Heineken (HEIA.NL) launched new week's trading with a big bearish price gap and is now trading over 6% lower on the day. Company released earnings report for the first half of 2024 today before opening of the European cash session. Results turned out to be a disappointment and the company also reported a big impairment charge on its investment in China.

Heineken reported disappointing net revenue in every region, with organic revenue growth disappointing in every region except for Africa, Middle East & Eastern Europe. Moreover, revenue growth and organic revenue growth was negative in company's key biggest market - Europe. Adjusted operating profit also missed expectations, although not in every market - the company reported a large beat in Americas. Overall, the report was disappointing but not disastrous.

However, Heineken also announced that it took one-time impairment charge of €874 million due to a decline in valuation of its stake in China Resources Beer Holdings, the largest brewer in China in which Heineken holds a 40% stake. Decline in valuation was due to concerns about consumer demand in mainland China.

Heineken also updated its full-year operating profit growth forecasts and now expects it to grow 4-8%. However, previous forecast called for growth in 'low-to-high single-digit range' therefore it can be said that it is now just more specific.

2024 first half results

- Net revenue: €14.81 billion vs €15.2 billion expected (+2.1% YoY)

- Europe: €5.91 billion vs €6.16 billion expected (-2.1% YoY)

- Americas: €5.25 billion vs €5.31 billion expected (+7.2% YoY)

- Asia-Pacific: €2.10 billion vs €2.15 billion expected (+4.0% YoY)

- Africa, Middle East & Eastern Europe: €1.92 billion vs €2.01 billion expected (-2.5% YoY)

- Organic revenue growth: +5.9% vs +7.9% expected

- Europe: -1.1% vs +2.8% expected

- Americas: +4.1% vs +5.6% expected

- Asia-Pacific: +7.9% vs +10.3% expected

- Africa, Middle East & Eastern Europe: +27.5% vs +24.0%

- Organic beer volume: +2.1% vs +3.7% expected

- Adjusted operating profit: €2.08 billion vs €2.16 billion expected

- Europe: €614 million vs €726.7 million expected (-1.1% YoY)

- Americas: €854 million vs €737.3 million expected (+42.0% YoY)

- Asia-Pacific: €409 million vs €467.9 million expected (+2.3% YoY)

- Africa, Middle East & Eastern Europe: €169 million vs €227.3 million expected (-24% YoY)

- Adjusted operating margin: 14.0% vs 14.3%

- Adjusted net income: €1.20 billion vs €1.23 billion expected

- Adjusted EPS: €2.15 vs €2.18 expected

Q2 2024 volume data

- Total beer volume: 62.8 million HL vs 65.25 million HL expected (-3.8% YoY)

- Europe: 22.8 million HL vs 23.23 million HL (flat year-over-year)

- Americas: 21.3 million HL vs 22.19 million HL (-2.3% YoY)

- Asia-Pacific: 11.7 million HL vs 11.9 million HL (+6.4% YoY)

- Africa, Middle East & Eastern Europe: 7 million HL vs 7.9 million HL (-27% YoY)

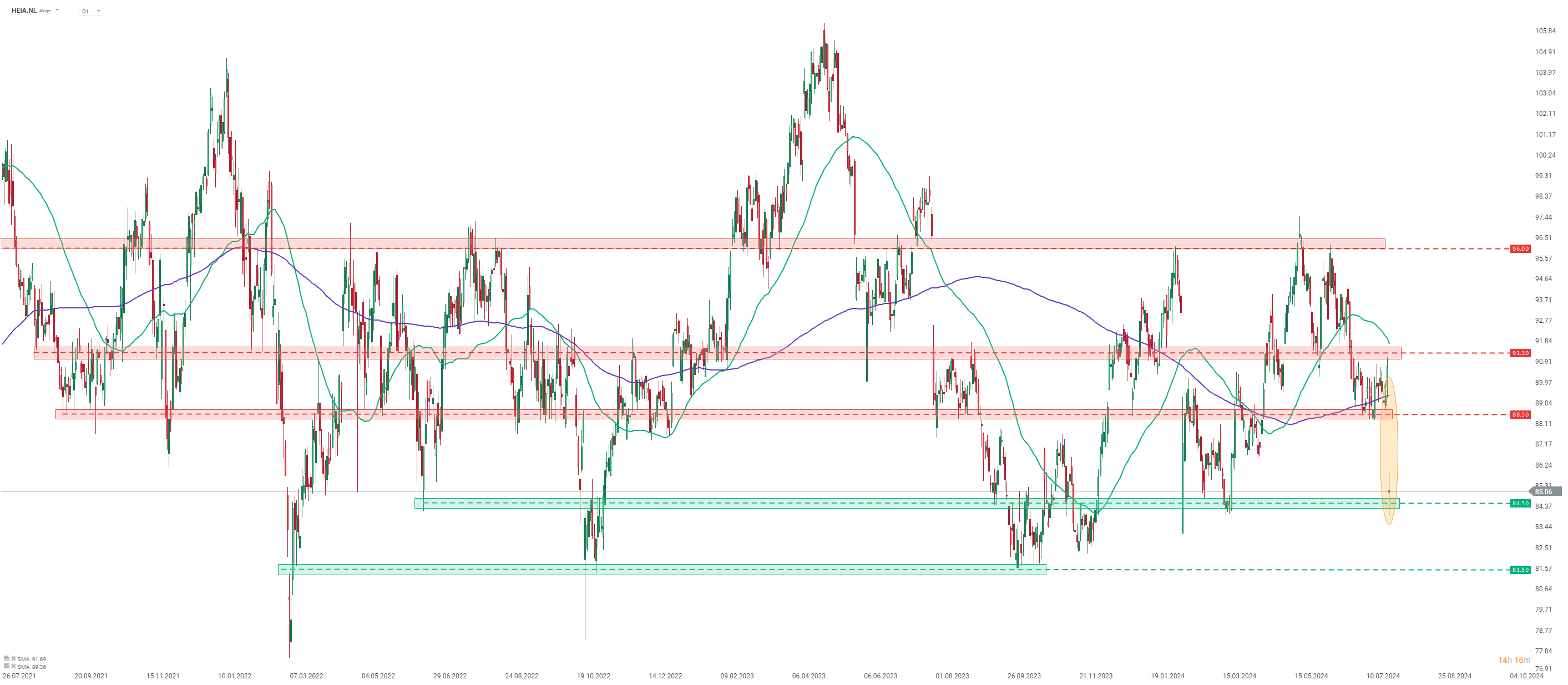

Heineken (HEIA.NL) launched today's trading with an over-6% bearish price gap and is trading at the lowest level since late-March 2024. Stock moved further lower after opening of the cash session and sellers attempted to break below the €84.50 support zone, marked with mid-March lows. However, no break below occurred and the stock has recovered back to the opening price.

Source: xStation5

Source: xStation5

ملخص اليوم: بيانات أمريكية ضعيفة تُؤدي إلى انخفاض الأسواق، والمعادن الثمينة تتعرض لضغوط مجدداً!

شركة داتادوغ في أفضل حالاتها: ربع رابع قياسي وتوقعات قوية لعام 2026"

الولايات المتحدة: ارتفاع وول ستريت رغم ضعف مبيعات التجزئة

أرباح شركة كوكاكولا: هل سيصمد الرئيس التنفيذي الجديد أمام الضغوط؟