wage growth fell to 5.0% YoY, from 5.2% increase in August and below market expectations of a 5.1% YoY.

Today's reading signals that the labour market is still tight, therefore Fed will most likely remain committed to bringing down inflation with more rate hikes.

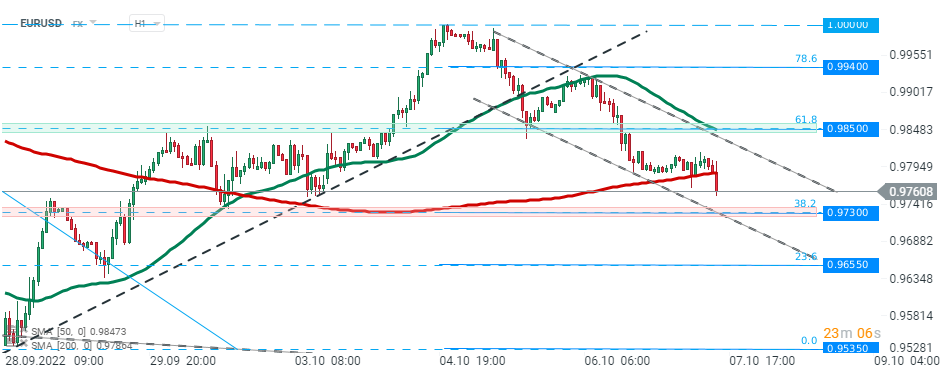

EURUSD is trading lower today and today’s data provided more fuel for bears. The main currency pair is heading towards a short-term support at 0.9730. Source: xStation

EURUSD is trading lower today and today’s data provided more fuel for bears. The main currency pair is heading towards a short-term support at 0.9730. Source: xStation

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Economic calendar: Indices and EURUSD await US retail sales report

Morning wrap (10.02.2026)

Market wrap: Novo Nordisk jumps more than 7% 🚀