US retail sales data for February was released at 12:30 pm GMT today. Market was expecting an increase but of a much smaller magnitude than in January. Actual report did not confirm those expectations with all retail sales metrics missing expectations. A weaker consumer may give Fed some comfort to be less aggressive with policy tightening amid the current macroeconomic and geopolitical backdrop. However, it is unlikely that it will have any major impact on today's monetary policy decision (6:00 pm GMT).

-

Headline: 0.3% MoM vs 0.4% MoM expected (+3.8% MoM previously)

-

Ex-autos: 0.2% MoM vs 1.0% MoM expected (+3.3% MoM previously)

-

Ex-autos and gas: -0.4% MoM vs 0.4% MoM expected (+3.8% MoM previously)

-

Control group: -1.2% MoM vs 0.3% MoM expected (4.8% MoM previously)

Simultaneously to the release of US data, the Canadian CPI report for February was released. Headline price growth was expected to accelerate from 5.1 to 5.5% YoY while core gauge was seen moving from 4.3 to 4.5%. Actual data showed headline price growth accelerating to 5.7% YoY and core price growth to 4.8% YoY. This boosts odds for more aggressive policy tightening from the Bank of Canada.

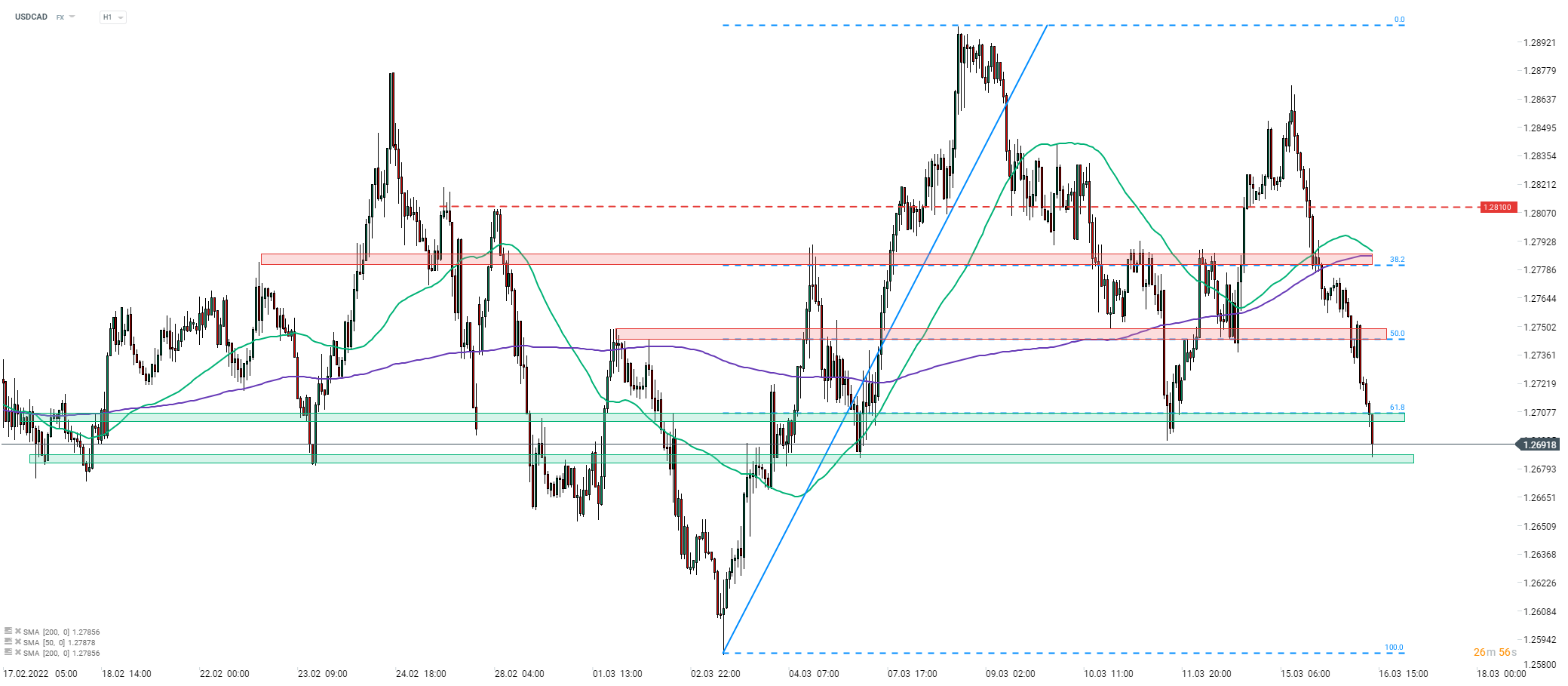

As both US and Canadian data was released at the same time, USDCAD was expected to experience elevated volatility. The pair was testing a support zone ranging below 61.8% retracement of the upward move launched at the beginning of March (1.2700 area) ahead of US-Canadian data drop. Release of the day weakened USD and supported CAD, triggering drop of the pair below the 1.2700 handle. However, the initial downward move was halted at the 1.2685 swing area.

Source: xStation5

Source: xStation5

الجدول الزمني الاقتصادي: هل سوق العمل الأمريكي مُهيأ للانتعاش؟ 🇺🇸 (07.01.2026)

عاجل: انتعاش مبيعات التجزئة الألمانية (DE40) رغم الانخفاض غير المتوقع في مبيعات التجزئة الألمانية 🇩🇪

السوق السعودي يفتح أبوابه لجميع المستثمرين الأجانب

بنك البلاد يخطط لإصدار صكوك رأسمالية إضافية بقيمة تصل إلى ملياري دولار