- The U.S. Department of Justice has conveyed that regulators will soon announce a global enforcement directive for the cryptocurrency market;

- The regulators' efforts make investors see the collapse of the entire industry as less and less likely, and reassure them that digital assets will continue to grow and mature as a new asset class;

- The cryptocurrency market is catching its breath and reasserting itself in the belief that the worst is over, and that the FTX bankruptcy ultimately did not trigger the collapses of other cryptocurrency exchanges;

- Despite relatively hawkish comments from Fed members suggesting that markets are getting prematurely and excessively excited about falling inflation, Wall Street is ignoring the warnings, rising indexes are helping the crypto market;

- Bulls continue their rally, and weakening macro data from the U.S. economy may cause the Fed to indeed start considering halting rate hikes in the first half of 2023 which could give fuel to risky assets.

- Bitcoin is approaching $21,500 and Ethereum is trading above $1,600 for the first time in more than 2 months.

Comments from Davos

The ongoing World Economic Forum in Davos has traditionally featured representatives of the cryptocurrency industry this year. Giving an interview, Vice President of Policy and Regulatory Strategy of fintech Circle, Teana Baker-Taylor indicated that the period of total speculation in the cryptocurrency market is over, companies in the industry are now focusing on real use cases of the technology. Blockchain companies are posting gains today, with shares of Coinbase (COIN.US), HIVE Blockchain (HIVE.US) and Argo Blockchain (ARG.UK) rising. On the other hand, Cliff Sarkin, head of strategic relations at Casper Labs, a cryptocurrency company that is also present in Davos answering questions indicated that he remains 'cautiously optimistic' while more and more industry insiders are beginning to believe that the cryptocurrency market has already reached the bottom.

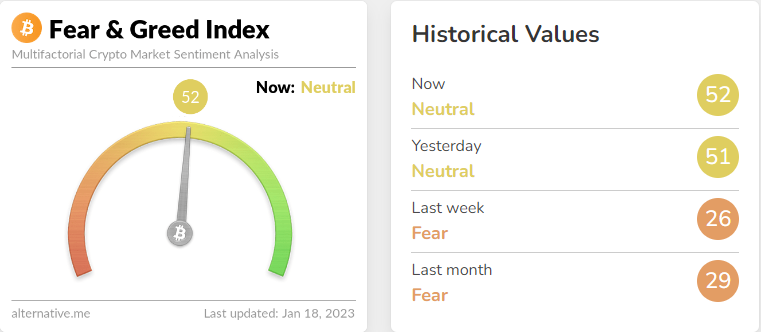

The Fear and Greed Index indicates that crypto market sentiment is once again neutral near 52 points. The index in recent days for the first time and in months crossed the 50 point level. Source: alternative.me

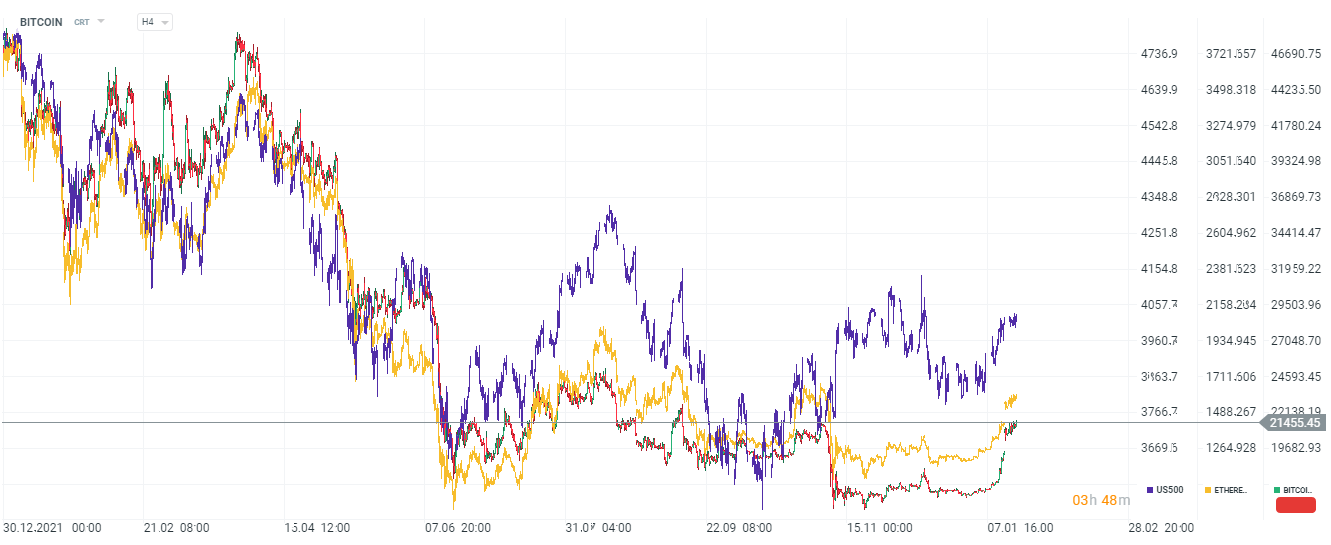

Bitcoin, Ethereum (gold line) and US500 (purple line), H4 interval. Euphoria among cryptocurrencies continues as the stock market records a definite improvement in sentiment in the face of falling inflation, a slowly weakening economy and a declining argument by the Fed for maintaining a very restrictive cycle of rate hikes. Bitcoin and Ethereum's correlation with the S&P500 index continues. Source: xStation5

Bitcoin, Ethereum (gold line) and US500 (purple line), H4 interval. Euphoria among cryptocurrencies continues as the stock market records a definite improvement in sentiment in the face of falling inflation, a slowly weakening economy and a declining argument by the Fed for maintaining a very restrictive cycle of rate hikes. Bitcoin and Ethereum's correlation with the S&P500 index continues. Source: xStation5

Market Wrap: UK Stagnation, Tariffs Weigh on Giants, and Crypto Stabilizes

Morning wrap (12.02.2026)

Daily summary: Weak US data drags markets down, precious metals under pressure again!

🚨 Bitcoin drops to $69,000 📉 A 1:1 correction scenario?