01:30 PM GMT, United States - Employment Data for December (NFP):

-

Private Nonfarm Payrolls: actual 223K; forecast 135K; previous 182K;

-

Participation Rate: actual 62.5%; previous 62.5%;

-

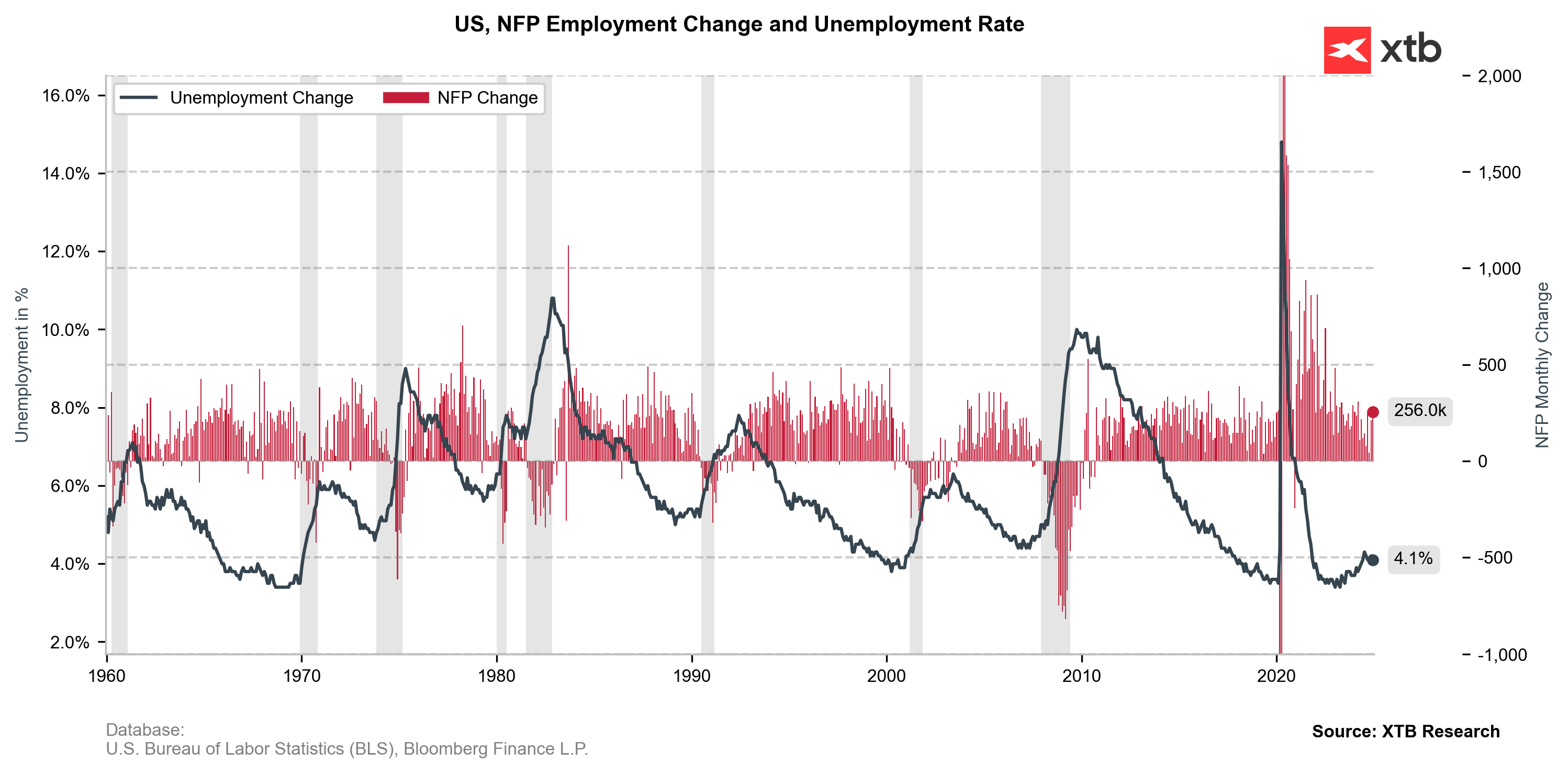

Nonfarm Payrolls: actual 256K; forecast 164K; previous 212K;

-

Manufacturing Payrolls: actual -13K; forecast 5K; previous 25K;

-

Government Payrolls: actual 33.0K; previous 30.0K;

01:30 PM GMT, United States - Employment Data for December (Unemployment rate & Earnings):

-

Unemployment Rate: actual 4.1%; forecast 4.2%; previous 4.2%;

-

U6 Unemployment Rate: actual 7.5%; previous 7.7%;

-

Average Hourly Earnings: actual 0.3% MoM; forecast 0.3% MoM; previous 0.4% MoM;

-

Average Hourly Earnings: actual 3.9% YoY; forecast 4.0% YoY; previous 4.0% YoY;

Today's U.S. labor market data significantly beat expectations, with nonfarm payrolls rising 256K vs 164K forecast. Private sector hiring was particularly strong at 223K (vs 135K expected), while manufacturing showed weakness (-13K). The unemployment rate unexpectedly dropped to 4.1%, and wage growth moderated to 3.9% YoY, suggesting contained inflation pressures despite robust hiring.

This strong employment report, combined with moderating wage growth, supports the Federal Reserve's patient stance on rate cuts. The data demonstrates continued resilience in the U.S. labor market while showing early signs of the gradual cooling the Fed seeks in wage pressures.

EURUSD is attempting to break below the January lows at 1.02237, a level that triggered a 0.7% selloff. A sustained break below this support could pave the way for further bearish momentum, while failure to breach may signal a potential rebound.

The US100 (Nasdaq-100 index) has experienced a drop of over 1% following the release of the data.

Bitcoin experiences drop of over 2% after the NFP data.

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

US2000 near record levels 🗽 What does NFIB data show?