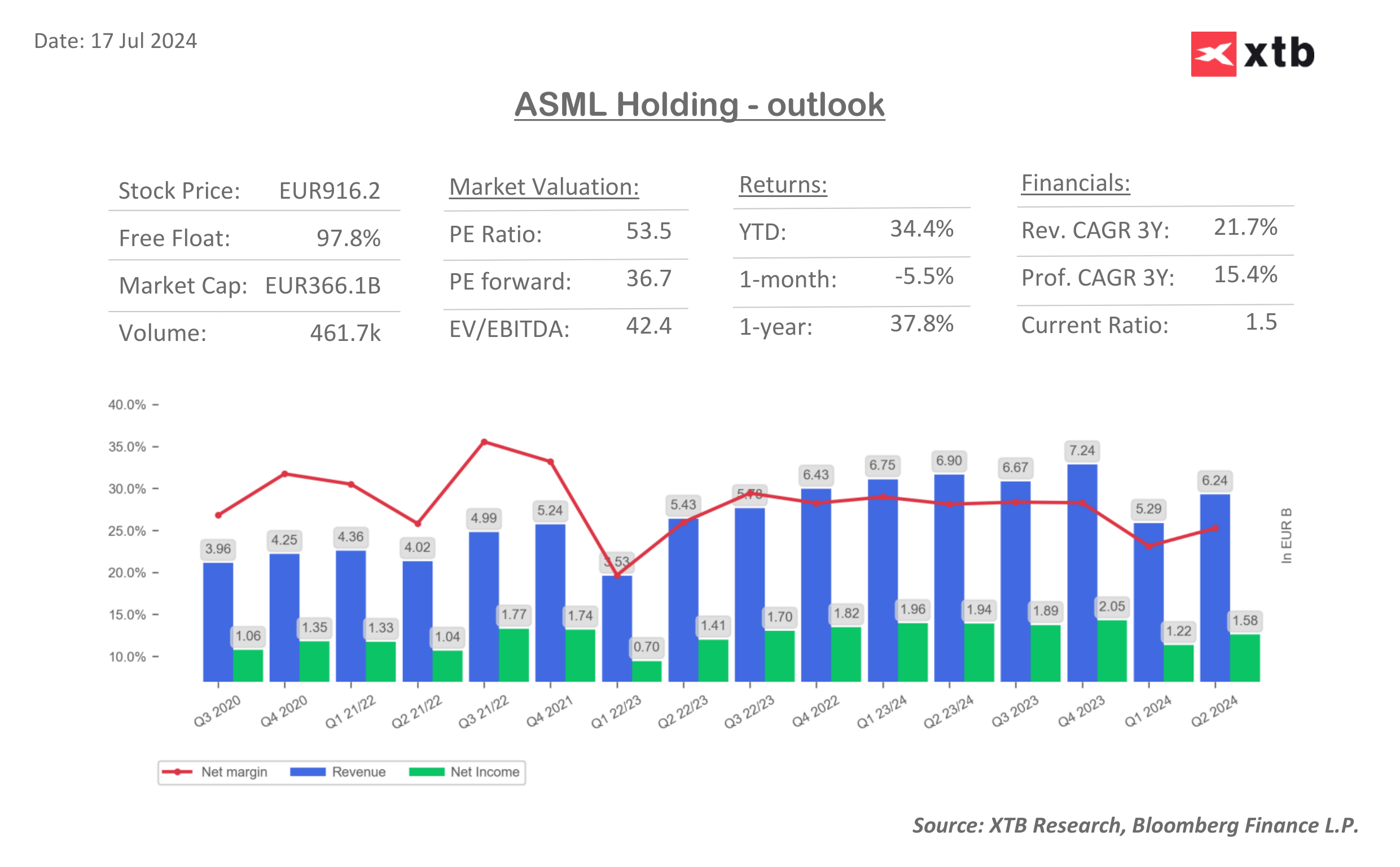

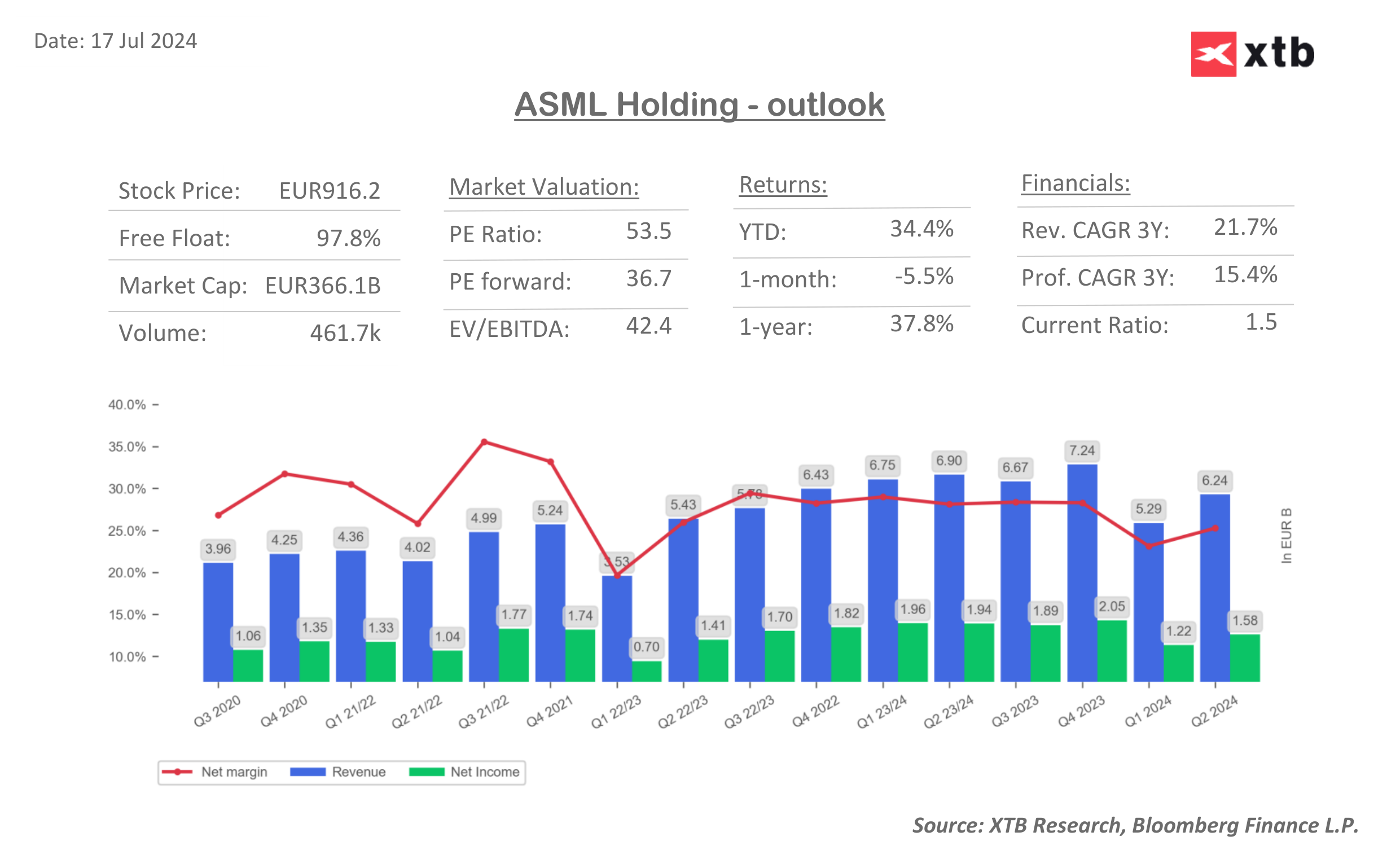

The biggest in Europe and one of the biggest in the world, advanced semiconductor producer, ASML (ASML.NL) loses today almost 6% despite stronger than expected Q2 earnings. Quite disappointing guidance with high valuations metrics was probably the biggest profit-taking signal, as the Dutch company rallied to all-time highs during last weeks. Despite very strong demand for AI chips, semiconductor equipment company may be suffering from concerns due to more tariffs and curbs on China chip exports. According to company, 2024 is a transition year for semis industry as a whole and AI developments are a key factor, which will drive a demand recovery.

- Revenue: 6.24 billion euros vs 6.03 billion euros exp. (9% drop YoY)

- Net profit: 1.58 billion euros vs 1.43 billion euros exp. (18.7% drop YoY)

- Net bookings and orders for machinery: 5.6 billion euros in the June quarter (24% YoY growth)

The company leave its full year outlook for the 2024-year unchanged, which disappointed analysts. Also, ASML sees Q3 net sales between 6.7 and 7.3 billion euros, while analysts expected 7.6 billion euros. ASML pointed to macro uncertainty, which is the reason why a chip producer can't be sure about a pace of future business expansion. Currently, ASML expects industry recovery to continue in the H2 2024, with possible 'cyclical upturn' in 2025.

ASML will also increase CAPEX, hitting cash flow to built new factories across the globe. As for now, AI is still a relatively small component of ASML business, which is facing some geopolitical headwinds. The Dutch government last year to cut China off from strategic chip making tools, especially ASML EUV machines. China market remained a critical part of ASML’s business in the Q2 2024, accounting for almost 50% of revenues (with no change quarterly). Export restrictions may impact 10% to 15% of it’s China sales, in 2024.

ASML valuation and multiples metrics

Źródło: XTB Research, Bloomberg Financial L.P.

Źródło: XTB Research, Bloomberg Financial L.P.

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

Economic calendar: NFP data and US oil inventory report 💡