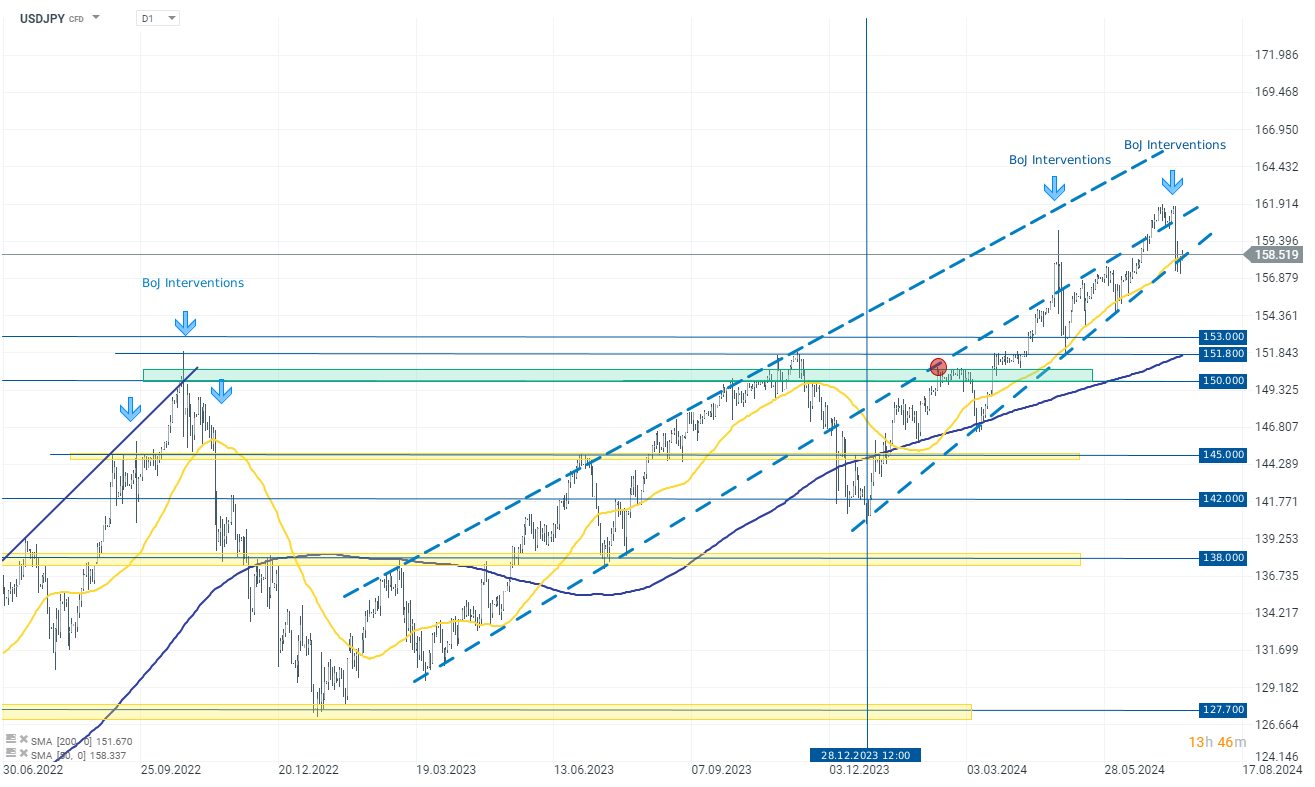

The Japanese yen is once again one of the weakest G10 currencies today due to investors' lack of faith in the currency's sustained strengthening despite intervention from the BoJ. USDJPY is up 0.30% to 158.5000, returning above the upward trend line.

Last week, following weaker CPI data, the dollar weakened sharply. The Bank of Japan decided to take advantage of this situation and intervened again in the forex market, leading to a temporary drop in USDJPY to 157.5000. However, looking at examples from previous years, the Bank's actions in the forex market have short-term impacts unless accompanied by a significant weakening of the dollar. As long as the interest rate difference remains high, pressure on the yen is likely to persist. Moreover, Japanese officials stated that they do not defend the currency at a specific level and typically intervene after sharp, not gradual, declines.

Start investing today or test a free demo

Open account Try demo Download mobile app Download mobile app- The BoJ's intervention on July 12 amounted to approximately $22 billion, or 3.5 trillion yen, based on a comparison of the Bank of Japan's accounts and money brokers' forecasts. As a result, USDJPY saw a 2.80% drop to 157.5000.

- The previous intervention by the Bank of Japan likely occurred between April 29 and May 1 and amounted to about $60 billion. This led to a 5.00% drop in USDJPY to 151.5000.

USDJPY (D1 interval)

As seen in the chart below, recent Bank of Japan interventions have a short-term nature, and declines can be observed for about 4-5 sessions depending on the scale. More importantly, USDJPY is returning above the 158.5000 level today, where the long-term upward trend line currently runs. If the daily candle closes above this level, we can expect the upward movement to continue and an attempt to return above the 160.0000 level. Otherwise, the lower support for bulls remains the zone of the recent drop, around 157.5000.

Source: Xstation5

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.