Warren Buffett and his Berkshire Hathaway are reducing exposure to Bank of America (BAC.US) shares just ahead of the expected start of the Federal Reserve's interest rate cut cycle, SEC data show.

Berkshire Hathaway has been selling Bank of America shares for six weeks, reducing its entire position by nearly 13%. Berkshire's latest report shows that another $982 million worth of shares (129 million shares of the bank) have been sold since last Monday.

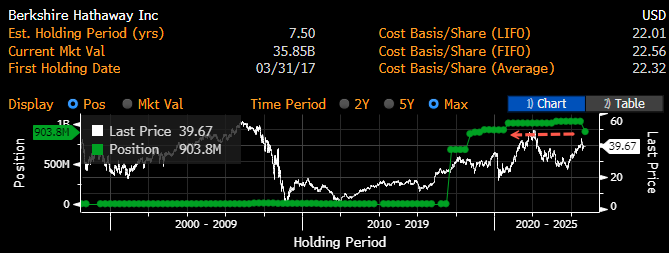

Berkshire remains the bank's largest shareholder at all times, holding 903.8 million shares worth about $36 billion at Tuesday's closing price. Source: Bloomberg Financial LP

It is worth keeping in mind that if the scenario of 3 interest rate cuts of 25 basis points each materializes by the end of the year, BofA's net interest income could be lower by about $225 million in the fourth quarter compared to the second quarter.

BAC.US shares are losing 0.75% before the opening of the session on Wall Street following news that Berkshire's position in the bank's shareholding has been reduced. Source: xStation

BAC.US shares are losing 0.75% before the opening of the session on Wall Street following news that Berkshire's position in the bank's shareholding has been reduced. Source: xStation

شركة بالو ألتو تستحوذ على سايبرآرك. شركة رائدة جديدة في مجال الأمن السيبراني!

الولايات المتحدة: هل تشير الأرقام القياسية للرواتب إلى مسار أبطأ لخفض أسعار الفائدة؟

ملخص السوق: ارتفاع أسعار النفط وسط التوترات الأمريكية الإيرانية 📈 مؤشرات أوروبية هادئة قبل صدور تقرير الوظائف غير الزراعية الأمريكية

التقويم الاقتصادي: بيانات الوظائف غير الزراعية وتقرير مخزونات النفط الأمريكية 💡