Big Lots (BIG.US) is one of the worst performing Wall Street stocks today. Company's share price slumps over 30% at press time. Bloomberg reported on Friday that a US discount home goods retailer hired a consulting firm specializing in corporate turnarounds and is gauging banks' willingness to offer it another loan. Bloomberg report triggered concerns over the company's financial wellbeing and caused analysts' to lower their recommendation on Big Lots.

A recommendation from Loop Capital Markets stands out among others and is drawing investors' attention today. Loop Capital analysts downgraded Big Lots from 'hold' to 'neutral' and cut the price target from $6.00 to $1.00 per share! Analysts noted Big Lots' asset-based credit facility is tied to the company's eligible inventory and credit card receivables, and it makes Big Lots susceptible to a death spiral if its suppliers tighten their credit terms.

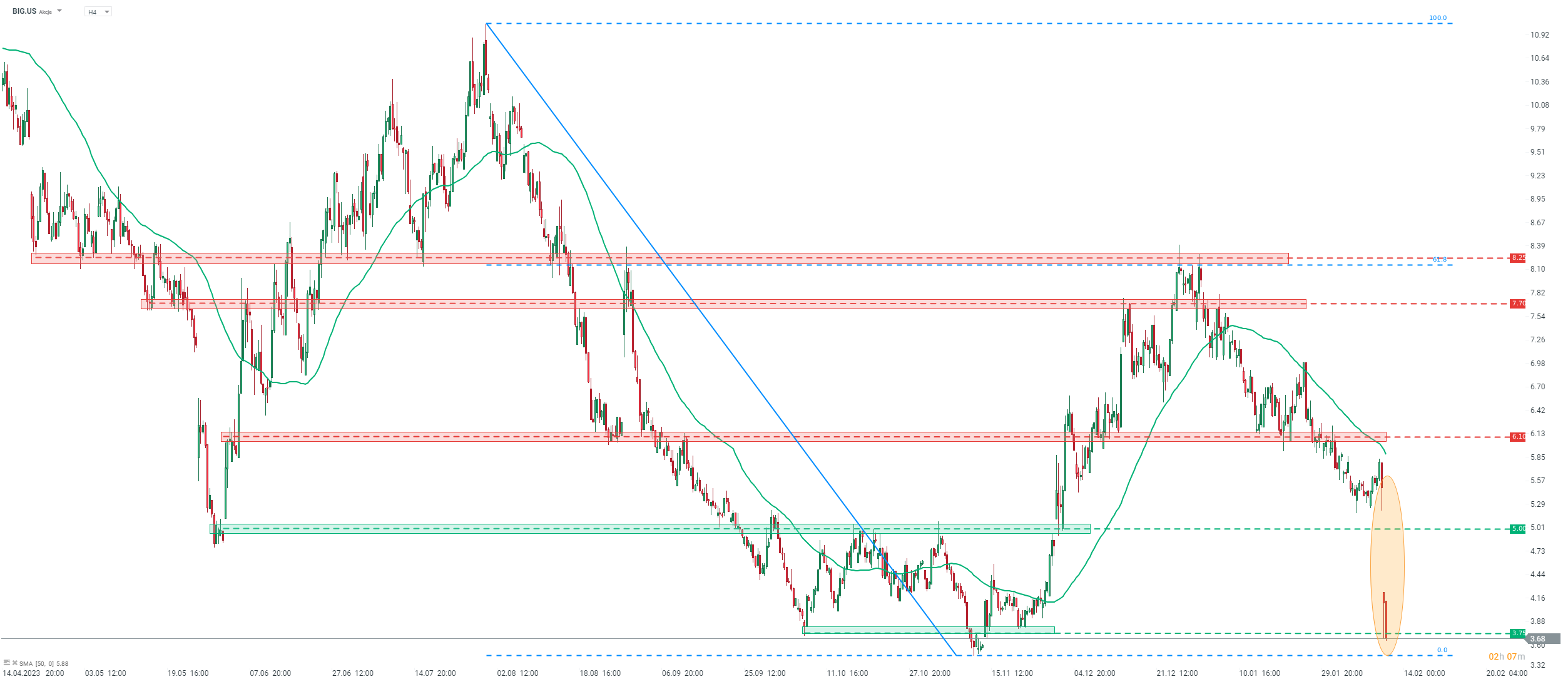

Big Lots attempted to calm markets' nerves ahead of today's market open, saying that its preliminary Q4 results, including comparable sales and gross margin, were in-line with guidance. However, this did not manage to soothe investors' concerns. Big Lots business outlook has been under pressure as high inflation and high interest rates discourage consumers from spending on home goods, like furniture. Big Lots trade over 50% year-to-date lower and around 95% below its mid-2021 peak.

Source: xStation5

Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

US Open: Wall Street rises despite weak retail sales

Coca-Cola Earnings: Will the New CEO Withstand the Pressure?