Next Friday, the Bank of Japan (BOJ) will make a decision on interest rates. The last unexpected increase by 15 basis points to 0.25% caused a panic sell-off in the global stock market and a sharp strengthening of the JPY. This was the result of the so-called carry trade, which was possible due to long-standing negative interest rates and the continuously weakening Japanese currency.

According to well-informed sources connected to the central bank, BOJ representatives are unlikely to raise the benchmark interest rate from the current level of 0.25% at the next meeting on September 20. The main reason is the negative market reaction to the previous rate hike in July and the record drop in the Nikkei 225 on August 5. The BOJ continues to monitor the effects of the last monetary tightening.

Most economists now predict that the BOJ will delay interest rate hikes until December or January, depending on economic and financial conditions. This stance is supported by Deputy Governor Shinichi Uchida’s view that the bank will avoid rate hikes during periods of financial instability. Currently, the market prices just a 51% chance of a 25 basis point hike at the BOJ meeting on January 24, 2025, which would make another 10 basis point hike more likely. Moreover, a new prime minister of Japan will be elected on October 1, although no major changes in monetary policy are expected.

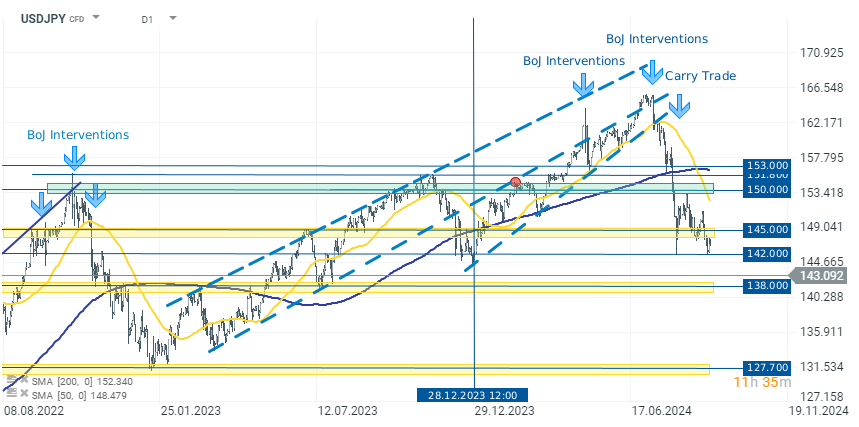

USDJPY (D1)

The USDJPY rate is currently 11.50% below its early July 2024 highs. Exchange rate is now consolidating around the support zone from 142.0000 to 145.0000. Volatility on the pair may be exceptionally high next week. On one hand, we will learn the decision and rationale from the BOJ, and on the other, the Fed is likely to begin a cycle of interest rate cuts. A 25 basis point cut is currently priced in, but markets may anticipate more easing. Therefore, it is possible that after the decision is published, we might see the USD strengthen. If the BOJ maintains rates, the USDJPY rate may rise. Otherwise, a drop in the rate below 140.0000 could push prices down to the next support zone at 138.0000.

Source: xStation 5

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS