This week was particularly important, as several macroeconomic publications started to show a weakening labor market, which is considered a lagging sector. Mid-week, the job openings report showed a sudden drop in open vacancies. Today, at 1:30 p.m. BST, we received another labor data pack, which showed the unemployment rate unexpectedly rising above forecasts to 3.8%. The actual report indicated a small beat in both non-farm and private payrolls. Wage growth data came in slightly lower than expected at 4.3% YoY. The ISM index, on the other hand, registered a ninth consecutive month of contraction in the manufacturing sector, with key sub-indices such as New Orders and Imports still showing contraction. The Production Index showed marginal improvement. Industry respondents pointed to continuing soft demand, supply constraints, and economic uncertainties. Despite weak customer orders, some improvement was noted, such as a decrease in the percentage of manufacturing GDP that contracted, suggesting cautious optimism for stabilization in the sector.

Regarding the NFP report, a total of 187,000 jobs were added in August, beating consensus estimates. However, this was offset by downward revisions for June and July by 110,000 jobs. The unemployment rate rose unexpectedly to 3.8% from the 3.5% expected, as 736,000 workers joined the labor force.

What next? 🔍

Now, only the CPI report for August remains to be published on September 13, before the meeting on September 19-20, 2023. Therefore, the labor data publications this week had significant implications for the US economy, as they were one of the last readings before the next FOMC meeting.

What will the Fed do? 🔮

It should also be noted that the FOMC expects the unemployment rate to pick up by the end of the year. The Federal Reserve may view the latest labor data as a mixed bag that does not necessarily warrant immediate action on interest rates. These factors could give the Fed some room for caution. It can be interpreted that the labor market is gradually normalizing but not overheating. Federal Reserve FOMC member Mester commented that the job market is still strong but achieving a better balance. She pointed out that the 3.8% unemployment rate is still low and highlighted that inflation remains too high. Mester suggests that future policy will be data-dependent, focusing on the balance between over-tightening and under-tightening.

What market anticipates after this week? 🔴

After the publication, the probability rate suggests that the Federal Reserve will not raise interest rates in the next meeting, with the probability of the next interest rate hike dropping to just 7%. Market expectations are now shifting towards the possibility of a rate cut, with Fed Swaps fully pricing in such a move in May instead of June. Additionally, the lowered odds in Fed Swaps suggest that another rate hike this year is becoming less probable.

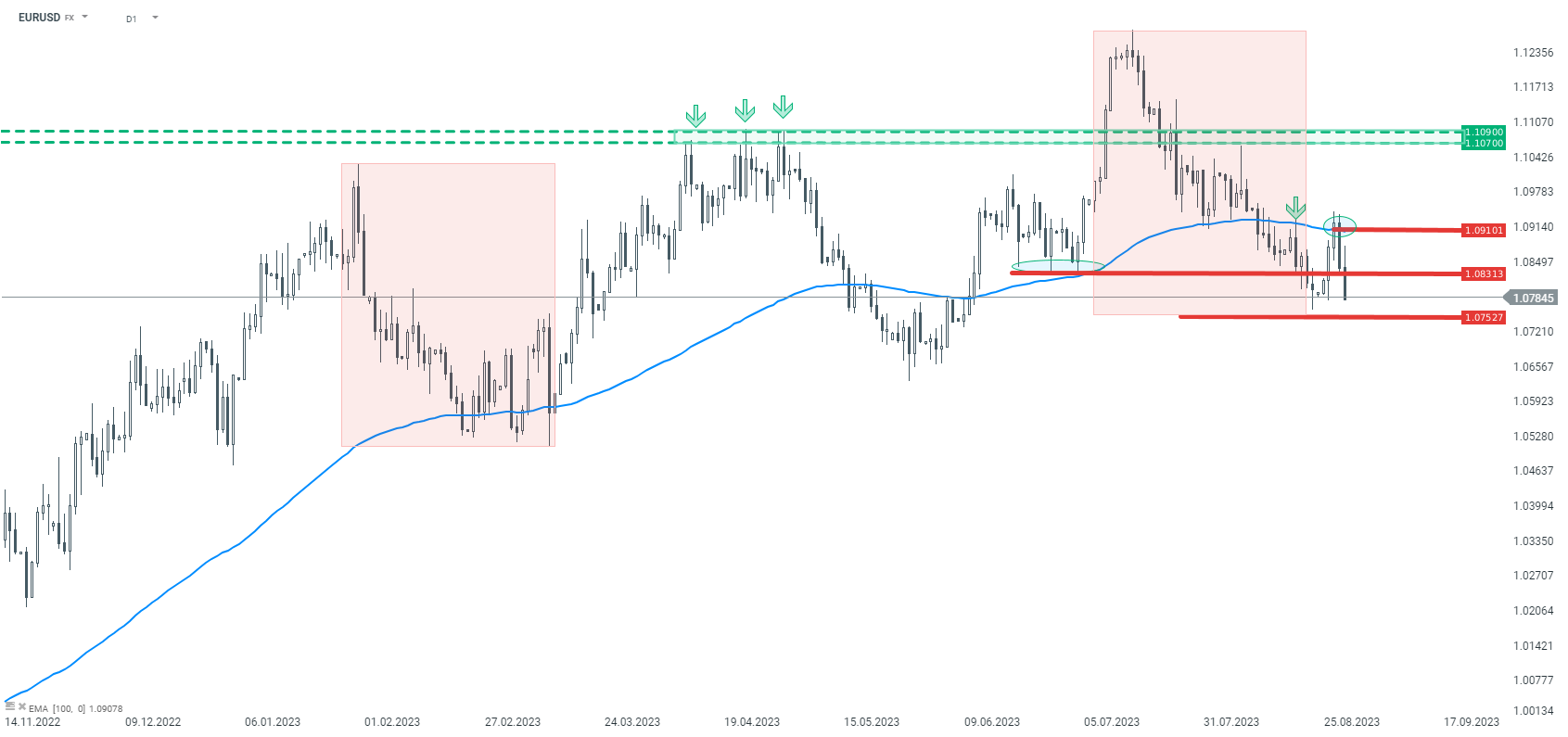

EURUSD erased entirely the rally that occurred just after the release of the labor market report. The pair not only wiped out the increases, but also fell below the level of $1.08. Currently a move towards the support at 1.0750 which results from the broad geometry pattern of 1:1 (marked as red rectangles) is probable. According to the overbalance methodology, as long as the price does not fall below 1.0750, the long-term trend is upward. However, in the short term, it seems that as long as the price does not return above 1.0830, the base scenario is further downside movement. A possible breach of the mentioned 1.0750 could lead to a breakdown of the trend and acceleration of the decline.

EURUSD erased entirely the rally that occurred just after the release of the labor market report. The pair not only wiped out the increases, but also fell below the level of $1.08. Currently a move towards the support at 1.0750 which results from the broad geometry pattern of 1:1 (marked as red rectangles) is probable. According to the overbalance methodology, as long as the price does not fall below 1.0750, the long-term trend is upward. However, in the short term, it seems that as long as the price does not return above 1.0830, the base scenario is further downside movement. A possible breach of the mentioned 1.0750 could lead to a breakdown of the trend and acceleration of the decline.

Source: xStation5

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

US Open: Cisco Systems slides 10% after earnings 📉 Mixed sentiments on Wall Street

BREAKING: US jobless claims slightly higher than expected

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.