Financial reports from major technology companies have negatively disappointed Wall Street and show a further slowdown. Despite a festive quarter in most business segments, the mega-techs failed to beat analysts' expectations. With a slowing economy and weaker consumer sentiment, it seems that a 'disinflationary' 2023 could be a challenge for Silicon Valley giants.

Apple (AAPL.US)

- Revenue $117.15 billion vs. $121.14 billion forecasts

- Earnings per share (EPS): 1.88 vs. 1.94 forecasts

- Iphone revenue: $65.78 billion vs. $68.3 billion forecasts

- MacBook revenue: $7.74 billion vs. $9.72 billion forecasts

- iPad revenue: $9.4 billion vs. $7.78 billion forecasts

- Total product revenue $96.39 billion vs. $98.98 billion forecasts

- Revenue in China: $23.91 billion vs. $21.8 billion forecasts

- Home and accessories: $13.48 billion vs. $15.32 billion forecasts

iPhone sales down 8% vs. record Q1 2022 although it's worth taking into account that in Q4 the company struggled with the closure of a key 'iPhoneCity' factory in Zhengzhou, China, which affected shipments and production. Higher revenues from iPads manufactured not only in China, but also in Vietnam indicate that the 'covid-zero' policy may have taken a 'one-time' toll on iPhone sales, smartphones still don't have geographically diversyfied production. However, higher-than-expected revenue from China may indicate that the Chnese opening economy will become an increasingly important market for Apple.

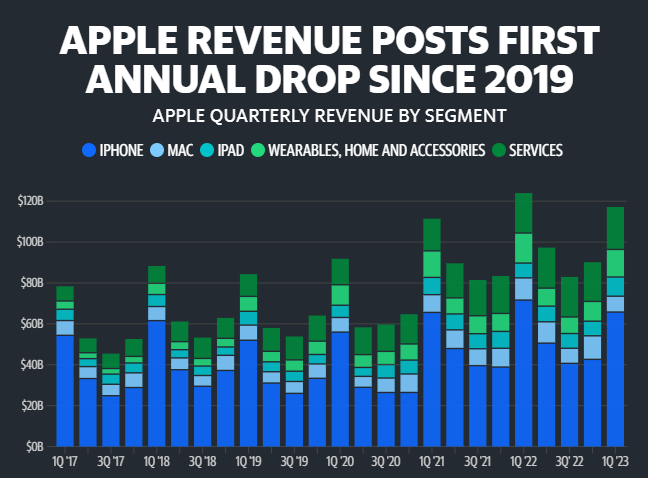

Apple reported its first year-over-year revenue decline since 2019. Although iPhone revenues were close to Q4 2021, they failed to beat Q1 2022 despite the debut of the new iPhone 14 and the holiday quarter. Source: Statista, YahooFinance

Amazon (AMZN.US)

- Revenue: $149.2 billion vs. $145.8 billion

- Earnings per share (EPS): $0.03 vs $0.17 forecasts

- Cloud computing (AWS) revenue: $21.38 billion vs $21.76 billion forecasts

- Operating profit: $2.7 billion vs. $2.51 billion forecasts

- Operating margin: 1.8% vs. 1.85% forecasts

- E-commerce sales: $64.53 billion vs. $65.03 billion forecasts

- Estimated operating profit in Q1 2023: 0 to $4.0 billion vs. $3.52 billion forecasts

- Estimated Q1 2023 revenue: $121 to $126 billion vs $125.55 billion forecasts

Amazon Web Services cloud computing revenue is seeing a slowdown and came in almost $400 million below expectations. AWS's high-margin business accounts for more than half of the company's net income, and if revenue from it slows in the double digits in 2023 as well, earnings per share could continue to fall in an environment of lower e-commerce sales. Earnings were surprisingly weak although it's worth noting that they were significantly weighed down by a loss in shares in EV manufacturer Rivian Automotive (RIVN.US), whose share price has risen more than 20% since the beginning of the year. The company forecast slower sales growth in Q1.

Alphabet (GOOGL.US)

- Revenue: $63.12 billion vs. $63.24 billion forecasts

- Earnings per share (EPS):$1.05 vs. $1.20

- Advertising revenue: $59.04 billion vs $60.64 billion forecasts

- Google cloud revenue: $7.32 billion vs $7.3 billion forecasts

- Youtube revenue: $7.96 billion vs $8.27 billion forecasts

- Services revenue: $67.84 billion vs $68.9 billion forecasts

- Other revenues: $8.80 billion vs $8.14 billion forecasts

The weaker earnings are mainly due to the weak advertising sector. A recent investment bank Cowen research indicated that ad spending will fall twice in 2023 compared to 2022, and 2/3 of advertisers are factoring recession into their budgets meaning Google's revenues can continue to fall until recesson fears persist. Cloud computing revenues, while slightly beating expectations, are clearly slowing.

Apple (AAPL.US) stock chart, D1 interval. The key level worth watching is the SMA200 (red line), above which the company managed to rise this week in an attempt to reverse the trend. A possible drop below $147 level could herald further weakness. Source: xStation5

Apple (AAPL.US) stock chart, D1 interval. The key level worth watching is the SMA200 (red line), above which the company managed to rise this week in an attempt to reverse the trend. A possible drop below $147 level could herald further weakness. Source: xStation5

Gazdasági naptár: NFP-adatok és amerikai olajkészlet-jelentés 💡

Live Trading - 2026.02.10.

🌍 Gyorsjelentési szezon az XTB-vel

🌍 Gyorsjelentési szezon az XTB-vel

Ezen tartalmat az XTB S.A. készítette, amelynek székhelye Varsóban található a következő címen, Prosta 67, 00-838 Varsó, Lengyelország (KRS szám: 0000217580), és a lengyel pénzügyi hatóság (KNF) felügyeli (sz. DDM-M-4021-57-1/2005). Ezen tartalom a 2014/65/EU irányelvének, ami az Európai Parlament és a Tanács 2014. május 15-i határozata a pénzügyi eszközök piacairól , 24. cikkének (3) bekezdése , valamint a 2002/92 / EK irányelv és a 2011/61 / EU irányelv (MiFID II) szerint marketingkommunikációnak minősül, továbbá nem minősül befektetési tanácsadásnak vagy befektetési kutatásnak. A marketingkommunikáció nem befektetési ajánlás vagy információ, amely befektetési stratégiát javasol a következő rendeleteknek megfelelően, Az Európai Parlament és a Tanács 596/2014 / EU rendelete (2014. április 16.) a piaci visszaélésekről (a piaci visszaélésekről szóló rendelet), valamint a 2003/6 / EK európai parlamenti és tanácsi irányelv és a 2003/124 / EK bizottsági irányelvek hatályon kívül helyezéséről / EK, 2003/125 / EK és 2004/72 / EK, valamint az (EU) 2016/958 bizottsági felhatalmazáson alapuló rendelet (2016. március 9.) az 596/2014 / EU európai parlamenti és tanácsi rendeletnek a szabályozási technikai szabályozás tekintetében történő kiegészítéséről a befektetési ajánlások vagy a befektetési stratégiát javasló vagy javasló egyéb információk objektív bemutatására, valamint az egyes érdekek vagy összeférhetetlenség utáni jelek nyilvánosságra hozatalának technikai szabályaira vonatkozó szabványok vagy egyéb tanácsadás, ideértve a befektetési tanácsadást is, az A pénzügyi eszközök kereskedelméről szóló, 2005. július 29-i törvény (azaz a 2019. évi Lap, módosított 875 tétel). Ezen marketingkommunikáció a legnagyobb gondossággal, tárgyilagossággal készült, bemutatja azokat a tényeket, amelyek a szerző számára a készítés időpontjában ismertek voltak , valamint mindenféle értékelési elemtől mentes. A marketingkommunikáció az Ügyfél igényeinek, az egyéni pénzügyi helyzetének figyelembevétele nélkül készül, és semmilyen módon nem terjeszt elő befektetési stratégiát. A marketingkommunikáció nem minősül semmilyen pénzügyi eszköz eladási, felajánlási, feliratkozási, vásárlási felhívásának, hirdetésének vagy promóciójának. Az XTB S.A. nem vállal felelősséget az Ügyfél ezen marketingkommunikációban foglalt információk alapján tett cselekedeteiért vagy mulasztásaiért, különösen a pénzügyi eszközök megszerzéséért vagy elidegenítéséért. Abban az esetben, ha a marketingkommunikáció bármilyen információt tartalmaz az abban megjelölt pénzügyi eszközökkel kapcsolatos eredményekről, azok nem jelentenek garanciát vagy előrejelzést a jövőbeli eredményekkel kapcsolatban.