The US CPI report for March was released today at 1:30 pm BST. Report was expected to show a steep deceleration in headline price growth as well as slight acceleration in core measure. However, as headline CPI was expected to drop below core CPI for the first time since late-2020, it was the core gauge that was especially on watch today.

Actual report showed headline inflation more than expected, from 6.0% to 5.0% YoY, while core gauge matched expectations by accelerating to 5.6% YoY. It looks like investors acted on softer headline reading with market reaction being clearly dovish - USD slumped while US index futures jumped.

Markets odds for a 25 basis point Fed rate hike at May meeting dropped from around 73% prior to data release to around 60% now.

US, CPI inflation for March

- Headline (annual): 5.0% YoY vs 5.2% YoY expected (6.0% YoY previously)

- Headline (monthly): 0.1% MoM vs 0.2% MoM expected

- Core (annual): 5.6% YoY vs 5.6% YoY expected (5.5% YoY previously)

- Core (monthly): 0.4% YoY vs 0.4% MoM expected

Headline US CPI inflation slowed below the pace of core US CPI inflation in March. Source: XTB, Bloomberg

Headline US CPI inflation slowed below the pace of core US CPI inflation in March. Source: XTB, Bloomberg

EURUSD jumped above April 4 highs following softer than expected US CPI data for March. Source: xStation5

EURUSD jumped above April 4 highs following softer than expected US CPI data for March. Source: xStation5

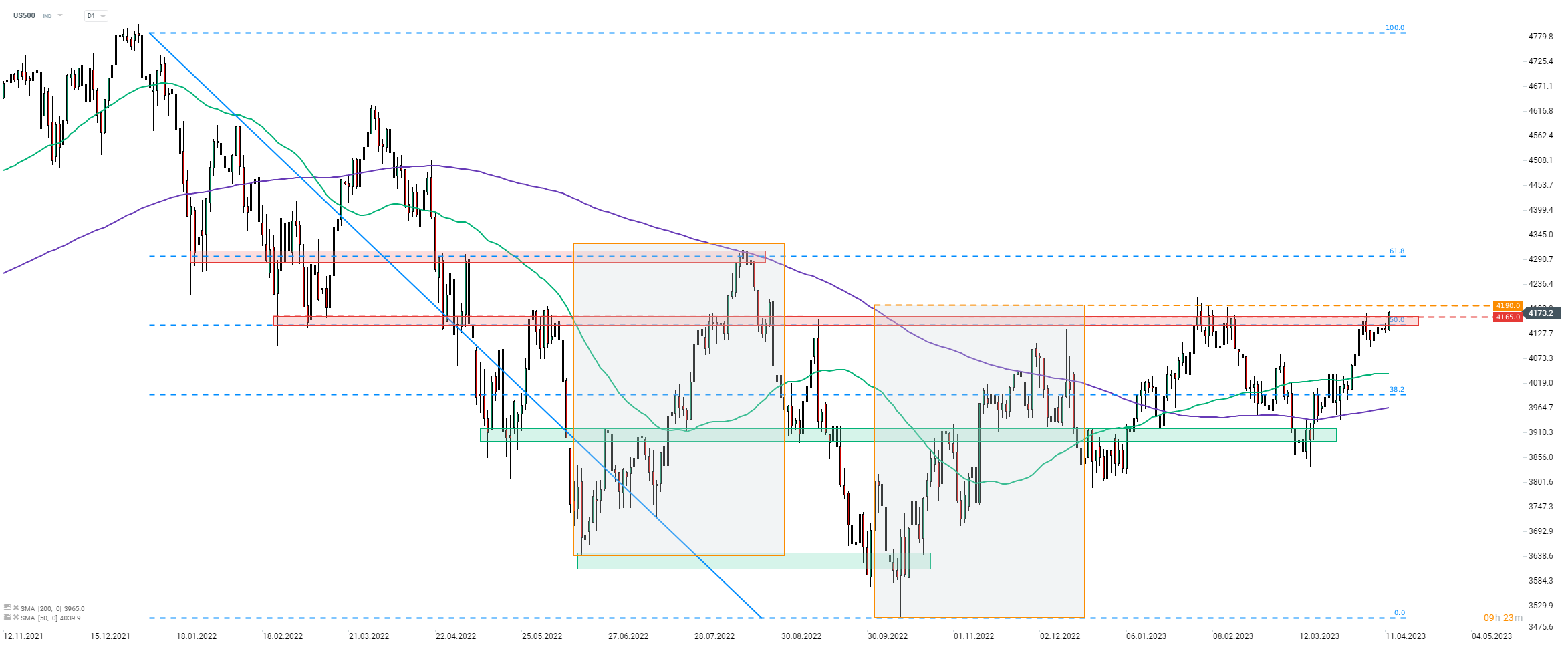

US500 caught a bid following US CPI data and is attempting to make a break above the resistance zone ranging between 50% retracement and 4,165 pts mark. Source: xStation5

US500 caught a bid following US CPI data and is attempting to make a break above the resistance zone ranging between 50% retracement and 4,165 pts mark. Source: xStation5

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Economic calendar: Indices and EURUSD await US retail sales report