Virgin Galactic (SPCE.US) released its Q2 results after Thursday’s session. The financial data surprised to the downside as the company lost $0.39 per share - a wider loss than expected as analysts predicted a $0.33 loss per share. Nevertheless, SPCE.US shares are rallying more than 7% at press time - why?

The firm is restarting ticket sales beginning at $450,000 - the new price is about double the $200,000 to $250,000 paid by around 600 people who previously booked seats on Virgin's spaceship between 2005 and 2014. As the company’s founder, Richard Branson, took part in a successful space flight, the company is said to be experiencing “a surge in consumer interest”. Some Wall Street analysts stress out that the reopening of space-tourism ticket sales is “a significant positive milestone for the company.”

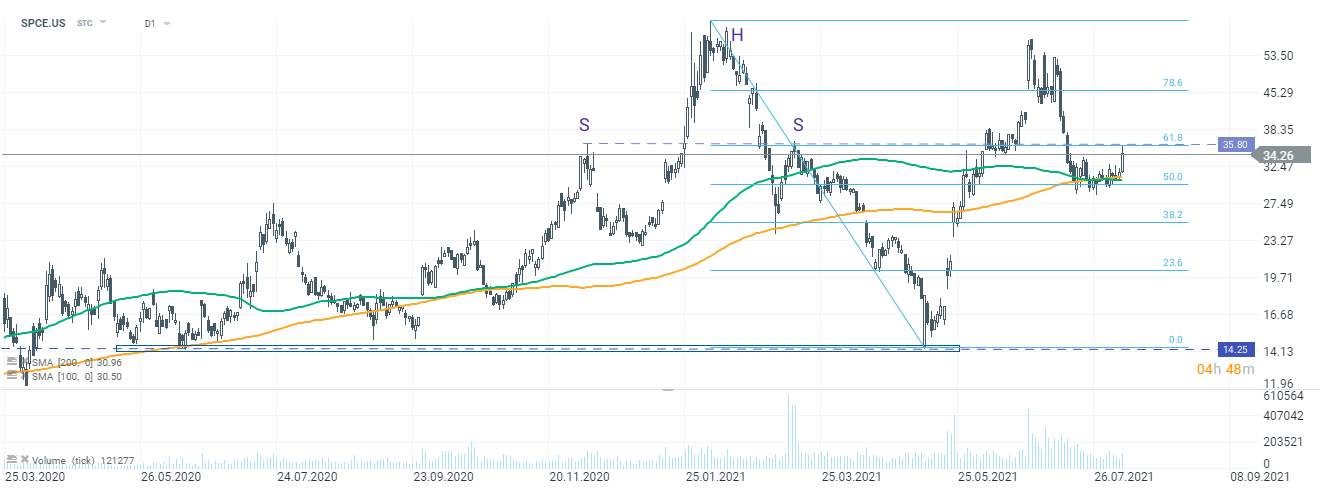

SPCE.US shares jumped towards $35.80 today, but the price was unable to break above. The levels is marked with the 61.8% Fibonacci retracement of the drop started in February, but also the line marked with shoulders of the head and shoulders pattern seen on a daily chart. The area near the 50% Fibonacci retracement, which coincides with the 100-day and 200-day moving average, remains the first important support. Source: xStation5

SPCE.US shares jumped towards $35.80 today, but the price was unable to break above. The levels is marked with the 61.8% Fibonacci retracement of the drop started in February, but also the line marked with shoulders of the head and shoulders pattern seen on a daily chart. The area near the 50% Fibonacci retracement, which coincides with the 100-day and 200-day moving average, remains the first important support. Source: xStation5

ملخص اليوم: بيانات أمريكية ضعيفة تُؤدي إلى انخفاض الأسواق، والمعادن الثمينة تتعرض لضغوط مجدداً!

شركة داتادوغ في أفضل حالاتها: ربع رابع قياسي وتوقعات قوية لعام 2026"

الولايات المتحدة: ارتفاع وول ستريت رغم ضعف مبيعات التجزئة

أرباح شركة كوكاكولا: هل سيصمد الرئيس التنفيذي الجديد أمام الضغوط؟