Protests erupted in China over the weekend as discontent over strict anti-Covid measures in the country grew. Protests were sparked by the death of 10 people in Xinjiang region in fire after firefighters were unable to arrive at the scene on time due to Covid restrictions. While pandemic restrictions spark the protests, those have quickly evolved into anti-government rallies with participants calling for the end of one party rule. Impact of protests on Chinese economic outlook will depend on their length and severity, and whether they expand to include employee strikes.

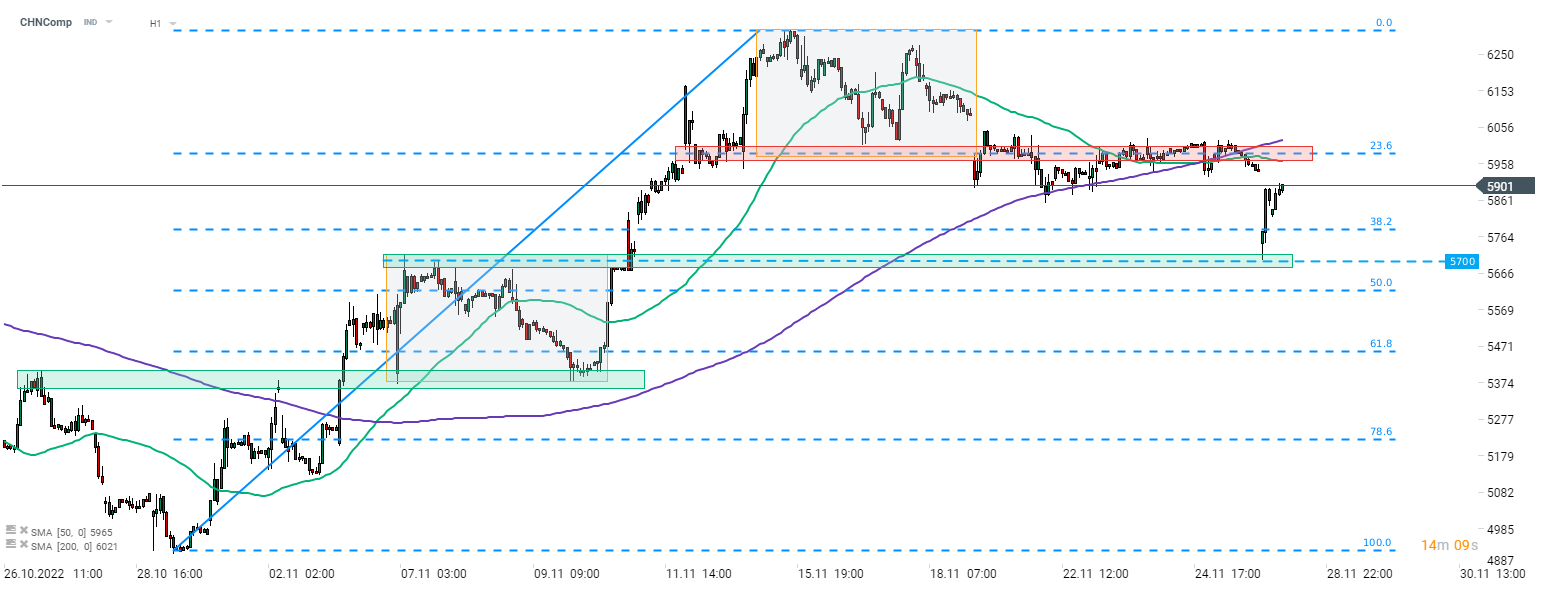

Unrest in China hit the sentiment at the beginning of a new week with Asian indices, as well as Europe and US index futures, launching new week's trade with bearish price gaps. CHNComp launched today's trading with an over-3% bearish price gap. Index found support in the 5,700 pts area shortly after session launch and started to recover. Majority of losses was recovered with CHNComp now trading around 0.5% below Friday's cash close. However, it should be noted that outlook remains somewhat bearish as the index remains below the lower limit of market geometry and 200-hour moving average (purple line).

Source: xStation5

Source: xStation5

ملخص اليوم: انخفاض المؤشرات والعملات الرقمية وسط ارتفاع أسعار النفط 🚩 ارتفاع الذهب والدولار الأمريكي

ارتفاع أسعار النفط بنسبة 11% وسط تصاعد الصراع في الشرق الأوسط 📈 وارتفع مؤشر VIX مدفوعاً بالخوف في وول ستريت

عاجل: إيران تُلمّح إلى أن أوروبا ستكون "هدفاً مشروعاً" إذا انضم الاتحاد الأوروبي إلى الحرب

وول ستريت تحاول وقف التراجع الحاد 🗽 سهم شركة مارفل للتكنولوجيا يقفز بنسبة 10%