The ‘Terminal’ module located at the bottom of the MT4 platform allows you to manage and monitor all your trading activities, pending orders, trading account history, cash operations, overall balance, equity and your margin. Learn more about it with this lesson.

The ‘Terminal’ module located at the bottom of the MT4 platform allows you to manage and monitor all your trading activities, pending orders, trading account history, cash operations, overall balance, equity and your margin. Learn more about it with this lesson.

*Since the recording of these videos, negative balance protection has come into force from 02.10.17. This means that whilst trading losses cannot exceed funds in your account, your capital is still at risk.

In this lesson, you’ll learn:

- About the Terminal and its features

- How to close and edit a position

- What margin level is and how it’s calculated

The ‘Terminal’ module located at the bottom of the MT4 platform allows you to manage and monitor all your trading activities, pending orders, trading account history, cash operations, overall balance, equity and your margin.

The Terminal acts as your main trading hub, so let’s take a closer look. A good understanding of how it works will help you to trade successfully over the long term.

Trade tab

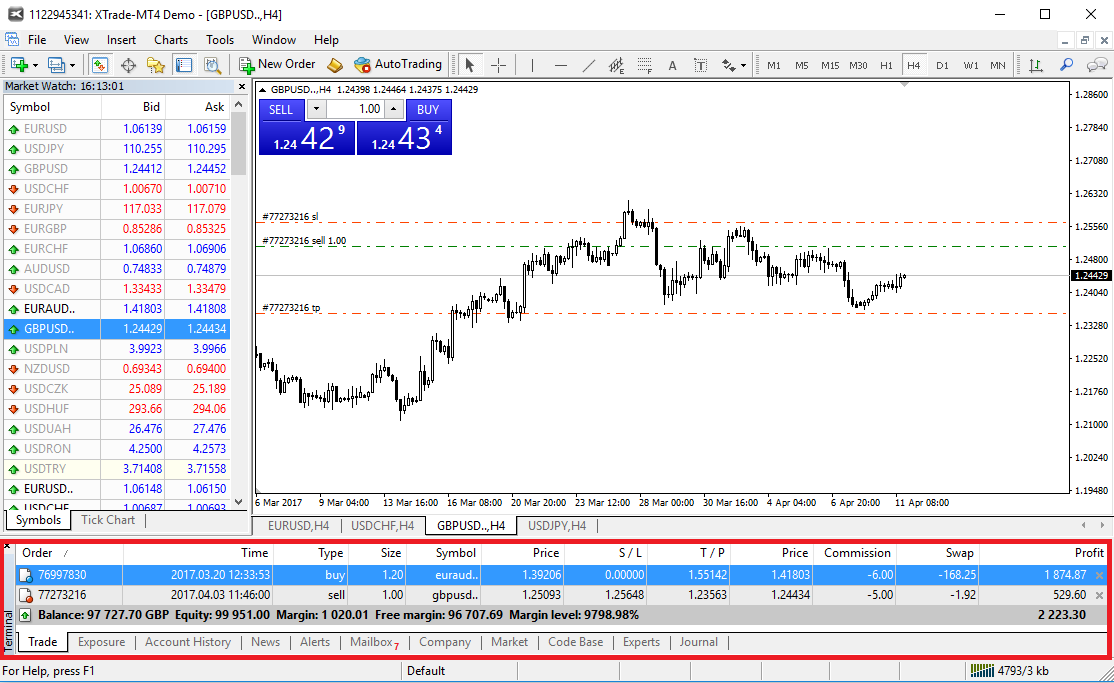

In the first "Trade" tab you can see all the details of your positions, both open and pending.

Details like:

Order: the unique ticker number of the trade, for reference when you have any questions about the trade.

Time: the time at which the position was opened.

Type: your order type is displayed here. ‘Buy’ denotes a long position, ‘sell’ denotes a short position. Pending orders are also displayed here.

Size: the amount of lots.

Symbol: name of the traded instrument.

Price: price at which the position was opened.

SL/TP: stop loss and take profit levels if set.

Price: the current market price, - not to be confused with opening price.

Commission: cost of opening the position if charged.

Swap: charged or added swaps points.

Profit: the current position profit/loss.

At the bottom you can see a summary of your entire trading account:

Balance: the amount of the money you have in your account before opening positions

Balance: the amount of the money you have in your account before opening positions

Equity: your account balance plus the profit/loss of your open positions

Margin: how much money has been set aside to secure the open positions

Free margin: the difference between your account equity and the margin set aside to cover open positions. This indicates the amount of available funds to make new trades.

Margin level: is the ratio of equity to margin, a built-in safety brake of MT4#

There are two important levels to remember when it comes to your margin.

If your account margin level reaches 100%, you can still close your open positions, but you cannot open any new positions.

Margin Level = (Equity / Margin) x 100

At XTB, your margin close “stop out” level is set to 30%, which means if your margin level falls below this level, the platform starts to close your losing positions automatically. This is an automatic safety mechanism to help protect your account funds and prevent losses from deepening. It starts by closing the biggest losing position and stops when your margin level returns to at least 30%.

Account history

The terminal window has also a number of helpful bookmarks, but the second most important is definitely ‘Account History’.

You can view and analyse all your past trading activity and generate a report of a specified period.

Everything you need in one place. In our most advanced platform xStation 5 we’ve added even more features like trader’s statistics, which makes you even more effective.

Everything you need in one place. In our most advanced platform xStation 5 we’ve added even more features like trader’s statistics, which makes you even more effective.