- The Japanese Yen is the best-performing currency

- USDJPY bouncing off a key resistance zone.

- Yen is appreciating amid growing concerns about intervention by the Bank of Japan (BoJ)

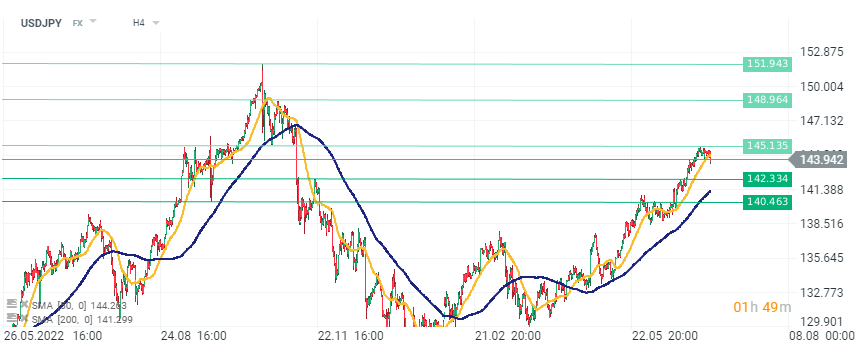

Last week, the Japanese Yen experienced significant losses against the US Dollar, and the USDJPY briefly crossed the 145 level. Since then, USDJPY has been consolidating for several days, but today selling pressure proved stronger, pushing the exchange rate down to 143, breaking below the consolidation channel.

Currency strength chart, the Japanese Yen (JPY) is currently the strongest currency among other major currencies, Source xStation 5

There could be two reasons for such a sharp strengthening of the Yen, not only against the Dollar but also other currencies. Firstly, recent strong gains may prompt investors to take profits, causing a short-term correction. However, the second, more fundamental reason is the market's fear of another intervention by the Bank of Japan. Downward pressure has increased following the statements by the country's leaders, including the finance minister, advocating for intervention against excessive depreciation of the domestic currency. The likelihood of another intervention is quite high, as evidenced by past experiences. In September and October 2022, the USDJPY experienced volatility after crossing the 145 and subsequently 150 levels. Intervention became necessary at those levels, significantly strengthening the Yen... however, only in the short term, as USDJPY started climbing again.

Currently, the USDJPY has rebounded from the 145 level and is trading at 143.8. If selling pressure does not weaken, the exchange rate could drop to around 142 or 140 levels. However, a return of USDJPY to an upward trajectory should be seen as an increasing probability of intervention by the Bank of Japan. In such a case, authorities will certainly resume their campaign to influence the currency market, which somewhat limits the upside potential. Nevertheless, a retest of the 145 level is still possible. Source xStation 5

Currently, the USDJPY has rebounded from the 145 level and is trading at 143.8. If selling pressure does not weaken, the exchange rate could drop to around 142 or 140 levels. However, a return of USDJPY to an upward trajectory should be seen as an increasing probability of intervention by the Bank of Japan. In such a case, authorities will certainly resume their campaign to influence the currency market, which somewhat limits the upside potential. Nevertheless, a retest of the 145 level is still possible. Source xStation 5

Live Trading - 2026.02.10.

Talpra Tréder - 2026.02.09.

Az EURUSD visszanyerte az 1,18-as szintet a kiváló német gyártási adatoknak köszönhetően 📈

Reggeli összefoglaló (05.02.2026)

Ezen tartalmat az XTB S.A. készítette, amelynek székhelye Varsóban található a következő címen, Prosta 67, 00-838 Varsó, Lengyelország (KRS szám: 0000217580), és a lengyel pénzügyi hatóság (KNF) felügyeli (sz. DDM-M-4021-57-1/2005). Ezen tartalom a 2014/65/EU irányelvének, ami az Európai Parlament és a Tanács 2014. május 15-i határozata a pénzügyi eszközök piacairól , 24. cikkének (3) bekezdése , valamint a 2002/92 / EK irányelv és a 2011/61 / EU irányelv (MiFID II) szerint marketingkommunikációnak minősül, továbbá nem minősül befektetési tanácsadásnak vagy befektetési kutatásnak. A marketingkommunikáció nem befektetési ajánlás vagy információ, amely befektetési stratégiát javasol a következő rendeleteknek megfelelően, Az Európai Parlament és a Tanács 596/2014 / EU rendelete (2014. április 16.) a piaci visszaélésekről (a piaci visszaélésekről szóló rendelet), valamint a 2003/6 / EK európai parlamenti és tanácsi irányelv és a 2003/124 / EK bizottsági irányelvek hatályon kívül helyezéséről / EK, 2003/125 / EK és 2004/72 / EK, valamint az (EU) 2016/958 bizottsági felhatalmazáson alapuló rendelet (2016. március 9.) az 596/2014 / EU európai parlamenti és tanácsi rendeletnek a szabályozási technikai szabályozás tekintetében történő kiegészítéséről a befektetési ajánlások vagy a befektetési stratégiát javasló vagy javasló egyéb információk objektív bemutatására, valamint az egyes érdekek vagy összeférhetetlenség utáni jelek nyilvánosságra hozatalának technikai szabályaira vonatkozó szabványok vagy egyéb tanácsadás, ideértve a befektetési tanácsadást is, az A pénzügyi eszközök kereskedelméről szóló, 2005. július 29-i törvény (azaz a 2019. évi Lap, módosított 875 tétel). Ezen marketingkommunikáció a legnagyobb gondossággal, tárgyilagossággal készült, bemutatja azokat a tényeket, amelyek a szerző számára a készítés időpontjában ismertek voltak , valamint mindenféle értékelési elemtől mentes. A marketingkommunikáció az Ügyfél igényeinek, az egyéni pénzügyi helyzetének figyelembevétele nélkül készül, és semmilyen módon nem terjeszt elő befektetési stratégiát. A marketingkommunikáció nem minősül semmilyen pénzügyi eszköz eladási, felajánlási, feliratkozási, vásárlási felhívásának, hirdetésének vagy promóciójának. Az XTB S.A. nem vállal felelősséget az Ügyfél ezen marketingkommunikációban foglalt információk alapján tett cselekedeteiért vagy mulasztásaiért, különösen a pénzügyi eszközök megszerzéséért vagy elidegenítéséért. Abban az esetben, ha a marketingkommunikáció bármilyen információt tartalmaz az abban megjelölt pénzügyi eszközökkel kapcsolatos eredményekről, azok nem jelentenek garanciát vagy előrejelzést a jövőbeli eredményekkel kapcsolatban.