Coca-Cola (KO.US) stock rose nearly 2 % in premarket after the world's largest soda maker posted upbeat quarterly figures. Company earned 68 cents per share beating consensus estimates of 56 cents per share. Revenue of $10.13 billion beat market expectations of $9.32 billion. Coca-Cola also raised its full-year sales and profit forecasts, as demand rebounds for its beverages from the re-opening of theaters, restaurants and stadiums. For the full year, Coke now expects to deliver organic revenue growth of 12% to 14%, up from its prior outlook of high-single digit growth. The company also raised its forecast for adjusted earnings per share growth to 13% to 15%, up from the prior range of high single digits to low double digits.

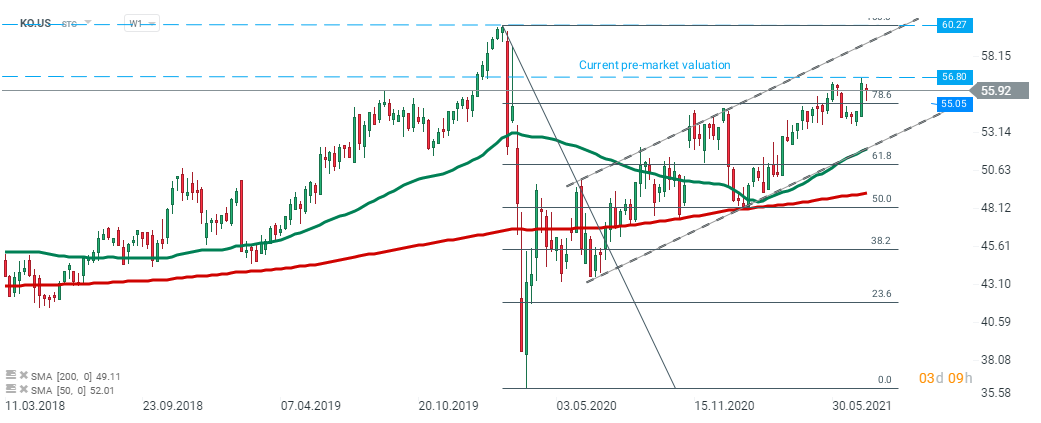

Coca-Cola (KO.US) stock price is testing local highs at $56.80. Should current sentiment prevail, then the upward move may accelerate towards all-time high at $60.27 which coincides with the upper limit of the ascending channel. On the other hand, should bears regain control, the nearest short-term support to watch lies at $55.05 and is marked with a 78.6% Fibonacci retracement of the last downward wave. Source: xStation5

التقويم الاقتصادي: بيانات الوظائف غير الزراعية وتقرير مخزونات النفط الأمريكية 💡

ملخص اليوم: بيانات أمريكية ضعيفة تُؤدي إلى انخفاض الأسواق، والمعادن الثمينة تتعرض لضغوط مجدداً!

شركة داتادوغ في أفضل حالاتها: ربع رابع قياسي وتوقعات قوية لعام 2026"

الولايات المتحدة: ارتفاع وول ستريت رغم ضعف مبيعات التجزئة