The report from the American labor market (Non-Farm Payrolls, NFP) is probably the most popular report among traders. This article explains why and shows examples of how the report has affected EURUSD in the past.

The Federal Reserve, the most important central bank in the world, has two main goals - low and stable inflation, and full employment. When traders want to predict the Fed's future steps, the labor market report is naturally the first point to observe. Employment growth is usually favourable for the US dollar, because it translates into a lower unemployment rate and may create inflationary pressure in the economy. In turn, the Fed reacts to this phenomenon by raising rates, and higher rates are usually favourable for the currency. However, what does high dynamic mean? Published data are always compared to expectations that can be checked in the economic calendar on the xStation platform. Let's look at a few examples.

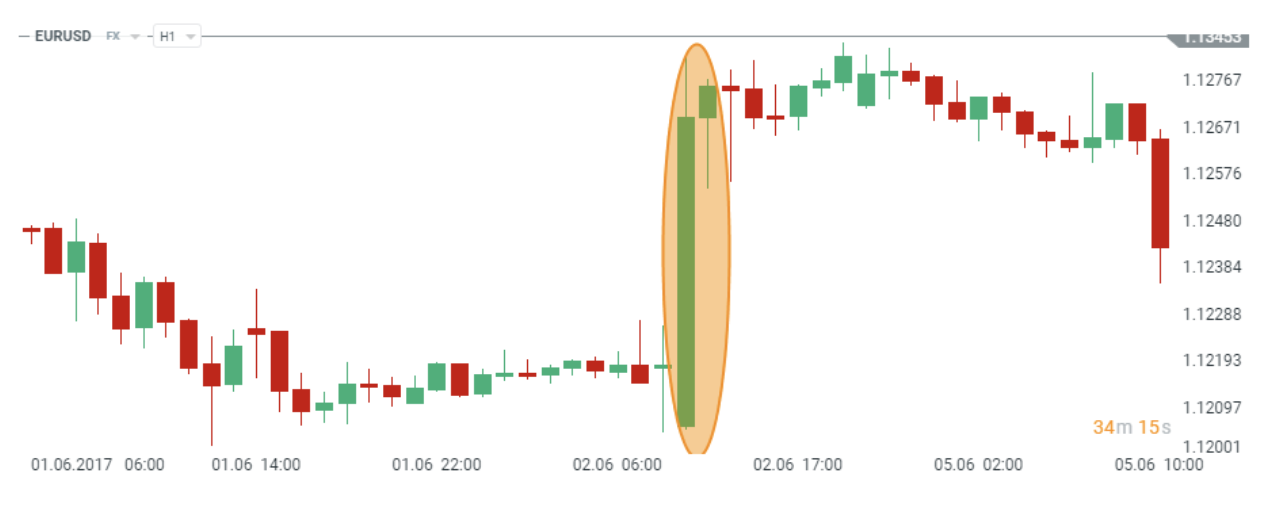

Example 1 - Weak NFP Report

The NFP report for May 2017 showed an increase in employment by 138,000. Although this was not a low value, the result turned out to be lower than expected - consensus pointed to an increase of 182,000. Therefore, the lower value was treated as a disappointment for investors and led to the weakening of the dollar. As a result, EURUSD increased sharply.

The data presented above refers to the past and cannot constitute an indicator or guarantee of achieving similar results in the future.

The data presented above refers to the past and cannot constitute an indicator or guarantee of achieving similar results in the future.

Source: xStation

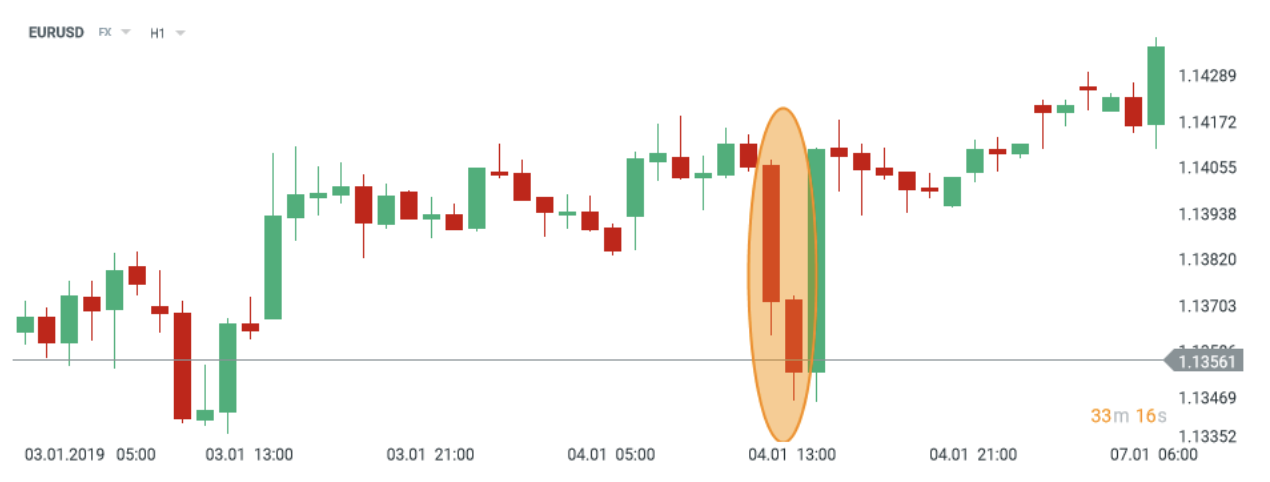

Example 2 - Strong NFP Report

The opposite situation took place after the release of the December 2018 data. The report showed an increase in employment by 370 thousand, while the consensus pointed to 184 thousand. As a result, the dollar gained strongly, while EURUSD fell.

The data presented above refers to the past and cannot constitute an indicator or guarantee of achieving similar results in the future. Source: xStation

The data presented above refers to the past and cannot constitute an indicator or guarantee of achieving similar results in the future. Source: xStation

As you can see, the NFP report can have a significant impact on EURUSD.