Autodesk (ADSK.US) is trading around 5% lower on the day. Company said that it will not be able to file its annual report within the 15-day extension periods. Autodesk said that it continues to investigate its free cash flow and non-GAAP operating margin practices. However, company assured that subject and scope of the investigation remains unchanged, and it simply needs more time to investigate the matter.

However, those assurances do not seem to be convincing enough for investors. A need for more time to investigate the matter may also mean that the issue is more complex than previously thought. While failure to meet the reporting deadline will put the company in breach of Nasdaq exchange listing requirements, Autodesk will have 60 days to regain compliance, and it said it will take necessary steps to do it as soon as possible.

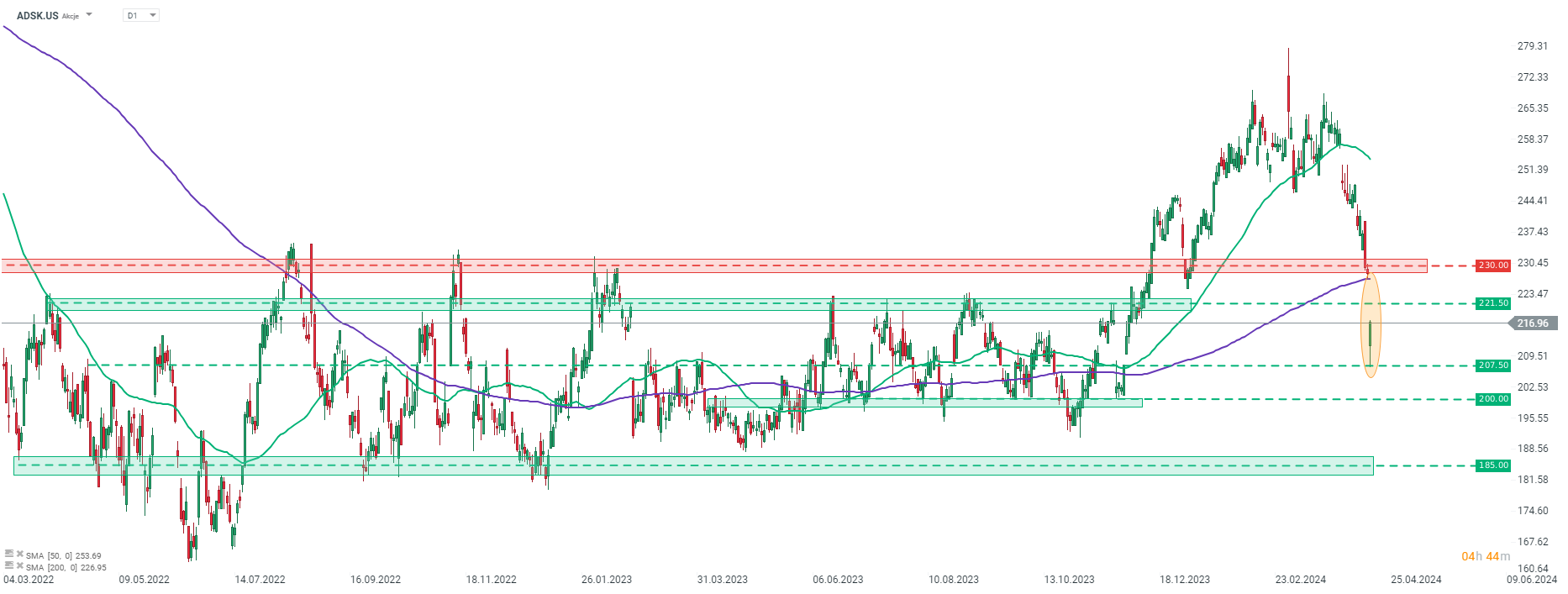

Taking a look at Autodesk (ADSK.US) chart at D1 interval, we can see that the stock launched today's cash session with a big bearish price gap (orange circle). Stock plunged below the $230 support zone, as well as 200-session moving average (purple line) at session launched and reached the lowest level since the end of November 2023. Sell-off was halted at the $207.50 swing area and stock began to recover. Nevertheless, Autodesk continues to trade around 5% lower on the day. Should declines resume and stock drops below $207.50 zone, the next support to watch can be found in the $200 area, marked with previous price reactions.

Source: xStation5

Source: xStation5

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

Economic calendar: NFP data and US oil inventory report 💡