NIO (NIO.US), the Chinese electric vehicle company we've talked about so much about in the past, seems to be in the midst of a crisis right now, and it seems like it's only a matter of time before the company announces another raise. capital. Due to relatively weak performance in recent months, the company is unlikely to hit its annual production targets this year, while the ongoing price war within the EV industry has already caused margin crunch and caused NIO to reach unsustainable levels of capital consumption. Add to this that the company's global ambitions could be threatened due to a lack of price advantage coupled with increased geopolitical risks, it seems obvious that NIO's advantage is limited. Therefore, although its shares are taking advantage of the short-term momentum due to the improvement in general market sentiment, it is difficult to think that the medium and long-term trend is sustainable.

Can't get Better

Since the beginning of the year, NIO has been actively involved in trying to aggressively expand its business, thanks to increasing demand for electric vehicles in China and around the world. In late March, the company opened its third European showroom, after which it hinted that it was preparing to launch a new cheap small EV for the European market next year. At the same time, back home, it launched the newest version of its budget ES6 crossover just a few weeks ago, which has an estimated range of 490km to 625km. On top of that, there are also signs that NIO is about to upgrade the batteries on some of its vehicles, which will be coming from a semi-solid-state battery supplier in the foreseeable future.

Yet despite all these developments, NIO continues to disappoint its shareholders and makes it difficult to consider its shares a sound investment. Just last week, the company released its first-quarter earnings results, which showed that while its revenue rose 7.7% year-on-year to $1.55 billion, it was nonetheless below overall estimates. At the same time, its diluted EPS (non-GAAP) was a loss of RMB2.51 (-$0.36) per share, while the company itself barely met its quarterly delivery target by delivering 31,041 vehicles during the period. of three months.

NIO key financial results (Q1-2023)

The worst thing is that the situation is unlikely to improve significantly in the coming months. For the second quarter, NIO already expects its revenue to be in the range of $1.270 million to $1.360 million, representing a slowdown of between 15.1% yoy and 9% yoy. On top of that, it also expects to deliver 23,000 to 25,000 vehicles during the second quarter, which also represents a decrease of between 8.2% and 0.2% compared to the previous year. Something that worries because they are figures that have not been seen since Q2 of 2021.

Taking into account that in April and May NIO published deliveries of 6,658 and 6,155 vehicles, respectively, it means that in order to reach the target in the quarter, only in June it needs to deliver at least 10,187 vehicles to meet. While the company could get an additional boost in sales thanks to the recent release of ES6, there is still a good chance that NIO will miss its targets due to its relatively weak performance over the past two months.

NIO quarterly deliveries (Q1_2023)

In addition to all this, at the end of 2022, the CEO of NIO indirectly hinted that he expects the company's sales to exceed 200,000 units in 2023, while its CFO, in an interview with Bloomberg at the end of March, said that he is confident that they will be able to sell 250,000 electric vehicles this year. Considering NIO's relatively weak performance in the first half of 2023, it is hard to believe that the company will be able to produce more than 140,000 vehicles in the second half of 2023 to meet its CEO's more conservative target of 200,000 units.

Loss of competitive advantage

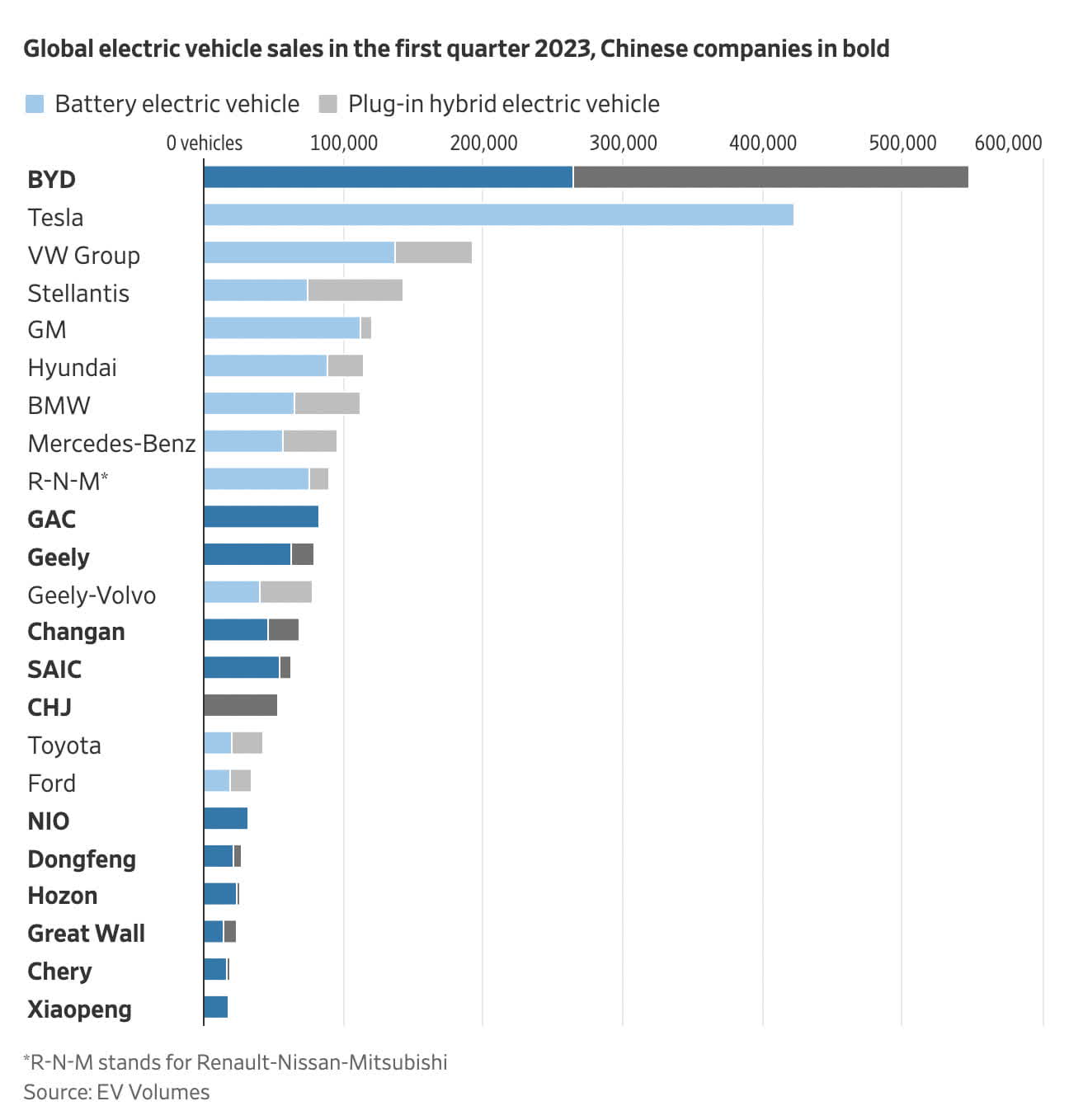

A recent WSJ article publicized the fact that all of NIO's new energy vehicles ("NEVs") are battery electric vehicles ("BEVs"), while just over half of BYD's NEVs are plug-in hybrids. (“PHEV”), instead of BEV:

Source: WSJ

What's worse is that, in addition to expecting a decline in revenue and deliveries in the second quarter, the company's margins are likely to continue to decline further due to the ongoing price war in the EV market. In the first quarter, NIO's vehicle margins were already down to 5.1% from 18.1% a year ago, and given the company's latest decision to cut prices across all its models by $4,000 , there are many reasons to believe that bottom line performance would suffer even more in the following quarters. At the same time, with the end of the free battery swap-in (BaaS) program, there is a risk that customers will be incentivized to buy vehicles from the company's competitors, as it would make even less sense to purchase EVs from NIO when a One of the most important and popular features is no longer available and that is that at the end of the period they are no longer free.

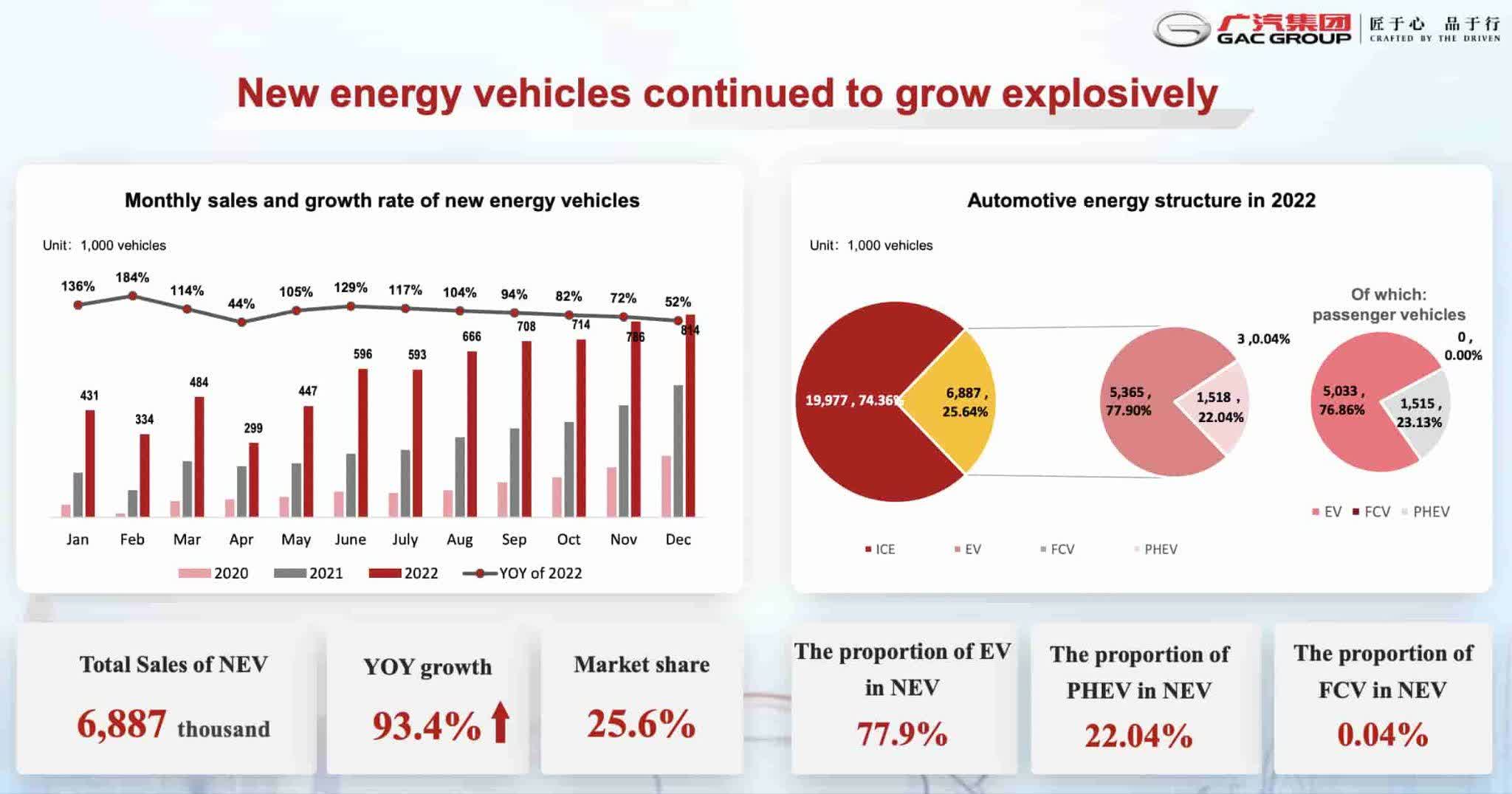

The NEV market is expanding in China and BEVs make up a bigger part of this market than PHEVs. According to CAAM (China Association of Vehicle Manufacturers), GAC's 2022 results presentation shows sales of 19,977,000 vehicles in China by 2022, 6,887,000 of these were NEVs and nearly 80% of these NEVs were BEVs, so the total BEV was 5,365,000:

China BEV (GAC 2022 Results Presentation)

The NEV market will be even bigger in 2023, but unfortunately for NIO, much of this increase is coming from lower-end PHEVs and BEVs rather than higher-end BEVs. An article from a magazine specialized in this market (CnEVPost) stated the following:

Based on our analysis of the premium SUV market (>RMB300,000, approx. $42,000), BEV mix is only 12% to date, compared to PHEV (includes EREV, Extended Range) of 18%, leaving a 70% for ICE (internal combustion engines). This is compared to the general market which is 21% BEV and 10% PHEV, which shows that customer preferences are quite different depending on the sub-segment.

Put another way, CnEVPost says premium NEV SUV models make up about 30% of the market so far in 2023 with the rest being ICE (internal combustion engines) and the NEV breakdown is 12% BEV and 18% PHEV. . This compares to the overall NEV segment which accounts for approximately 31% of the market with a breakdown of 21% BEV and only 10% PHEV. This means that companies like BYD that sell both BEVs and PHEVs at different prices have many sales opportunities that NIO does not.

The Competition is Tough

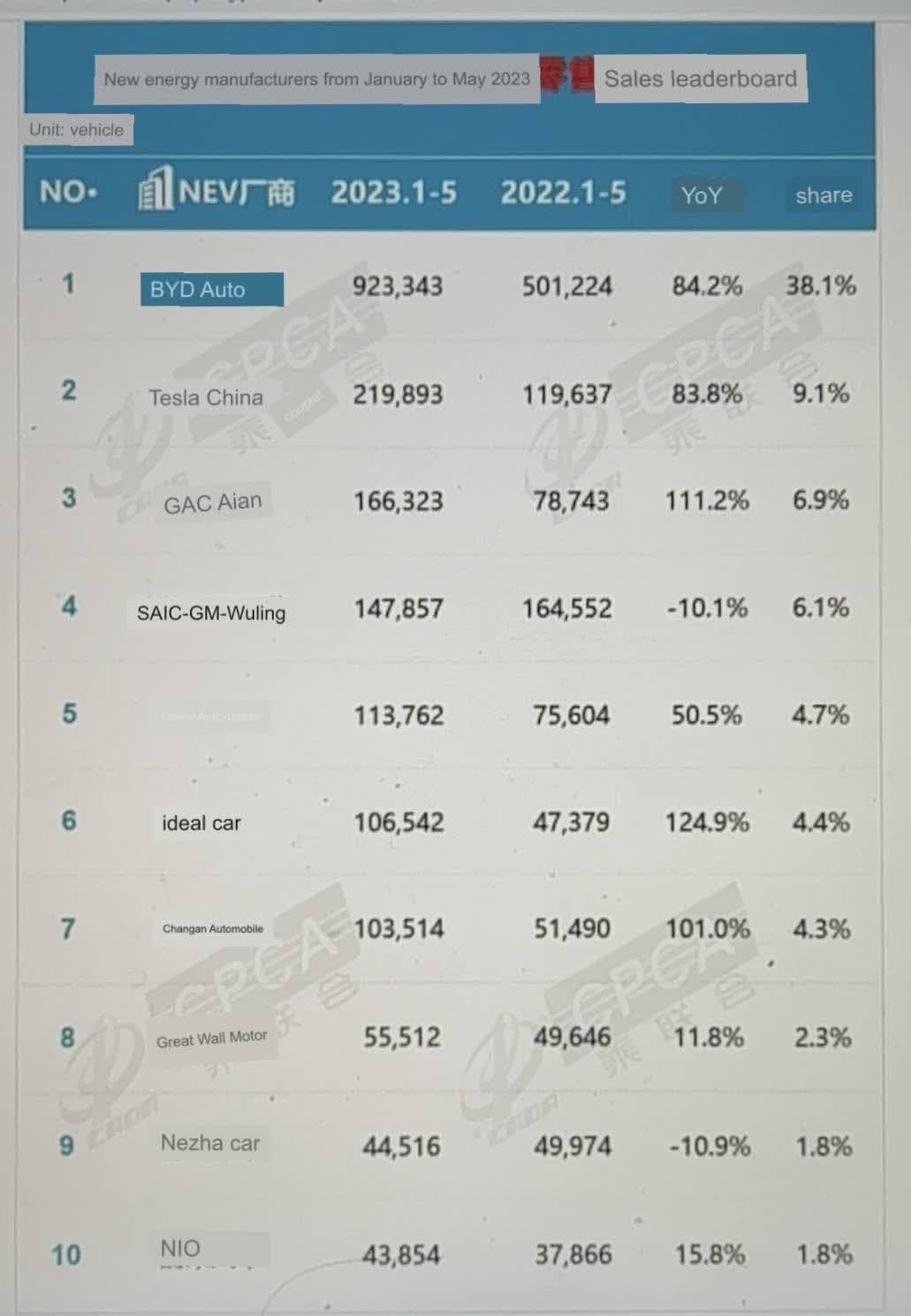

Given consumer preferences for high-end PHEVs over older high-end BEVs, large companies like BYD have an advantage over NIO in terms of increased unit sales. The growth of another big competitor, Tesla (TSLA.US), is more concerning than BYD in some ways because Tesla also offers high-end BEVs, even though the Tesla Model 3 is a more affordable model than NIO's reference model. The CPCA (China Passenger Vehicle Association) shows that BYD and Tesla are outperforming everyone with January-May NEV sales of 923,343 units and 219,893 units, respectively. Their year-over-year growth rates are over 80%, which is especially impressive given the fact that they both started with already large base data last year. In the fifth position we see Geely Auto and NIO is in tenth place with a year-on-year growth rate of 15.8%, which is more modest:

Chinese NEVs (ECAC)

In addition to BYD and Tesla, NIO also has to compete with GAC Aion, whose year-on-year growth rate is over 100%. SAIC-GM-Wuling is in fourth place, although this company is not a benchmark because most of its models look more like golf carts than premium cars. Geely Auto and Changan are number 5 and 7 respectively and are working together on electrification.

Therefore, as the ongoing price war has no end in sight, and it becomes even more difficult for NIO to curb capital consumption (cash flow) due to declining margins and increasing expenses , is among the most likely and viable options that NIO would be forced to execute another capital increase to stay afloat. In 2021, NIO already executed a $2 billion worth of deal that diluted its shareholders but also increased its liquidity from $6.7 billion in Q3 2021 to $8.3 billion in Q4 2021. However, after almost two years after that capital increase, the business remains significantly unprofitable and the expected relatively weak performance in the following months coupled with increased competition will make it difficult for NIO to break even anytime soon. At the end of the first quarter of 2023, the company already had just $4.8 billion in cash reserves, and as those reserves dwindle and no profit is expected in subsequent years, the capital raise appears to be only a matter of time.

Is the european expansion done?

Another problem NIO is currently facing is the inability to compete properly on a global stage. Recently, the CEO of the company indicated that NIO has ambitions to compete with the German automaker Volkswagen (VOW3.DE) in its own market by launching a new electric model in Europe at a price of less than €30,000. However, NIO is more than likely facing several major challenges that could undermine its European efforts for the foreseeable future.

First, the company plans to produce new models for European customers in China at a factory currently under construction. As such, there is every reason to believe that NIO will not have significant pricing power in the European region, as higher shipping costs coupled with the vulnerability of long-distance supply chains would make the company competitive with success against traditional brands. Brands that have production facilities in Europe. This is one of the reasons why Tesla (TSLA) has been actively diversifying its supply chains and opened the factory in Berlin last year to have better pricing power in the region.

Add to all this the fact that NIO's margins are already small and in decline due to the price war, and it becomes even more difficult to believe that the company will be able to successfully compete with the well-established names without burning more cash. There is also no guarantee that European consumers will be interested in buying NIO's cars in the first place. In the first quarter, the company sold just 328 of its cars in Europe, while in the second quarter it sold just 287 of its vehicles. Volkswagen, on the other hand, has sold more than 60,000 EVs in Europe in each of the last few quarters. Given this, it's hard to see how NIO could establish a strong footing in the region given all the challenges it currently faces, while at the same time, the potential worsening of China-Europe relations would make things even more difficult for the company. . to aggressively expand in the region in the following years.

What's worse is that NIO has not been able to successfully penetrate Europe so far, and yet there are already plans to enter the US market in 2025. In my opinion, this plan is mostly wishful thinking due to the fierce competition in the region. along with the lack of any production facility there as well. Furthermore, worsening Sino-US relations would make it even more difficult for any Chinese brand to enter the US market in the foreseeable future. NIO has already experienced the impact of the ongoing trade war, as the implementation of US chip export restrictions last year likely negatively affected its data center infrastructure, which was running on Nvidia's A100 GPUs ( NVDA.US). While Nvidia managed to circumvent the restrictions by offering a scaled-down version of the A100 GPUs for the Chinese market, a potential Sino-American confrontation down the road makes it hard to believe that NIO could establish a strong US presence in the future. Furthermore, the fact that there is still a risk that NIO's shares could be delisted from US exchanges due to problems with audits of China-based companies, it becomes obvious that the company's global ambitions could be ruined. whenever.

Valuation

NIO's 1Q23 announcement shows deliveries increased from 25,768 in 1Q22 to 31,041 in 1Q23. However, vehicle sales by amount remained fairly stable, from RMB 9.244 million to RMB 9.224 million. This price drop is worrisome, as the price cut is not elastic enough to substantially increase the number of vehicles sold:

NIO IR (1Q23 report)

Gross margin

Obviously, the drop in the sales price mentioned above hurts the gross margin. In addition, the 2022 annual report says that the vehicle gross margin fell by around 3.8% in 2022 due to the increase in the cost of batteries per vehicle, in the report they state the following:

The sales margin in 2022 was 13.7%, compared to 20.1% in 2021. The decrease in the sales margin compared to 2021 was mainly due to (i) the increase in battery cost per vehicle with a negative impact of around 3.8%, and (ii) higher inventory provisions, accelerated depreciation at production facilities, and losses on purchase commitments for existing ES8, ES6, and EC6 generation that are expected to have lower production and delivery levels due to their transition to new models under NT2.0, with a negative 2.2% impact on vehicle margin.

Technical analysis

NIO.US, D1. Source: xStation

The behavior of the NIO share maintains the bearish tone that it accumulates from its highs slightly above 67 $ per share, which means a drop to the recent lows of 90%. There is little hope of recapturing key 2019 levels at 10,62 $ per share, but fundamentals remain poor and show deterioration that will continue until it breaks even and delivers positive results.

Conclusions

Considering all the challenges NIO faces, it's hard to justify the company's current $15 billion market capitalization. There are already questions about whether the company's global expansion is sustainable in the long term, while the ongoing price war in the EV industry will make it even more difficult for the automaker to stop cash flow and be profitable. The market currently believes that NIO could break even in 2026, but a possible further margin squeeze coupled with the potential inability to meet its delivery targets for this year 2023 could make those expectations sound overly optimistic.

Dario Garcia, EFA

XTB Spain

Gazdasági naptár: NFP-adatok és amerikai olajkészlet-jelentés 💡

Reggeli összefoglaló - 2026.02.11.

Live Trading - 2026.02.10.

Gazdasági naptár: Az indexek és az EURUSD az amerikai kiskereskedelmi adatok a középpontban

Ezen tartalmat az XTB S.A. készítette, amelynek székhelye Varsóban található a következő címen, Prosta 67, 00-838 Varsó, Lengyelország (KRS szám: 0000217580), és a lengyel pénzügyi hatóság (KNF) felügyeli (sz. DDM-M-4021-57-1/2005). Ezen tartalom a 2014/65/EU irányelvének, ami az Európai Parlament és a Tanács 2014. május 15-i határozata a pénzügyi eszközök piacairól , 24. cikkének (3) bekezdése , valamint a 2002/92 / EK irányelv és a 2011/61 / EU irányelv (MiFID II) szerint marketingkommunikációnak minősül, továbbá nem minősül befektetési tanácsadásnak vagy befektetési kutatásnak. A marketingkommunikáció nem befektetési ajánlás vagy információ, amely befektetési stratégiát javasol a következő rendeleteknek megfelelően, Az Európai Parlament és a Tanács 596/2014 / EU rendelete (2014. április 16.) a piaci visszaélésekről (a piaci visszaélésekről szóló rendelet), valamint a 2003/6 / EK európai parlamenti és tanácsi irányelv és a 2003/124 / EK bizottsági irányelvek hatályon kívül helyezéséről / EK, 2003/125 / EK és 2004/72 / EK, valamint az (EU) 2016/958 bizottsági felhatalmazáson alapuló rendelet (2016. március 9.) az 596/2014 / EU európai parlamenti és tanácsi rendeletnek a szabályozási technikai szabályozás tekintetében történő kiegészítéséről a befektetési ajánlások vagy a befektetési stratégiát javasló vagy javasló egyéb információk objektív bemutatására, valamint az egyes érdekek vagy összeférhetetlenség utáni jelek nyilvánosságra hozatalának technikai szabályaira vonatkozó szabványok vagy egyéb tanácsadás, ideértve a befektetési tanácsadást is, az A pénzügyi eszközök kereskedelméről szóló, 2005. július 29-i törvény (azaz a 2019. évi Lap, módosított 875 tétel). Ezen marketingkommunikáció a legnagyobb gondossággal, tárgyilagossággal készült, bemutatja azokat a tényeket, amelyek a szerző számára a készítés időpontjában ismertek voltak , valamint mindenféle értékelési elemtől mentes. A marketingkommunikáció az Ügyfél igényeinek, az egyéni pénzügyi helyzetének figyelembevétele nélkül készül, és semmilyen módon nem terjeszt elő befektetési stratégiát. A marketingkommunikáció nem minősül semmilyen pénzügyi eszköz eladási, felajánlási, feliratkozási, vásárlási felhívásának, hirdetésének vagy promóciójának. Az XTB S.A. nem vállal felelősséget az Ügyfél ezen marketingkommunikációban foglalt információk alapján tett cselekedeteiért vagy mulasztásaiért, különösen a pénzügyi eszközök megszerzéséért vagy elidegenítéséért. Abban az esetben, ha a marketingkommunikáció bármilyen információt tartalmaz az abban megjelölt pénzügyi eszközökkel kapcsolatos eredményekről, azok nem jelentenek garanciát vagy előrejelzést a jövőbeli eredményekkel kapcsolatban.