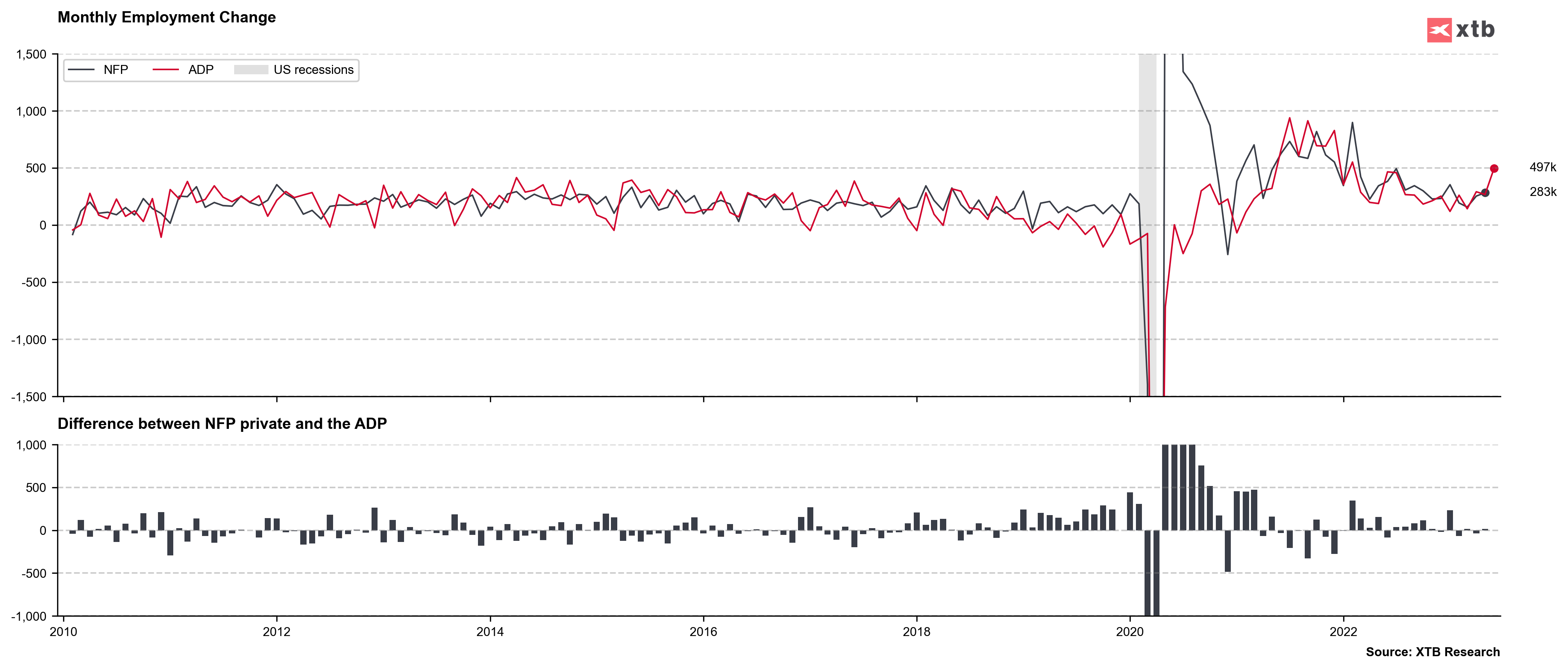

Release of the US NFP report for June at 1:30 pm BST is a key macro event of the day. ADP report released yesterday showed an employment gain of almost half a million in June (+497k) and has easily beat market expectations (+230k). This was a blockbuster release as the range of estimates for ADP release in Bloomberg poll was from 95k to 275k. Also it should be noted that while ADP was a poor predictor of NFP readings in the past, the two have been coming in more or less in-line with each other in recent months. Having said that, investors are eager to see whether NFP will extend its beat streak and show higher-than-expected employment gain today as well.

ADP data released yesterday showed a massive jump in employment in June. Source: Macrobond, XTB

ADP data released yesterday showed a massive jump in employment in June. Source: Macrobond, XTB

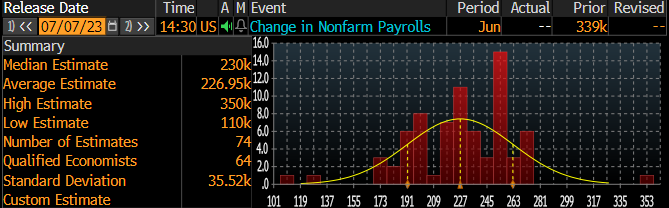

Estimates for today's NFP reading from economists polled by Bloomberg range from 110k to 350k. Should NFP data today come in-line with yesterday's ADP reading it would not only by a massive beat but also the highest reading since January 2023 when it came in at 504k (revised higher from initial 472k reading). As NFP have not missed estimates since March 2022 report and continued to show strong job increases since, there is a feeling in the markets that we may see another beat today. However, whether it beats by similar magnitude as ADP data is uncertain.

Range of estimates for today's NFP in a Bloomberg poll is wider than for yesterday's ADP but neither economist surveyed expects it to be as strong as ADP. Source: Bloomberg

Apart from non-farm payrolls data, today's report will also include data on unemployment rate and wages. Unemployment rate is expected to tick lower from 3.7 to 3.6%, following a spike from 3.4 to 3.7% in May. Annual wage growth is seen moderating slightly but monthly pace of wage increases is expected to come in at 0.3% MoM, the same as it did a month ago.

Headline reading will likely draw most of the attention today because of yesterday's ADP beat. Wage growth data may be overlooked unless it shows a major deviation from expectations.

US, NFP report for June.

- Non-farm payrolls. Expected: +225k. Previous: +339k (ADP: +497k)

- Unemployment rate. Expected: 3.6%. Previous: 3.7%

- Wage growth (annual). Expected: 4.2% YoY. Previous: 4.3% YoY

- Wage growth (monthly). Expected: 0.3% MoM. Previous: 0.3% MoM

A look at the charts

A strong NFP reading would mean that Fed has room to continue tightening and would likely be met with USD strengthening and a pullback on equity markets. However, traders should keep in mind that the reaction may be short-lived and we will see a U-turn reversal after the opening of the Wall Street session, as is often the case with data-driven price moves.

EURUSD

A wide head and shoulders pattern can be spotted on EURUSD market. The main currency pair has recently failed to break above the 1.10 mark and painted the right shoulder of the pattern in the process. Neckline of the pattern can be found slightly below the 1.07 mark and a break below could trigger a 500 pips move lower. Traders should note that the 50-session moving average proved to be a strong support recently and has been limiting recent downward moves. Source: xStation5

A wide head and shoulders pattern can be spotted on EURUSD market. The main currency pair has recently failed to break above the 1.10 mark and painted the right shoulder of the pattern in the process. Neckline of the pattern can be found slightly below the 1.07 mark and a break below could trigger a 500 pips move lower. Traders should note that the 50-session moving average proved to be a strong support recently and has been limiting recent downward moves. Source: xStation5

US100

Nasdaq-100 (US100) started to struggle. Index has once again failed to break above 15,400 pts resistance zone, painting a double top in the process. Should the index continue to slide and breaks below the 14,850 pts zone, which is also marked with the neckline of the pattern, a deeper downward move may be looming. Textbook range of the downside breakout from the pattern suggests a possibility of a drop to as low as 14,290 pts. Source: xStation5

Nasdaq-100 (US100) started to struggle. Index has once again failed to break above 15,400 pts resistance zone, painting a double top in the process. Should the index continue to slide and breaks below the 14,850 pts zone, which is also marked with the neckline of the pattern, a deeper downward move may be looming. Textbook range of the downside breakout from the pattern suggests a possibility of a drop to as low as 14,290 pts. Source: xStation5

Live Trading - 2026.02.10.

A nap chartja 🗽

Gazdasági naptár: Az indexek és az EURUSD az amerikai kiskereskedelmi adatok a középpontban

Reggeli összefoglaló (10.02.2026)

Ezen tartalmat az XTB S.A. készítette, amelynek székhelye Varsóban található a következő címen, Prosta 67, 00-838 Varsó, Lengyelország (KRS szám: 0000217580), és a lengyel pénzügyi hatóság (KNF) felügyeli (sz. DDM-M-4021-57-1/2005). Ezen tartalom a 2014/65/EU irányelvének, ami az Európai Parlament és a Tanács 2014. május 15-i határozata a pénzügyi eszközök piacairól , 24. cikkének (3) bekezdése , valamint a 2002/92 / EK irányelv és a 2011/61 / EU irányelv (MiFID II) szerint marketingkommunikációnak minősül, továbbá nem minősül befektetési tanácsadásnak vagy befektetési kutatásnak. A marketingkommunikáció nem befektetési ajánlás vagy információ, amely befektetési stratégiát javasol a következő rendeleteknek megfelelően, Az Európai Parlament és a Tanács 596/2014 / EU rendelete (2014. április 16.) a piaci visszaélésekről (a piaci visszaélésekről szóló rendelet), valamint a 2003/6 / EK európai parlamenti és tanácsi irányelv és a 2003/124 / EK bizottsági irányelvek hatályon kívül helyezéséről / EK, 2003/125 / EK és 2004/72 / EK, valamint az (EU) 2016/958 bizottsági felhatalmazáson alapuló rendelet (2016. március 9.) az 596/2014 / EU európai parlamenti és tanácsi rendeletnek a szabályozási technikai szabályozás tekintetében történő kiegészítéséről a befektetési ajánlások vagy a befektetési stratégiát javasló vagy javasló egyéb információk objektív bemutatására, valamint az egyes érdekek vagy összeférhetetlenség utáni jelek nyilvánosságra hozatalának technikai szabályaira vonatkozó szabványok vagy egyéb tanácsadás, ideértve a befektetési tanácsadást is, az A pénzügyi eszközök kereskedelméről szóló, 2005. július 29-i törvény (azaz a 2019. évi Lap, módosított 875 tétel). Ezen marketingkommunikáció a legnagyobb gondossággal, tárgyilagossággal készült, bemutatja azokat a tényeket, amelyek a szerző számára a készítés időpontjában ismertek voltak , valamint mindenféle értékelési elemtől mentes. A marketingkommunikáció az Ügyfél igényeinek, az egyéni pénzügyi helyzetének figyelembevétele nélkül készül, és semmilyen módon nem terjeszt elő befektetési stratégiát. A marketingkommunikáció nem minősül semmilyen pénzügyi eszköz eladási, felajánlási, feliratkozási, vásárlási felhívásának, hirdetésének vagy promóciójának. Az XTB S.A. nem vállal felelősséget az Ügyfél ezen marketingkommunikációban foglalt információk alapján tett cselekedeteiért vagy mulasztásaiért, különösen a pénzügyi eszközök megszerzéséért vagy elidegenítéséért. Abban az esetben, ha a marketingkommunikáció bármilyen információt tartalmaz az abban megjelölt pénzügyi eszközökkel kapcsolatos eredményekről, azok nem jelentenek garanciát vagy előrejelzést a jövőbeli eredményekkel kapcsolatban.