- Small-cap companies are once again favored by investors

- The dollar loses 0.15%

- Bond yields are also recorded lower

Markets in the USA open the last trading session of this week definitely in an optimistic mood. PCE data came out as expected, which did not cause a significant market reaction. In the early hours of trading, we observe strong gains in the sector of smaller capitalization companies. The US2000 index gains 1.40% to 2270 points. However, the US500 and US100 also perform well, gaining 0.88% and 0.80%, respectively.

Start investing today or test a free demo

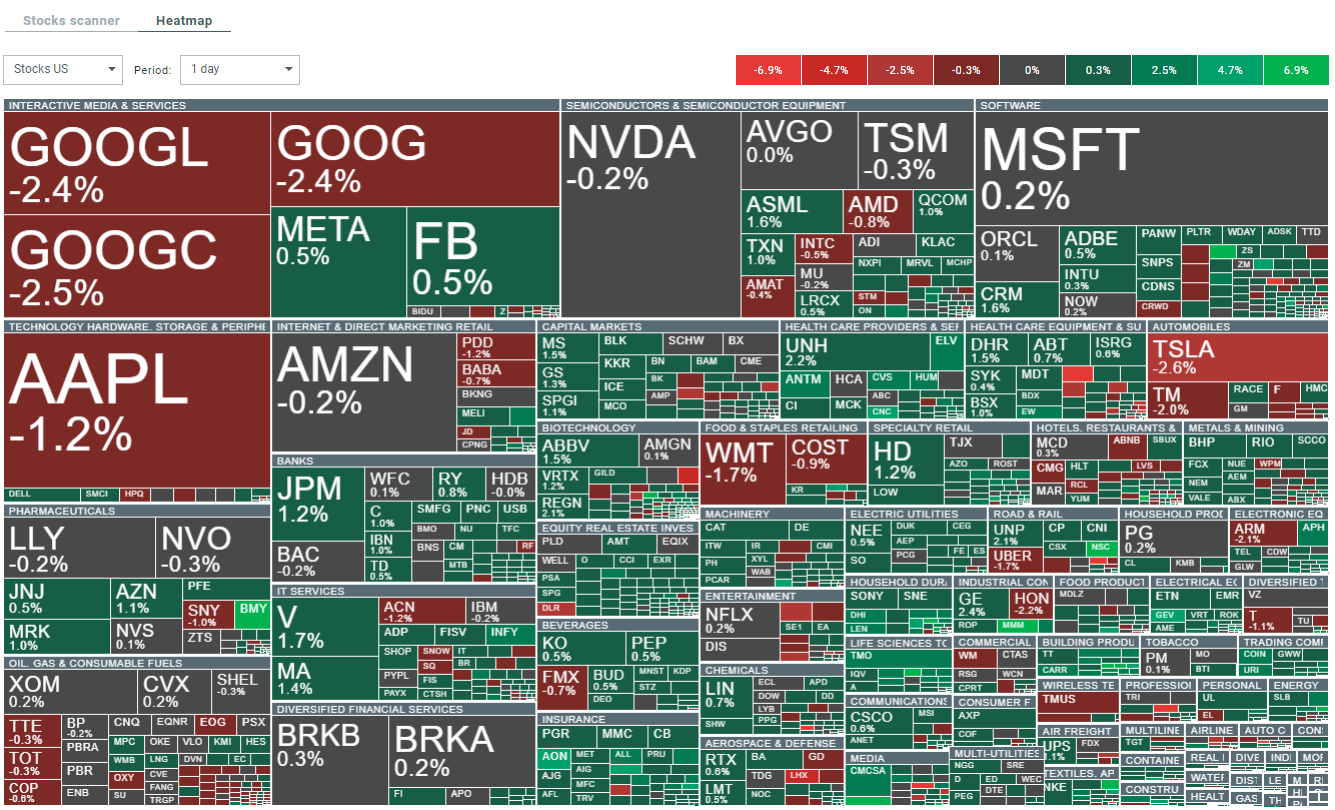

Open account Try demo Download mobile app Download mobile appThe increases are mainly dominated by smaller companies. In BigTech, we observe mixed sentiments with Apple, Alphabet, and Tesla recording losses. Source: xStation 5

US2000

The index price has remained in a consolidation range. Currently, we observe a price rise to the upper limit below the 2300 point level. If bulls manage to break through this zone, we can expect a continuation of increases. The direction of exit from the current consolidation between 2200-2300 points will be key.

Source: xStation 5

Corporate news

Coursera (COUR.US) stock gained 42% following strong quarterly results, significantly fueled by the growing demand for generative AI courses. CEO Jeff Maggioncalda highlighted that the success was largely due to over two million enrollments in AI-related courses. For fiscal year 2024, Coursera has reaffirmed its revenue expectations to be between $695 million and $705 million, aligning with analyst estimates around $699.91 million. Additionally, the company expects its adjusted EBITDA to range from $24 million to $28 million, which supports its goal of an approximate 4% EBITDA margin.

Boston Beer (SAM.US) initially decreased by more than 4% after the company reported disappointing second-quarter results. However, the stock has rebounded strongly and are currently trading at +4% note. The earning report shows the revenue fell by 4%, primarily due to a decline in sales volumes, although this was somewhat mitigated by price increases. The brand's depletion rate and shipment volume also saw reductions, largely due to weak performance in the Truly Hard Seltzer brand.

DexCom's (DXCM.US) stock experienced a significant drop of over 41% after releasing mixed second-quarter results. Despite a 15% year-over-year increase in revenue, the company's future revenue outlook was lower than anticipated. DexCom now projects third-quarter revenue to be between $975 million and $1 billion, missing the $1.15 billion consensus. For the full year, the company anticipates revenue to be between $4 billion and $4.05 billion, which is below the expected $4.33 billion.

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.