The cryptocurrency market has been spooked by a systemic threat from FTX, after a Coindesk report pointed to security vulnerabilities at Alameda Research, a major investment fund affiliated with Sam Bankman-Fried's cryptocurrency exchange. On the wave of the report, Binance decided to sell all of the FTX exchange's nearly $2.1 billion worth of token reserves. Bitcoin fell below $20,000 and Ethereum traded below $1,500. Investors were frightened by the risk of a 'second Luna scenario':

What did the Coindesk report show?

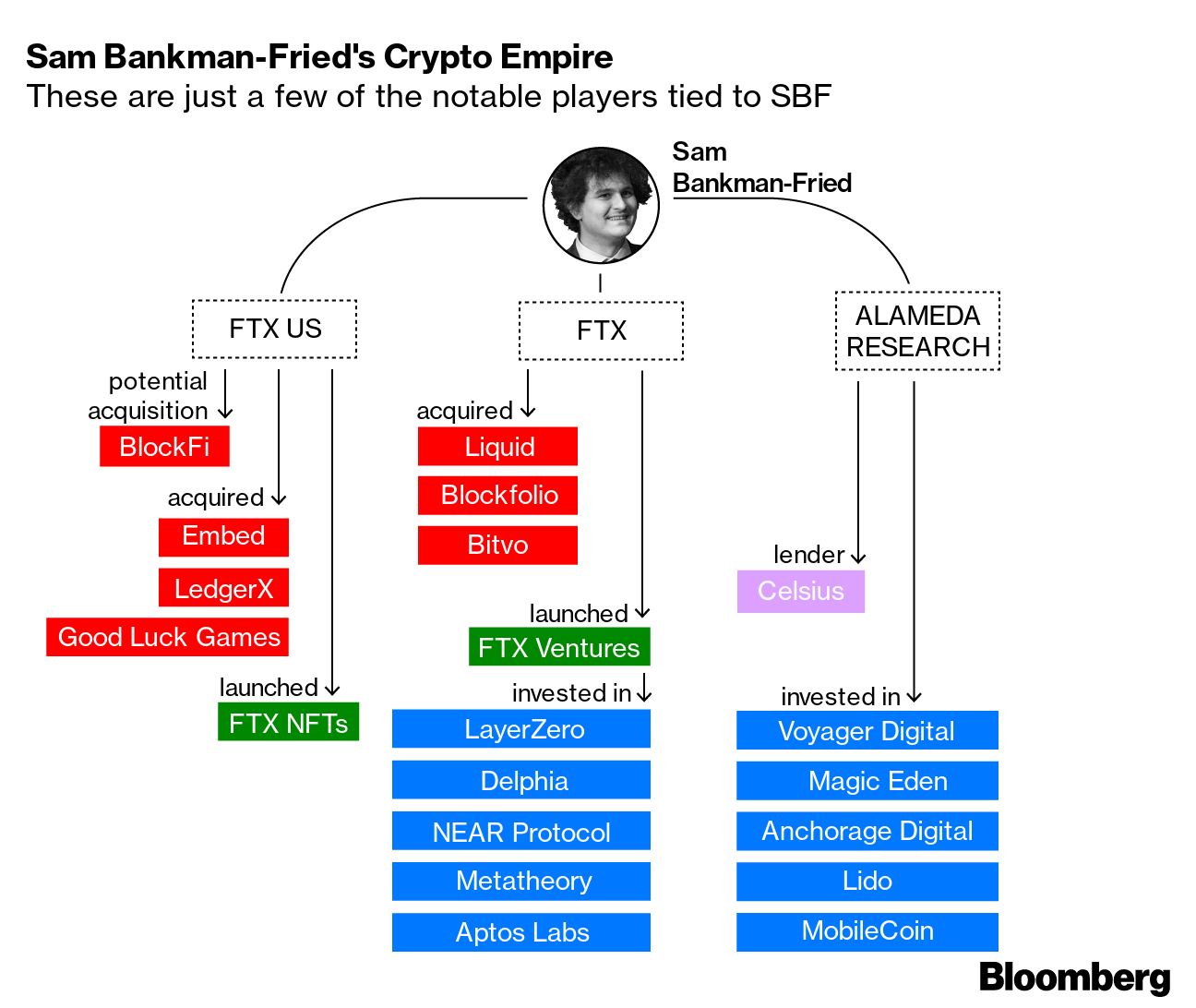

Chanpenga Zhao's exchange already published information on Alameda Research's reserves disclosed by Coindesk on November 3. Let's emphasize - Alameda and FTX are connected vessels, owned by Sam Bankman-Fried. According to the exchange, the biggest risk is that Alameda Research holds most of its reserves in poorly liquid altcoins, and the largest share of Alameda's assets is held by the FTT exchange token itself, created by FTX. The collateral structure thus appears fragile and prone to spikes in volatility, as there is no hard collateral in the form of a significant % of cash or US Treasury bills;

The collapse of Alameda Research could spill over to the entire cryptocurrency industry. According to Coindesk, the private financial document is likely only a slice of the broader picture of Alameda Research's operations. According to the document, Alameda has $14.6 billion in assets and $8 billion in liabilities. The fund bet on the FTT token expecting the success of the FTX exchange, which is probably why it has such a large share of collateral. This, however, opens the door to systemic risk. As the FTX exchange develops, the FTT token should gain in value. But what if the exchange stops growing rapidly or slows down?

As of June 30, 2022, Alameda had assets of $3.66 billion in FTT, $2.16 billion in leveraged FTT positions, $3.37 billion in other cryptocurrencies (including $292 million in Solana, $863 million in Solana's staking pool), $2 billion in 'equity securities, and cash of $134 million. Liabilities were dominated by $7.4 billion in loans and $292 million in 'blocked' FTT tokens. It can be said that Alameda holds the future of FTT in its own hands with the impossibility of not having a valuation impact on the assets it holds in the face of the liquidation of the reserve.

Contagion risk still alive?

- The market, after the dramatic events of May and June this year for the industry (Luna/Terra, Celsius Network, Three Arrows Capital, Voyager, etc.), remains extremely sensitive to news of possible bankruptcy or possible liquidity problems of the largest cryptocurrency players. Investors taught by history have recognized that the collapse of large entities despite favorable press or popularity is possible;

- The head of the Binance exchange, Chanpeng Zhao (identified as CZ), refused an offer from Alameda Research CEO Caroline Alisson, who suggested that the fund would buy back all the nearly $2.1 billion worth of tokens from Binance at a price of $22. However, Binance intends to liquidate them on the 'open market'. In this way, the exchange is stopping 'Alamede' from possibly 'improving its image,' but the exact reasons for the refusal are not known;

- According to CZ, with Binance, the FTX exchange was said to be involved in keeping the industry's unfavorable talks with outside parties secret from competitors. Bankman-Fried himself was quick to address Binance's comments and referred to CZ's posts as false rumors, and indicated that FTX will continue to process withdrawals and has sufficient funds to cover all of the exchange's customer resources;

- FTX is one of the fastest-growing cryptocurrency exchanges to date and the world's second-largest cryptocurrency entity in terms of daily user trading volume. Speculation in the industry continues unabated around a possible planned image blow from Binance aimed at slowing down competition.

If the panic over FTX continues, it could end up with rising withdrawals from the exchange's users and a consequent further sell-off of the FTX exchange token. By comparison, when the U.S. financial system collapsed during the crisis of the 1920s, the banks that went bankrupt more than once had adequate safeguards and controlled risks. Despite this, they were unable to stop panic among customers withdrawing funds en masse, and collapsed as a result. Other, often less secure institutions often prospered longer . This shows that in periods of panic the crowd tends to abandon rational behavior and choices. This seems to be the main threat to FTX at the moment and has the potential to spawn systemic risk.

Innvestment fund of cryptocurrency billionaire Sam Bankman-Fried (referred to as SBF), Alameda Research holds significant positions in the Lido protocol, which is the largest Ethereum 2.0 staking pool. The popular SBF this summer wanted to rebuild confidence in the crypto industry by acquiring the assets of collapsed cryptocurrency entities like Celsius, BlockFi and Voyager Digital and compensating the victims. FTX was expected to consolidate the cryptocurrency industry by agreeing to centralization and regulation, and SBF itself pointed to the need for transparent regulation in the industry to guard against risks from rogue entities and a lack of safeguards against risks. According to OpenSecrets data, the SBF contributed $39 million to fund this year's election campaign 'midterms' in the US. Source: Bloomberg ProtocolmLido holds nearly 4 million staked Ethereum 2.0 tokens, more than the combined reserves of major entities like Binance, Coinbase and Kraken. Source: Glassnode

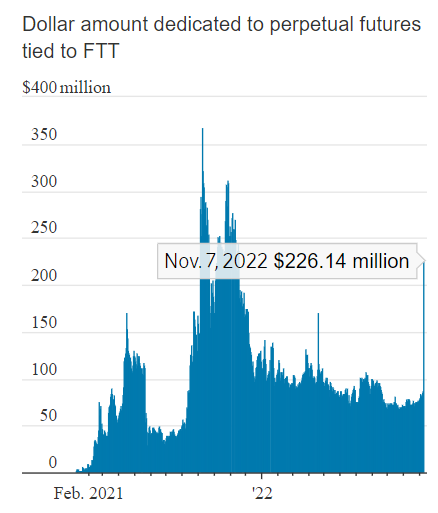

ProtocolmLido holds nearly 4 million staked Ethereum 2.0 tokens, more than the combined reserves of major entities like Binance, Coinbase and Kraken. Source: Glassnode The dollar-denominated trading volume of futures contracts associated with the FTX exchange token has already jumped to $226 million on Sunday. Source: Coinglass

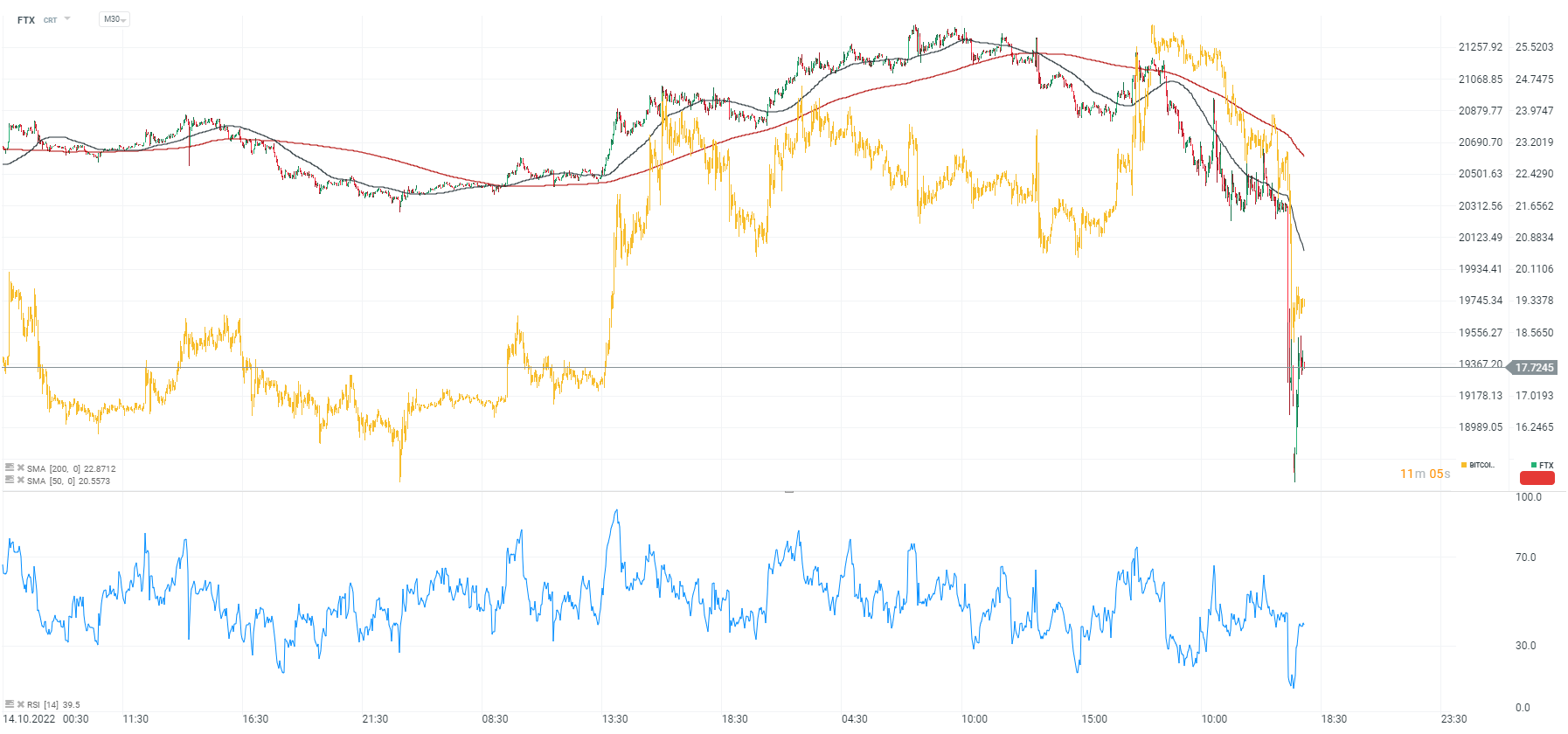

The dollar-denominated trading volume of futures contracts associated with the FTX exchange token has already jumped to $226 million on Sunday. Source: Coinglass FTX chart, M30 interval. The FTX cryptocurrency's big move brought with it a wave of liquidation that spilled over into the broader cryptocurrency market. The token was unable to hold at $22 after Binance refused to sell tokens to Alameda at that price. Bitcoin (yellow chart) retreated to the area of $19,700. Source: xStation5

FTX chart, M30 interval. The FTX cryptocurrency's big move brought with it a wave of liquidation that spilled over into the broader cryptocurrency market. The token was unable to hold at $22 after Binance refused to sell tokens to Alameda at that price. Bitcoin (yellow chart) retreated to the area of $19,700. Source: xStation5

Reggeli összefoglaló (16.01.2026)

Technikai elemzés - Ethereum (14.01.2026)

Talpra Tréder - 2026.12.1.

Reggeli összefoglaló (09.01.2026)

Ezen tartalmat az XTB S.A. készítette, amelynek székhelye Varsóban található a következő címen, Prosta 67, 00-838 Varsó, Lengyelország (KRS szám: 0000217580), és a lengyel pénzügyi hatóság (KNF) felügyeli (sz. DDM-M-4021-57-1/2005). Ezen tartalom a 2014/65/EU irányelvének, ami az Európai Parlament és a Tanács 2014. május 15-i határozata a pénzügyi eszközök piacairól , 24. cikkének (3) bekezdése , valamint a 2002/92 / EK irányelv és a 2011/61 / EU irányelv (MiFID II) szerint marketingkommunikációnak minősül, továbbá nem minősül befektetési tanácsadásnak vagy befektetési kutatásnak. A marketingkommunikáció nem befektetési ajánlás vagy információ, amely befektetési stratégiát javasol a következő rendeleteknek megfelelően, Az Európai Parlament és a Tanács 596/2014 / EU rendelete (2014. április 16.) a piaci visszaélésekről (a piaci visszaélésekről szóló rendelet), valamint a 2003/6 / EK európai parlamenti és tanácsi irányelv és a 2003/124 / EK bizottsági irányelvek hatályon kívül helyezéséről / EK, 2003/125 / EK és 2004/72 / EK, valamint az (EU) 2016/958 bizottsági felhatalmazáson alapuló rendelet (2016. március 9.) az 596/2014 / EU európai parlamenti és tanácsi rendeletnek a szabályozási technikai szabályozás tekintetében történő kiegészítéséről a befektetési ajánlások vagy a befektetési stratégiát javasló vagy javasló egyéb információk objektív bemutatására, valamint az egyes érdekek vagy összeférhetetlenség utáni jelek nyilvánosságra hozatalának technikai szabályaira vonatkozó szabványok vagy egyéb tanácsadás, ideértve a befektetési tanácsadást is, az A pénzügyi eszközök kereskedelméről szóló, 2005. július 29-i törvény (azaz a 2019. évi Lap, módosított 875 tétel). Ezen marketingkommunikáció a legnagyobb gondossággal, tárgyilagossággal készült, bemutatja azokat a tényeket, amelyek a szerző számára a készítés időpontjában ismertek voltak , valamint mindenféle értékelési elemtől mentes. A marketingkommunikáció az Ügyfél igényeinek, az egyéni pénzügyi helyzetének figyelembevétele nélkül készül, és semmilyen módon nem terjeszt elő befektetési stratégiát. A marketingkommunikáció nem minősül semmilyen pénzügyi eszköz eladási, felajánlási, feliratkozási, vásárlási felhívásának, hirdetésének vagy promóciójának. Az XTB S.A. nem vállal felelősséget az Ügyfél ezen marketingkommunikációban foglalt információk alapján tett cselekedeteiért vagy mulasztásaiért, különösen a pénzügyi eszközök megszerzéséért vagy elidegenítéséért. Abban az esetben, ha a marketingkommunikáció bármilyen információt tartalmaz az abban megjelölt pénzügyi eszközökkel kapcsolatos eredményekről, azok nem jelentenek garanciát vagy előrejelzést a jövőbeli eredményekkel kapcsolatban.