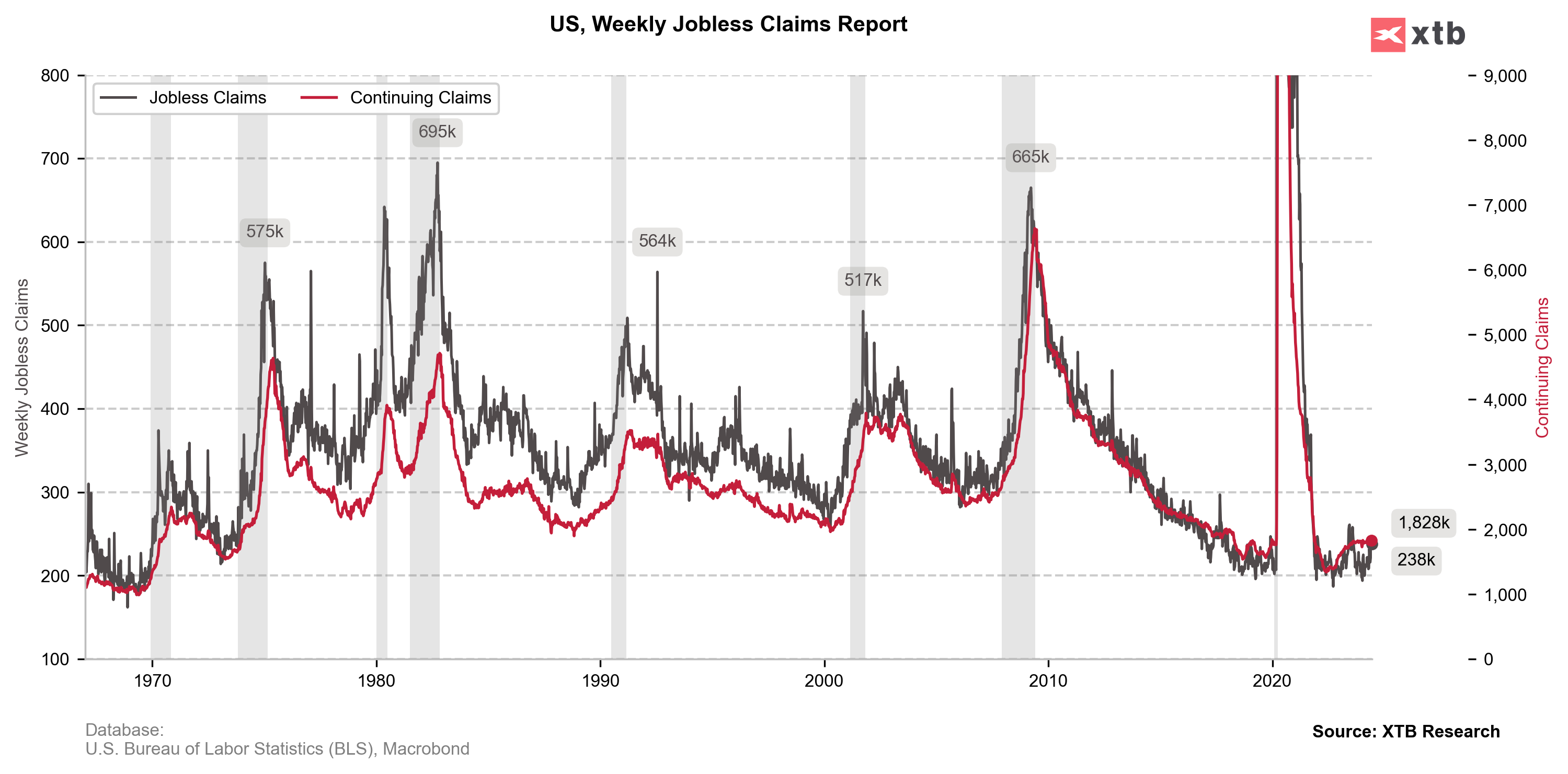

US jobless claims came in 238k vs 235k exp. and 242k previously (Continued jobless claims came in 1810k vs 1828k exp. and 1820k previously)

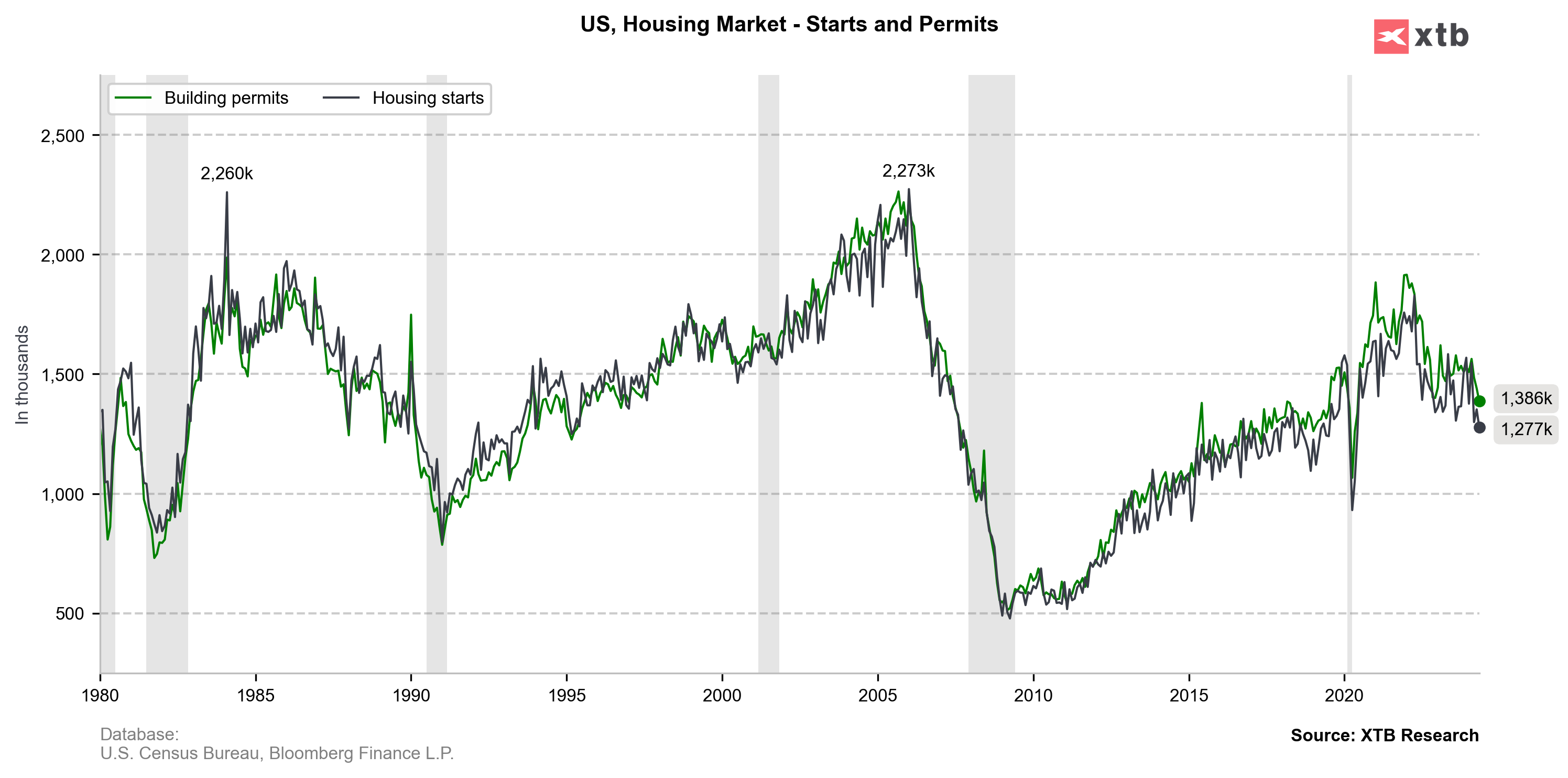

- US Housing Starts came in 1.277M vs 1.37M exp. and 1.36M previously (-5.5% MoM vs 0.7% exp. and 5% previously)

- US Building permits came in vs 1.45M and 1.44M previously (-3.7% MoM vs 0.7% exp. and -3% previously)

US Philly Fed Index came in 1.3 vs 5 exp. and 4.5 previously

In the first reaction, the US dollar strengthened after the macro readings, despite some weakness seen in housing starts and regional manufacturing index from Philadelphia. The reason of it may be in lower than previous one jobless claims reading, but on the other hand we saw unexpected rise in continued jobless claims to 1828k, which signals that US job market doesn't deteriorate in fast pace but may see some weakness.

EURUSD (M15 interval)

Source: xStation5

Source: xStation5

Source: XTB Research, Bureau of Labor Statistics (BLS), Macrobond

Source: XTB Research, Bureau of Labor Statistics (BLS), Macrobond

Source: XTB Research, US Census Burea, Bloomberg Finance L.P.

Source: XTB Research, US Census Burea, Bloomberg Finance L.P.

US OPEN: Holiday season extinguish volatility despite political risks

BREAKING: US jobless claims below expectations!🚨

BREAKING: CB consumer sentiment bellow expectations!🔥📉

BREAKING: US industry data slightly better than expected!🏭📈