- European equities climb for fourth straight session

- Continuing claims hit new pandemic-era low

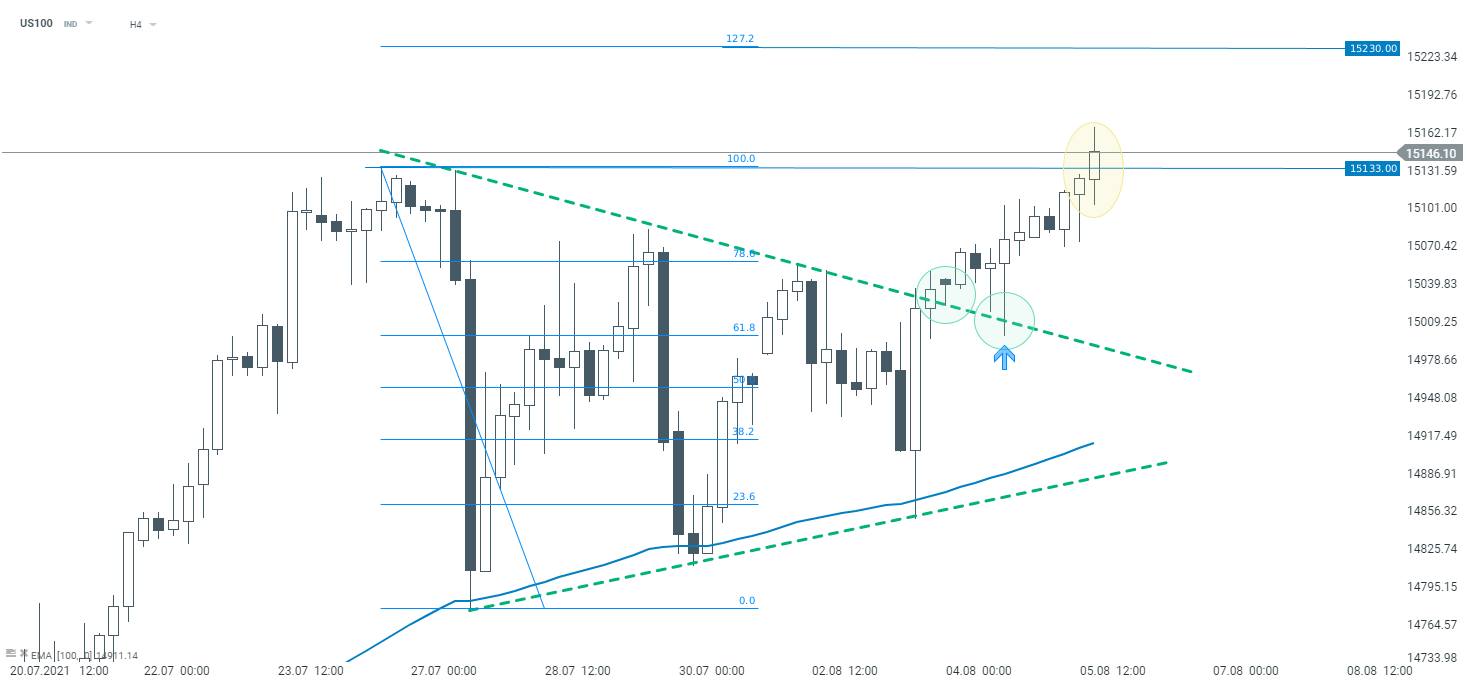

- US100 hit new all-time high

European indices extended winning streak amid another batch of upbeat quarterly earnings. Danish pharmaceutical company Novo Nordisk recorded solid quarterly earnings and lifted its full-year guidance similar to Adidas. Other German heavyweight Siemens lifted its profit guidance for the third time this year. Meanwhile the Bank of England left interest rate at 0.1% and its bond-buying program unchanged as widely expected. However, officials signaled some modest tightening of monetary policy over the next two years was likely to be necessary if the economy continues to improve. The central bank also said it would start reducing its stock of bonds when its policy rate reaches 0.5% by not reinvesting proceeds and it would start considering selling stock of purchased assets when the rate reaches at least 1%.

US indices are trading higher, with Nasdaq 100 at new all-time highs amid solid quarterly earnings and upbeat claims report. Of the 340 companies in the S&P 500 that have reported earnings so far, a record 87.6% have beat profit estimates. On the data front, US weekly jobless claims dropped to 385k and broadly in line with market expectations of 384k. Continuing jobless claims, which measure unemployed people who have been receiving unemployment benefits for a longer period of time, reached a fresh pandemic low of 2.930 million. The trade deficit reached new record levels as imports hit a new high. It is worth noting, however, that today the movements in the stock markets were limited, it is clearly visible that investors are waiting for tomorrow's data from the US labor market.

WTI crude rose 1.20% and is trading slightly below $69.00 a barrel, while Brent fell 1.10% and is trading above $71.00 as a result of renewed tensions in the Middle East, seen as a backward step in talks about a nuclear deal between Iran and the world powers, which offset concerns over lower demand and rising inventories. Elsewhere gold fell 0.35% and is trading slightly above $ 1,804.00 / oz, while silver is trading 0.50 % lower around $ 25.22 / oz.

As for the currency market, the dollar did not perform well on Thursday. The US currency lost over 0.2% against the British pound and the Australian dollar. The USD also depreciated less than 0.3% against CAD and NZD, but gained 0.25% against the Japanese yen. On the other hand, the USDCHF and EURUSD currency pairs were oscillating in the afternoon in the regions of the reference level. It seems that the forex market is also waiting for tomorrow's NFP report.

US100 hit a new all-time high during today's session. The upward move could be caused by a breakout from the triangle formation, which, according to the classic assumptions of technical analysis, heralds the continuation of the trend. If the current sentiment prevails further upward impulse towards resistance at 15,230 points could be launched. This level is marked with the external 127.2% Fibonacci retracement. Source: xStation5

US100 hit a new all-time high during today's session. The upward move could be caused by a breakout from the triangle formation, which, according to the classic assumptions of technical analysis, heralds the continuation of the trend. If the current sentiment prevails further upward impulse towards resistance at 15,230 points could be launched. This level is marked with the external 127.2% Fibonacci retracement. Source: xStation5

ملخص اليوم - تقرير قوي عن الوظائف غير الزراعية قد يؤخر خفض أسعار الفائدة من قبل الاحتياطي الفيدرالي

عاجل: زيادة هائلة في احتياطيات النفط الأمريكية!

الولايات المتحدة: هل تشير الأرقام القياسية للرواتب إلى مسار أبطأ لخفض أسعار الفائدة؟

عاجل: بيانات الوظائف غير الزراعية من الولايات المتحدة