Investors take a shine to UK assets Labour enjoys its honeymoon period

On her first full working day as Chancellor, Rachel Reeves was busy talking to business leaders and making inroads to implementing her pre-election manifesto. The Chancellor announced well-flagged reforms to the UK’s planning system on Monday, including 300 additional planning officers across the country, reviews of greenfield sites and a pledge to build 1.5 million new homes in 5 years, including more social homes to rent. There were announcements too about wind farms and prioritizing infrastructure projects, although there was no mention of extending the HS2 rail connectivity project.

A bullishly pragmatic chancellor

Start investing today or test a free demo

Open account Try demo Download mobile app Download mobile appThe new chancellor’s tone was both bullish and pragmatic at the same time. She reiterated her plan to work with business and private investors to build new infrastructure in the UK, and tomorrow the Prime Minister is set to announce the new GB energy fund. Regardless of whether you agree with the new government, you can’t accuse them of resting on their laurels. These first steps have been broadly welcomed by the financial markets. GBP/USD has climbed to its highest level since March 2024, and has broken out of its recent range. The next target for this pair is $1.30. The pound is having a stella run, since the start of the month it is the best performing currency in the G10 FX space and is higher by 1.47% vs. the USD.

Labour gives the pound a boost

A stronger pound is symbolic for the government, as it suggests that investors could be buying the pound on the back of an improved economic outlook for the UK under a labour government. It also has practical benefits for traders and investors: currency adjusted returns on foreign assets could improve.

Will UK stocks now play catch up with their international peers?

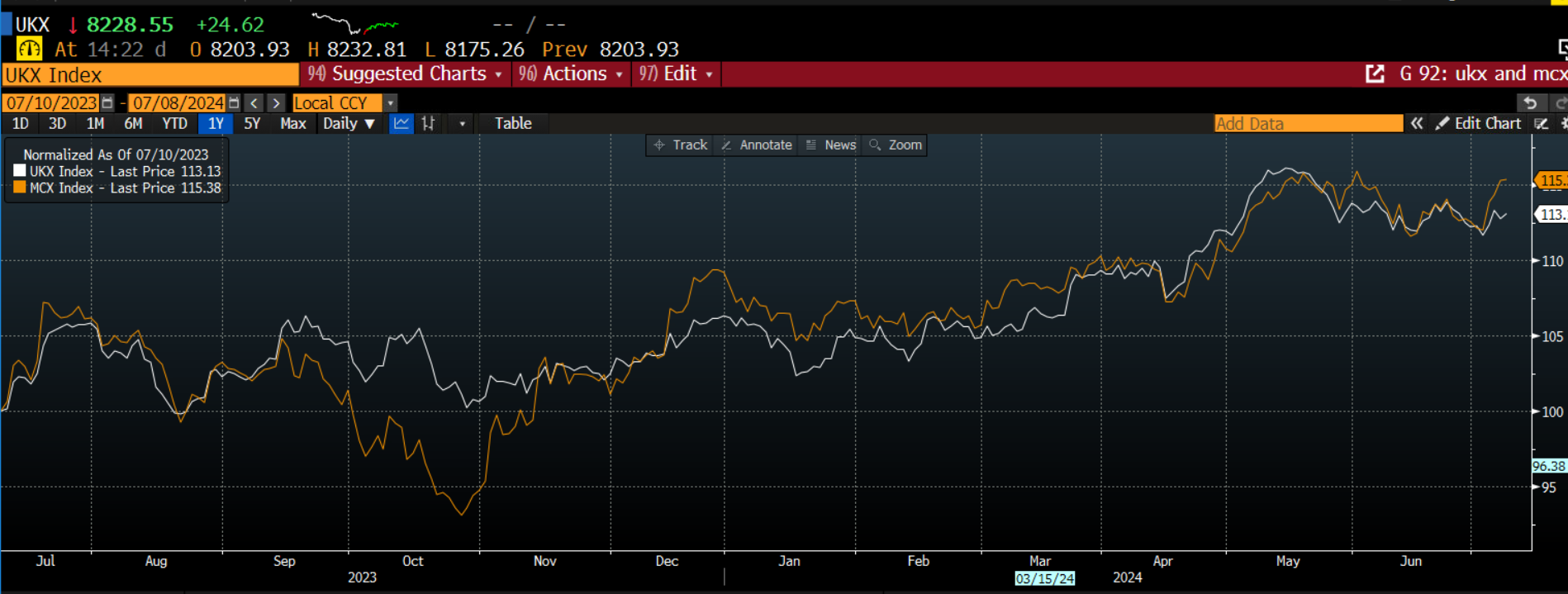

This positive reaction to Reeves’ growth-friendly message is not only showing up in sterling, it is also visible in the stock market. The FTSE 250 index, which is a broad index of UK mid-cap and domestically focused stocks, is outperforming the FTSE 100, as you can see in the chart below, which has been normalized to show how these UK indices move together. These indices had tracked each other closely, however, the mixture of a comfortable win for Starmer, and Reeves’ pro-growth message is reverberating well with investors and helping the FTSE 250 to pull away from the main UK index. Interestingly, that is not the case in other parts of Europe or the US, where Russel 2000 is underperforming the S&P 500, as you can see in chart 2 below.

Chart 1: FTSE 100 and FTSE 250

Source: XTB and Bloomberg

Chart 2: S&P 500 and Russell 2000

Source: XTB and Bloomberg

Source: XTB and Bloomberg

Interestingly, the pound is outperforming, even though there is a rising expectation of a rate cut from the BOE next month. UK Gilt yields are also at their lowest level of the year; however, this is not hindering GBP.

How long will the honeymoon period last?

The question now is, how long will the honeymoon period with the Labour government last? Rachel Reeves has said that she will hold her first budget in the Autumn, which will include an OBR growth forecast. The Bank of England will also update their growth forecasts ahead of this at August’s monetary policy meeting. Will the BOE upgrade their growth forecasts on the back of the new Labour government’s policies? If yes, then UK asset prices could get another boost.

For now, it seems that everything the Labour government touches turns to gold. The pound is rising steadily and the top performing stocks in the UK include homebuilders like Persimmon and Taylor Wimpey, both of which have seen their share prices rise more than 7% in the past week. Since UK shares are considered undervalued compared to their peers, can Labour’s laser focus on the economy help narrow this gap in the medium term? Eventually, Labour needs to prove that these measures will actually boost growth, but for now, the market likes what it hears.

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.