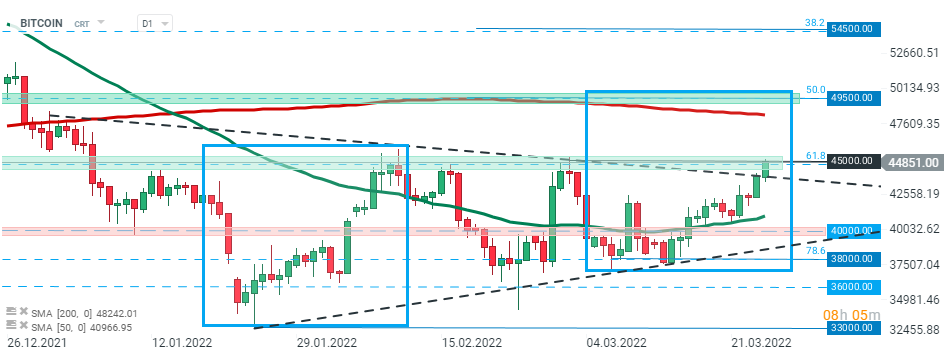

Bitcoin price is on the front foot this week despite the ongoing war and bulls hope that the relief rally may turn into a broader uptrend. The crucial thing will be to see whether BTC bulls will be able to decisive break above key resistance at $45,000 which managed to reject price each time it has been tested since the beginning of the year.

However some on-chain metrics suggest that sellers did not lay down their weapons. Rising buyers activity seems to have liquidated quite a bit of short positions, however the on-chain volume and number of daily active addresses (DAA) do not reflect bullish momentum.

Since the beginning of March DAA dropped to 0.95 million from 1.09 million. The on-chain volume also showed no large fluctuations and remains at the level of 30 billion. Source: Santiment

Since the beginning of March DAA dropped to 0.95 million from 1.09 million. The on-chain volume also showed no large fluctuations and remains at the level of 30 billion. Source: Santiment

Meanwhile Russia's energy chief said Russia is taking into consideration the possibility of allowing China and Turkey to pay for energy in Bitcoin. He said those countries could begin paying for energy in Russian Rubles, Chinese Yuan, Turkish Lira — or even Bitcoin (BTC) — rather than the international standard US dollar.

If Bitcoin manages to close on the daily chart above $45,500, this may signal a potential breakout from the consolidation zone. In this scenario price may be heading towards next key resistance around $49500which is marked upper limit of the 1:1 structure and 50% Fibonacci retracement of the upward wave launched in July 2021. On the other hand, if sellers manage to regain control, then another downward impulse towards psychological support at $40,000 may be launched. Source: xStation5

If Bitcoin manages to close on the daily chart above $45,500, this may signal a potential breakout from the consolidation zone. In this scenario price may be heading towards next key resistance around $49500which is marked upper limit of the 1:1 structure and 50% Fibonacci retracement of the upward wave launched in July 2021. On the other hand, if sellers manage to regain control, then another downward impulse towards psychological support at $40,000 may be launched. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

🚨 Bitcoin drops to $69,000 📉 A 1:1 correction scenario?

Market wrap: Novo Nordisk jumps more than 7% 🚀

Crypto news: Bitcoin falls below $70k 📉Will crypto slide again?