Bitcoin's price is moving in a sideways trend and holding below the $17,000 level. We will have at least a couple of volatility catalysts in the coming days, the earliest of which is tomorrow's expiration of $320 million worth of positions in the options market. Two others are the U.S. inflation reading on Tuesday and Powell's decision and speech on Wednesday, which has traditionally caused wild volatility among risky assets, including the cryptocurrency market.

News

- JP Morgan CEO Jaimie Dimon again criticized cryptocurrencies, pointing to their use in the criminal world and the losses of traders. At the same time, he emphasized the potential of blockchain technology and the practical application of some projects;

- The head of the New York Stock Exchange and president of the Intercontinental Exchange (ICE.US) Joeffrey Sprecher pointed to the possible integration of traditional assets like stocks and ETFs with blockchain technology through tokenization. According to Sprecher, the U.S. Securities and Exchange Commission will soon address market regulation, and cryptocurrencies will be covered by twin regulations to the stock market - there will be no need for entirely new regulations.

- ECB member Fabio Panetta called for global regulation of cryptocurrencies due to the cross-border nature of the cryptocurrency market. He also referred to digital assets as a speculative bubble;

- Payments giant PayPal (PYPL.US) will expand its cryptocurrency service to Luxembourg in what will become its European Union debut in the coming days. Luxembourg, where PayPal's European headquarters are located, could serve as a gateway for the other 26 countries when the Digital Asset Markets Regulation (MiCA) comes into effect. The regulatory scheme could theoretically give companies a license to offer their services throughout the EU. Binance and Coinbase, as well as Nexo and Gemini, which have registered in Italy, among others, have gone this route. PayPal's entry into Luxembourg follows the initial launch of cryptocurrency services in the US in 2020, followed by the UK last year. Once available, users will be able to buy, sell and store Bitcoin, Ethereum and Litecoin, among others.

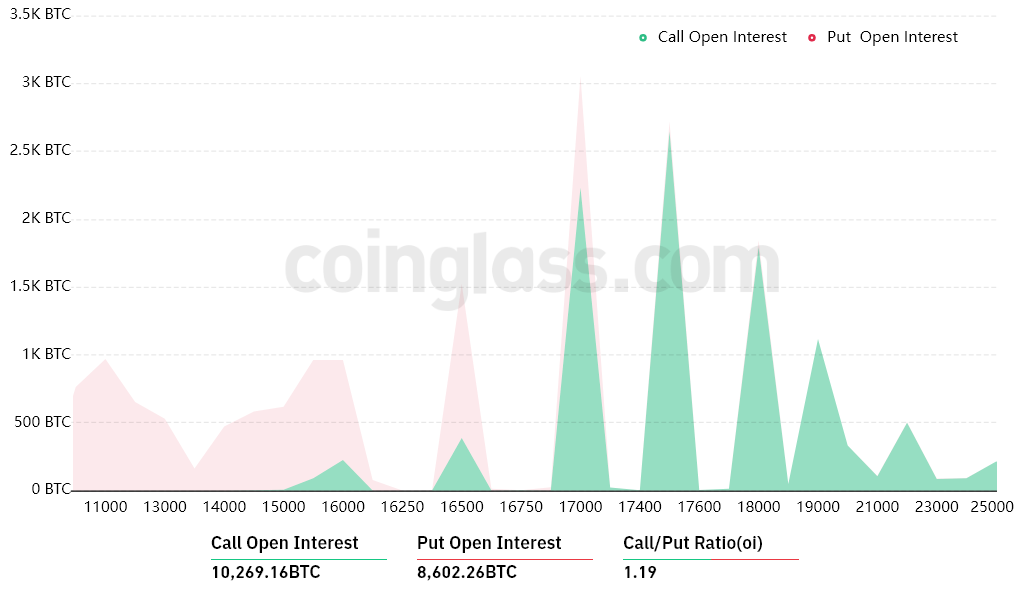

Open interest in the BTC options market indicate that bearish traders have exaggerated the downward scenario by betting on price declines well below $16,500. If BTC holds at current price levels, Friday's options expiration has the potential to cascade the supply side of the options market which could potentially help bulls to take Bitcoin to new monthly peaks. Source: Coinglass

Open interest in the BTC options market indicate that bearish traders have exaggerated the downward scenario by betting on price declines well below $16,500. If BTC holds at current price levels, Friday's options expiration has the potential to cascade the supply side of the options market which could potentially help bulls to take Bitcoin to new monthly peaks. Source: Coinglass

A CNBC survey conducted from November 26-30 showed that 24% of Americans have invested, traded or used cryptocurrencies in the past, up from 16% in March. According to CNBC, the survey's marignes of error was about 3.5% with a comparison of the March results from NBC News:

- According to the survey, 42% of crypto investors currently have a negative opinion of cryptocurrencies. 17% of crypto investors are "very negative" about cryptocurrencies. Bitfury analysts point out that the sentiment of the retail market is crucial because it has historically accounted for up to 90% of cryptocurrency trading. The survey found that 53% of the public believes cryptocurrencies should be subject to the same or more regulation and oversight as stocks, with 21% of all adults and 16% of investors, wanting stricter regulation. But at the same time, just 26% of Americans say now is a good time to invest in stocks, down two points from last quarter's survey and the most pessimistic level recorded in the 15-year history of the CNBC survey. 51% say it's a bad time to invest, the third highest in the survey's history, beating only the weaker results of the previous two surveys from this year.

CNBC's survey indicated that Americans' attitudes toward cryptocurrencies have definitely deteriorated since March, which is actually not surprising - it's been the same in each of the previous down cycles. By nearly 65%, the number of positive votes fell. The ratio of negative votes definitely increased, it amounted to 43%. Source: All America Survey, CNBC

CNBC's survey indicated that Americans' attitudes toward cryptocurrencies have definitely deteriorated since March, which is actually not surprising - it's been the same in each of the previous down cycles. By nearly 65%, the number of positive votes fell. The ratio of negative votes definitely increased, it amounted to 43%. Source: All America Survey, CNBC

Bitcoin chart, H4 interval. The price of the major cryptocurrency is moving in a narrow range between the SMA 100 and SMA 200 averages, and we can see how both averages are aiming for the intersection known as the 'golden cross', which is usually a very bullish formation that works with a lag (the price starts to rise before the cross becomes visible). Particularly noteworthy, therefore, is the SMA 100 (black line), which is currently aiming to cross the 200-session average from below. The behavior of both averages indicates a chance, for cryptocurrencies to return to growth next week. Probably necessary for this would be a reading of falling inflation in the US. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

🚨 Bitcoin drops to $69,000 📉 A 1:1 correction scenario?

Market wrap: Novo Nordisk jumps more than 7% 🚀

Crypto news: Bitcoin falls below $70k 📉Will crypto slide again?