-

European indices trade higher

-

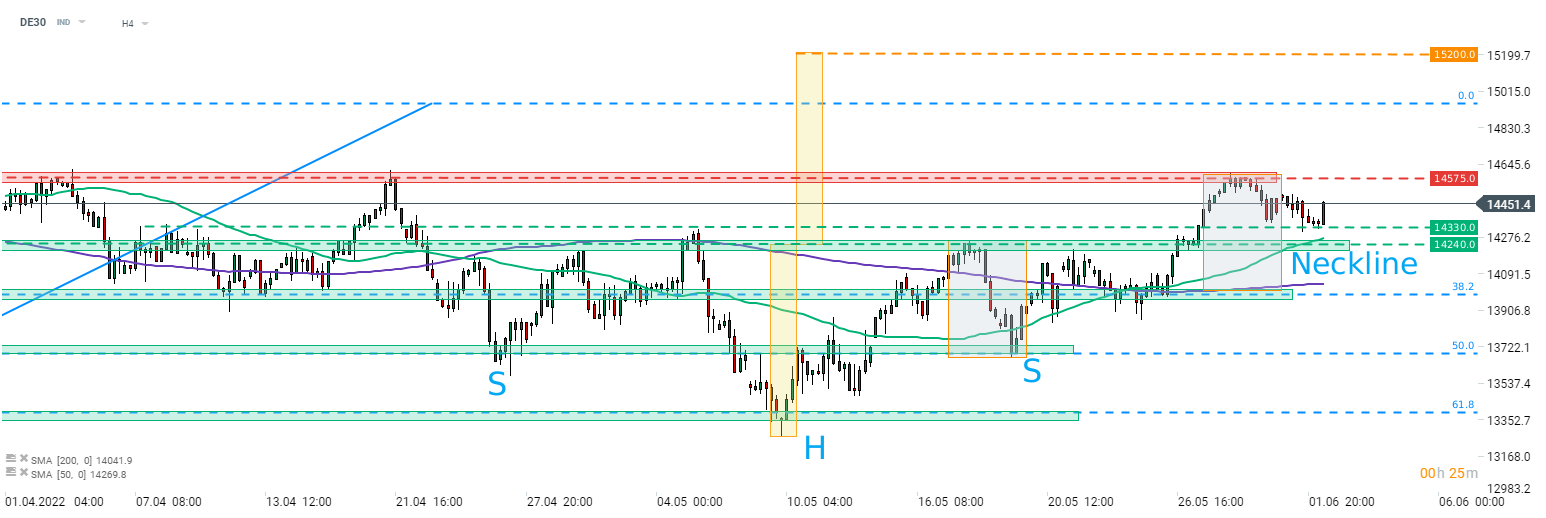

DE30 bounces off the 14,330 pts support

-

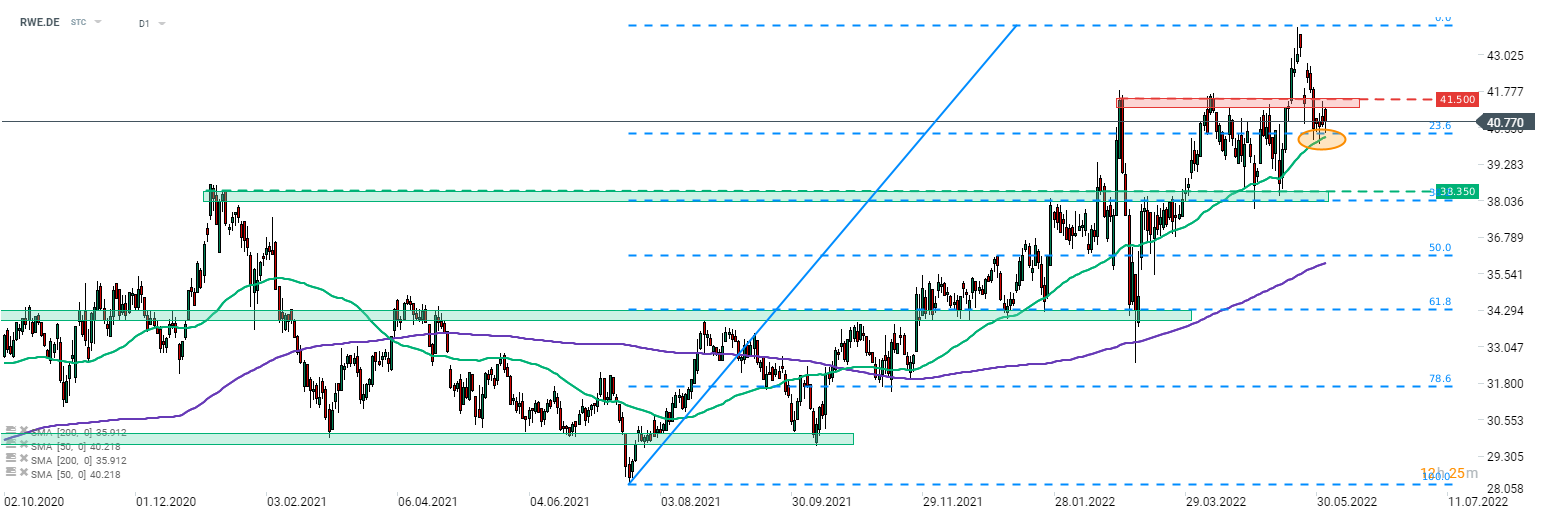

RWE buys gas-fired plant from Vattenfall

European indices caught a bid following a flat opening of the cash session and are now trading higher. Liquidity is slightly thinner as UK markets are closed for holidays. French CAC40 (FRA40) is a top performer, trading 1% higher, followed by German DAX (DE30) which is trading 0.8% higher. Polish WIG20 (W20) is a top laggard with a 0.1% drop. ADP report release at 1:15 pm BST is a key macro release of the day.

Source: xStation5

Source: xStation5

DE30 managed to halt a recent pullback in the 14,330 pts area and is attempting to launch a recovery move. An inverse head and shoulders pattern is still in play and an upward move towards 15,200 pts remains one of possible scenarios. However, a break above the 14,575 pts resistance would be needed first. This is a key near-term level to watch. ADP data release may trigger some short-term volatility on the stock markets if it shows a big deviation from expectations. However, tomorrow's NFP release will be more important.

Company News

RWE (RWE.DE) reached an agreement with Vattenfall for a gas-fired power plant located in the Netherlands. Deal is valuing the plant at €500 million and also includes a 5.6 MW solar park. Power plant is said to be technically suitable to use up to 30% hydrogen fuel content.

Chief Executive Officer of Vonovia (VNA.DE) said that if high inflation persists, rents will also need to increase. He said that inflation that is permanently at or above 4% would require a similar price hike in the future.

Chairman of Kloeckner (KCO.DE) confirmed during the annual general meeting yesterday that revenue and sales volumes are expected to be significantly above 2021 levels this year with cash flow also expected to be year-over-year higher. Company also said that it expects Q2 EBITDA to reach €180-240 million.

Shares of RWE (RWE.DE) launched today's trading higher but have already erased most of the early gains. An area near €40.20 is marked with a 23.6% retracement of recent upward impulse and 50-session moving average, and should be considered a key near-term support. The nearest resistance to watch can be found in the area below the €41.50 mark. Source: xStation5

Shares of RWE (RWE.DE) launched today's trading higher but have already erased most of the early gains. An area near €40.20 is marked with a 23.6% retracement of recent upward impulse and 50-session moving average, and should be considered a key near-term support. The nearest resistance to watch can be found in the area below the €41.50 mark. Source: xStation5

مخطط اليوم 🗽 استمرار انتعاش مؤشر US100 مع انطلاق موسم أرباح الشركات الأمريكية

هل يدخل السوق الأمريكي مرحلة تصحيح؟

وول ستريت تواصل مكاسبها؛ و US100 ينتعش بأكثر من 1% 📈

ملخص السوق: نوفو نورديسك تقفز بأكثر من 7% 🚀